- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

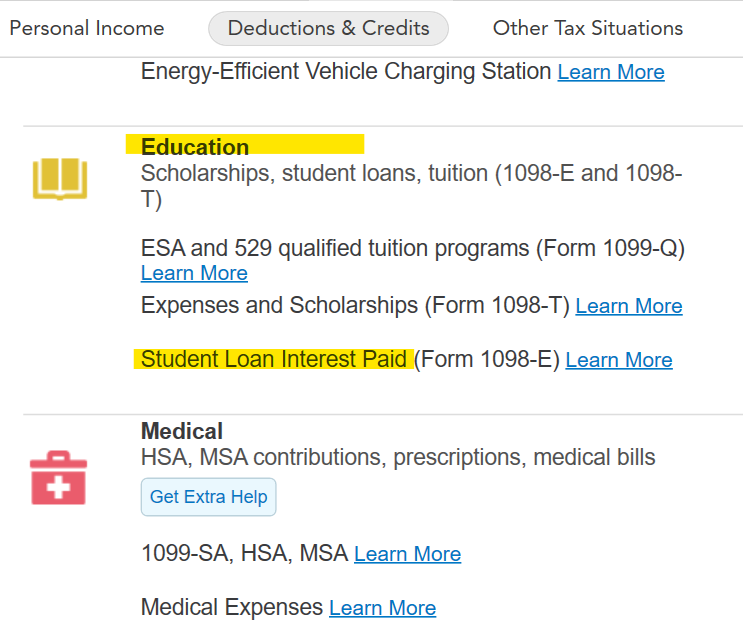

If you paid less than $600 in interest, you might not have gotten a 1098-E from your lender. If you're not sure how much you paid, contact your lender. You don't need to attach your 1098-E to your return. It is entered in Deductions and Credits section, under Education, Student Loan Interest Paid.

***The student loan has to be in your name.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 21, 2024

6:29 PM