- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Mortgage Interest Deduction Issues

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Deduction Issues

I have an issue with the 750K cap for the mortgage interest deduction. Here is the situation:

Purchased a home for $470k in 2016. Balance as of 12/31/2022 per 1098T- 309K.

Purchased a home for $903k in 6/30/2022. Balance as of 12/31/2022 per 1098T-896K

When I enter 1098Ts then I need to limit the interest deduction because since 6/30/2022, I have been over 750K cap.

The system calculates the average of both mortgages by adding the beginning and ending balances of both mortgages, then it divides it by 2 , and then it applies the limitation percentage which results in me being able to deduct only about 60% of interest from both homes. This method seems to be consistent with the IRS guide. But I was only over the limit since 6/30/2022, so this makes no sense. How do I go about this? I do have 2 1098T issued so I am assuming I must enter the numbers exactly how they appear on those 1098Ts.

This seems to be the right way to calculate the average balance for 903K loan- take 903k/12 X 7 months =451,500. Is that accurate?

Then add 451,500+ 313K=765k then the percentage limits applies which would be 97% but that seems high/wrong if I can deduct 97% of mortgage interest from both loans combined?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Deduction Issues

It depends, per IRS guidleines,

Home mortgage interest.

You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. However, higher limitations ($1 million ($500,000 if married filing separately)) apply if you are deducting mortgage interest from indebtedness incurred before December 16, 2017.

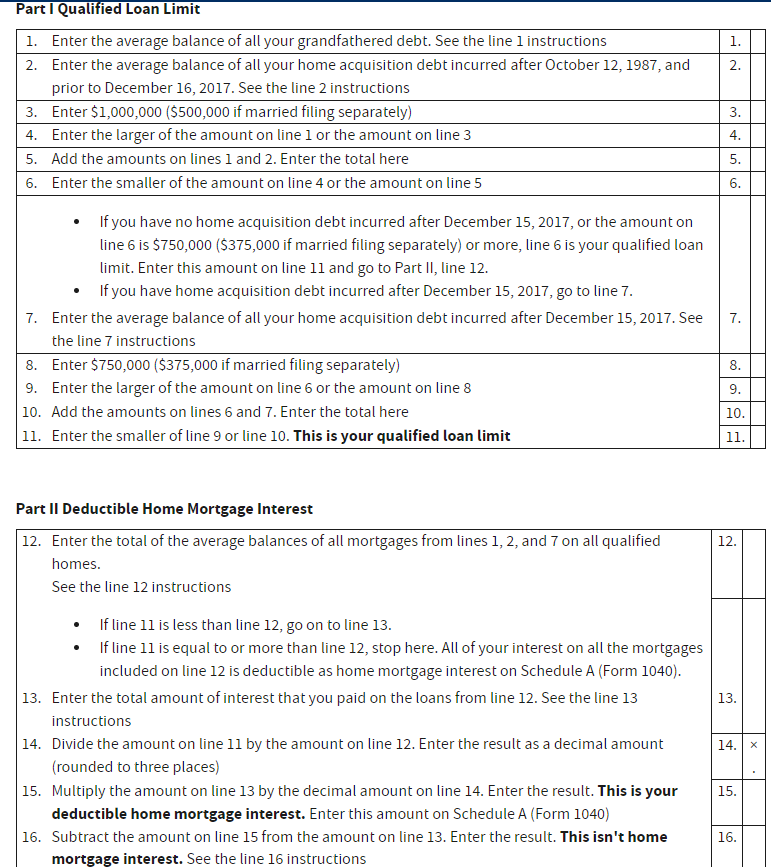

Table 1 Instructions which is used in your case the image above.

You can deduct all of the interest you paid during the year on mortgages secured by your main home or second home in either of the following two situations.

All the mortgages are grandfathered debt.

The total of the mortgage balances for the entire year is within the limits discussed earlier under Home Acquisition Debt.

In either of those cases, you don't need Table 1. Otherwise, you can use Table 1 to determine your qualified loan limit and deductible home mortgage interest.

How to enter a different value for interest, click here for more instructions. or see below:

You can manually calculate the Outstanding Mortgage Balance to report for your second 1098 on the new home using the interest rate method by dividing the interest paid reported in box 1 by the lowest interest rate you paid on this home during 2021. You can use this calculated amount as the Box 2 Outstanding Mortgage Balance rather than what is reported on Form 1098.

If the system asks for the balance of your loan on January 1, 2022, you will want to report the same number you calculated since the system will take the average of these two numbers as your Outstanding Mortgage Balance.

[EDITED 03/31/2023 | 11:39 am PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Deduction Issues

It does not address the issue I posted. As I mentioned, one mortgage was obtained in 2016 and the second home was obtained 6/2022. Still was over 1M for the last 7 months of 2022.

This is not the issue. The issue is, the system calculates as both loans were outstanding the entire year which is wrong. The system adds up both loans to 1.2M and applies the limitation. It does NOT account for the fact that the the large loan which put me over the limit was only outstanding for 7 months. So the first 5 months of interest from the first home SHOULD NOT BE limited. So again, the question is how to correctly calculate and input the average balance of the 2022 loan so the system calculates it properly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Deduction Issues

You can use the Average Monthly Balance method to calculate your Home Mortgage Interest.

Per Expert RaifH:

'You can manually calculate the Outstanding Mortgage Balance to report for your second 1098 on the new home using the interest rate method by dividing the interest paid reported in box 1 by the lowest interest rate you paid on this home during 2022. You can use this calculated amount as the Box 2 Outstanding Mortgage Balance rather than what is reported on Form 1098.

If the system asks for the balance of your loan on January 1, 2023, you will want to report the same number you calculated since the system will take the average of these two numbers as your Outstanding Mortgage Balance. '

Here's more info on How to Enter a Different Average Mortgage Balance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ramseym

New Member

eric6688

Level 2

TEAMBERA

New Member

ericbeauchesne

New Member

in Education

catdelta

Level 2