- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

It depends, per IRS guidleines,

Home mortgage interest.

You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. However, higher limitations ($1 million ($500,000 if married filing separately)) apply if you are deducting mortgage interest from indebtedness incurred before December 16, 2017.

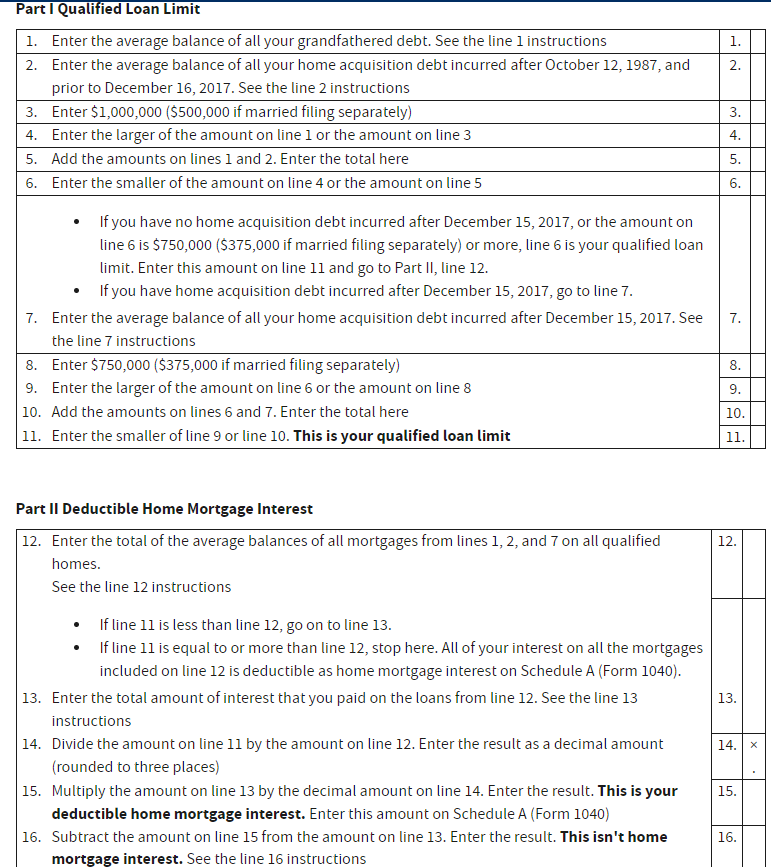

Table 1 Instructions which is used in your case the image above.

You can deduct all of the interest you paid during the year on mortgages secured by your main home or second home in either of the following two situations.

All the mortgages are grandfathered debt.

The total of the mortgage balances for the entire year is within the limits discussed earlier under Home Acquisition Debt.

In either of those cases, you don't need Table 1. Otherwise, you can use Table 1 to determine your qualified loan limit and deductible home mortgage interest.

How to enter a different value for interest, click here for more instructions. or see below:

You can manually calculate the Outstanding Mortgage Balance to report for your second 1098 on the new home using the interest rate method by dividing the interest paid reported in box 1 by the lowest interest rate you paid on this home during 2021. You can use this calculated amount as the Box 2 Outstanding Mortgage Balance rather than what is reported on Form 1098.

If the system asks for the balance of your loan on January 1, 2022, you will want to report the same number you calculated since the system will take the average of these two numbers as your Outstanding Mortgage Balance.

[EDITED 03/31/2023 | 11:39 am PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"