- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- I did take $10,000 out of my deferred comp in 2020 (?) but it wasn't for a disaster.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did take $10,000 out of my deferred comp in 2020 (?) but it wasn't for a disaster.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did take $10,000 out of my deferred comp in 2020 (?) but it wasn't for a disaster.

What page or screen are you on? If it's asking about disasters then say NO.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did take $10,000 out of my deferred comp in 2020 (?) but it wasn't for a disaster.

That question is referring to distributions that taxpayers took from a retirement plan due to qualified disasters (the president declares federally qualified disasters). For qualified disasters, the Secure Act 2.0 lets you spread the taxable amount over 3 years and waives the early withdrawal penalty. For distributions due to COVID 19 or financial issues due to the pandemic, the Cares Act lets you spread the taxable distribution over 3 years and waives the early distribution penalty as well.

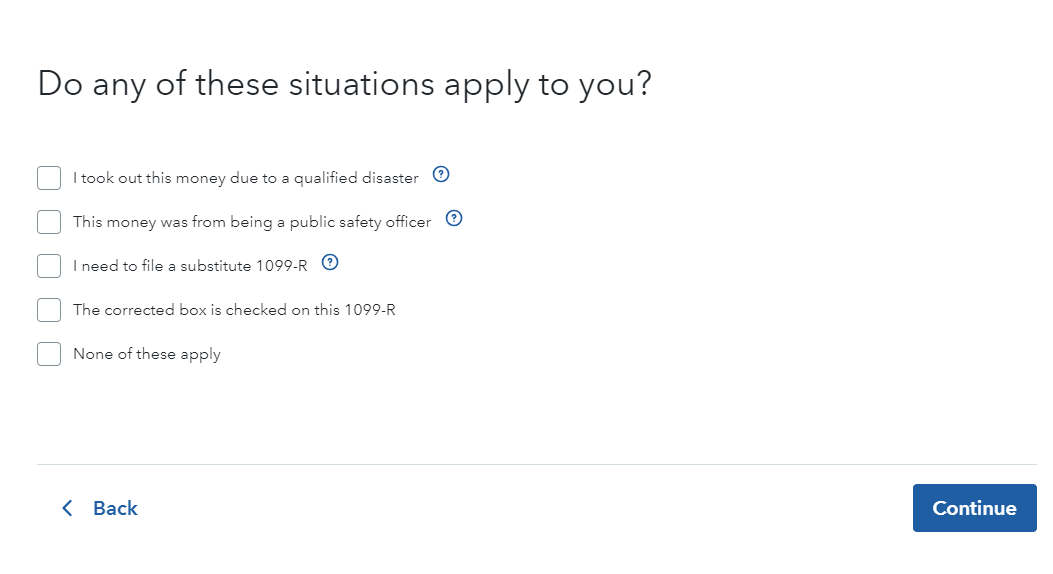

If your retirement distribution wasn't due to a disaster, when you get to the screen Do any of these situations apply to you?, do not check the box; I took out this money due to a qualified disaster.

For more information, refer to the TurboTax articles 2020 Stimulus: Tax Relief for This Year's Taxes, How do I use Form 8915 to report my 2020 COVID-related retirement distributions? and What is Form 8915-F Qualified Disaster Retirement Plan Distributions and Repayments?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cjohnson052

New Member

TaxLearner1

Returning Member

TaxLearner1

Returning Member

ronjd670-gmail-c

Level 2

laverna536

New Member