in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- How do I claim interest paid on a Student loan from a bank in Canada for an institution attended in the USA on my US resident alien taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I claim interest paid on a Student loan from a bank in Canada for an institution attended in the USA on my US resident alien taxes?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I claim interest paid on a Student loan from a bank in Canada for an institution attended in the USA on my US resident alien taxes?

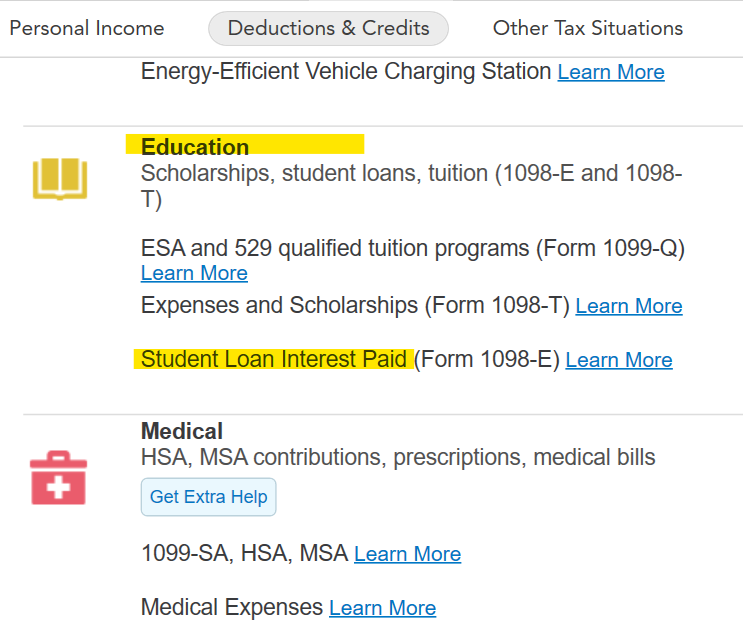

If you paid less than $600 in interest, you might not have gotten a 1098-E from your lender. If you're not sure how much you paid, contact your lender. You don't need to attach your 1098-E to your return. It is entered in Deductions and Credits section, under Education, Student Loan Interest Paid.

***The student loan has to be in your name.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I claim interest paid on a Student loan from a bank in Canada for an institution attended in the USA on my US resident alien taxes?

Do I just input the CAD dollar amount if the student loan interest was paid in Canadian currency?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I claim interest paid on a Student loan from a bank in Canada for an institution attended in the USA on my US resident alien taxes?

You would have to convert the Canadian Currency amount into US dollars. You could do that by using the average exchange rate for the year as you probably made payments during several months of the year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Tax_Fledgling

Level 1

Pago

New Member

rachelle-roy16

New Member

gaeg-ajg

New Member

in Education

Phillips99901

Level 2