- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

That question is referring to distributions that taxpayers took from a retirement plan due to qualified disasters (the president declares federally qualified disasters). For qualified disasters, the Secure Act 2.0 lets you spread the taxable amount over 3 years and waives the early withdrawal penalty. For distributions due to COVID 19 or financial issues due to the pandemic, the Cares Act lets you spread the taxable distribution over 3 years and waives the early distribution penalty as well.

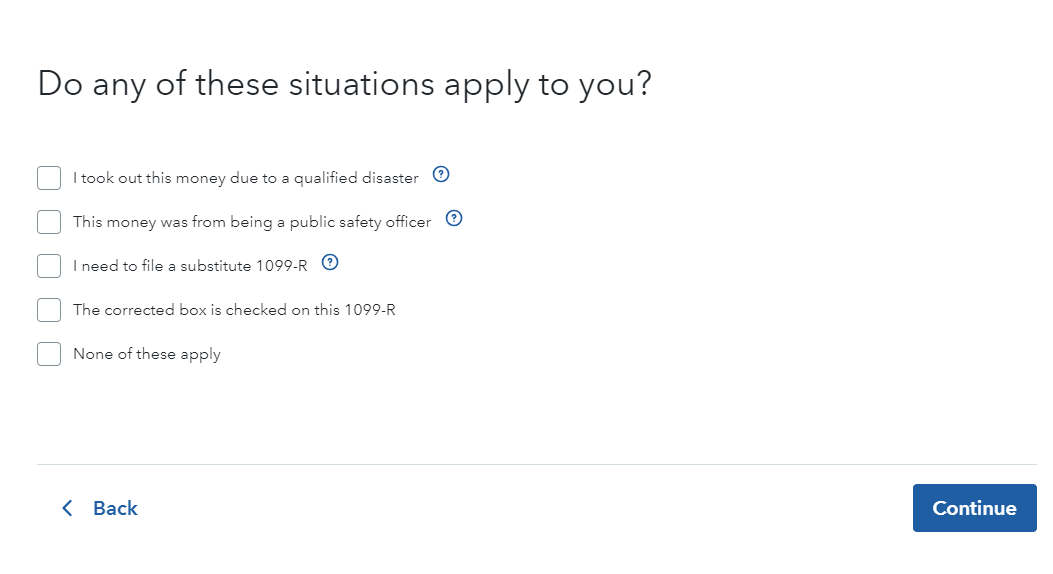

If your retirement distribution wasn't due to a disaster, when you get to the screen Do any of these situations apply to you?, do not check the box; I took out this money due to a qualified disaster.

For more information, refer to the TurboTax articles 2020 Stimulus: Tax Relief for This Year's Taxes, How do I use Form 8915 to report my 2020 COVID-related retirement distributions? and What is Form 8915-F Qualified Disaster Retirement Plan Distributions and Repayments?

**Mark the post that answers your question by clicking on "Mark as Best Answer"