- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- I have a vehicle that I used for business and personal. The motor seized. Can I deduct this as a loss where I still own the vehicle?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a vehicle that I used for business and personal. The motor seized. Can I deduct this as a loss where I still own the vehicle?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a vehicle that I used for business and personal. The motor seized. Can I deduct this as a loss where I still own the vehicle?

It depends. You have both a personal use loss and a business use loss on your vehicle. The way to calculate the two separate losses is to total all business use mileage for the life of the vehicle, then divide this by the total miles on the vehicle. This will give your the business use portion and the difference will be the personal use portion.

- The personal use portion of your vehicle could be considered a possible casualty loss. However the loss must be greater than 10% of your adjusted gross income and only the difference is carried to Schedule A if you can itemize your deductions.

- The loss for the business use portion of your vehicle would be calculated by first figuring out if there is any business cost basis remaining that has not been used as an expense on your tax return.

- If you used the standard mileage rate (SMR) the first year you placed the vehicle in service, then changed to the actual expense method you would use your business use percentage (calculated above). Multiply that by the original cost basis then compare that to the total depreciation already claimed on the vehicle (all years). If there is any business portion of cost remaining you can deduct that amount as a miscellaneous expense. Be sure to use a description that you will recognize later on.

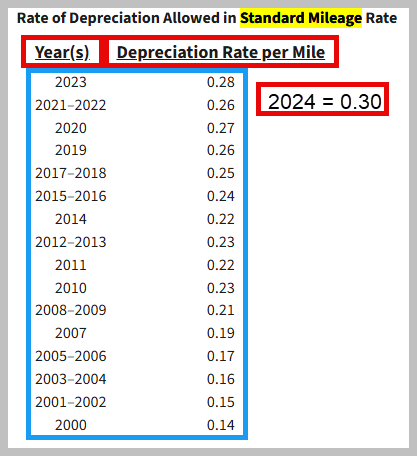

- If you used the standard mileage rate for all years there is a depreciation factor portion which would allow you to total all depreciation expense for all years. This would allow you to calculate any business portion of the cost that might be remaining using the formula in 1 above.

- See Publication 463 for the SMR Chart (see the image below).

- IRS Topic 510-Business Use of your Car

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

fieldsmichelle70

New Member

Pmh-co-unltd

New Member

TaxesForGetSmart

Level 1

exintrovert

New Member

Binoy1279

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill