- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Form 1116 Schedule B can't file

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 Schedule B can't file

Hi there, I filed my taxes about a month ago and realized I made a mistake with my foreign income. I have been trying to amend my return and to claim the foreign tax credit (which was finally available today), but when I get to the end I get this message and it won't let me file. It looks like I will have a carryover in 2022 (2021 is the first year in which I have foreign income) and that's why I need schedule B, I guess? But what does the message mean? That it will be available at some point just not now? I saw online that schedule B will only be available for Print and not fo E-file. What does that mean in practice? That I can still fill out everything online and then I just print out that extra form and mail everything?

Thanks so much.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 Schedule B can't file

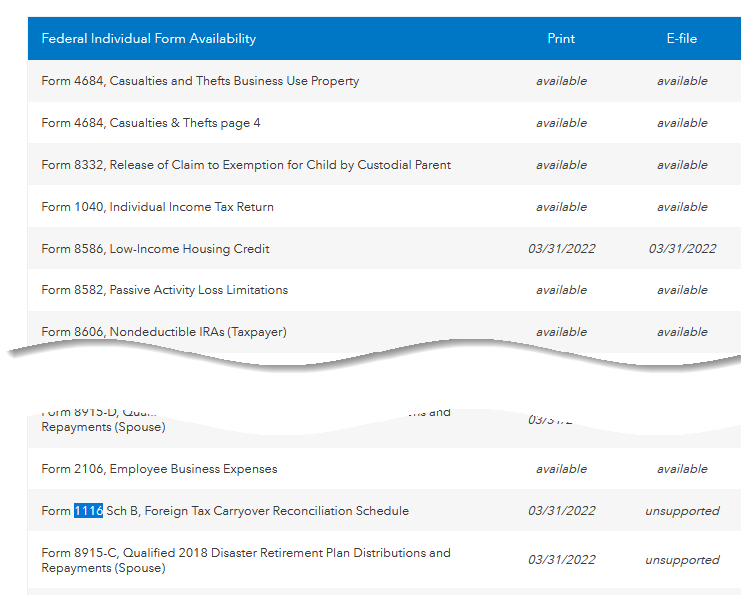

Form 1116, Schedule B, is scheduled to be available 03/31/2022.

However, you are correct that it needs to be included in a Printed/Mailed return.

Form 1116 Schedule B Foreign Tax Carryover Reconciliation Schedule is new for tax year 2021.

Click this link for a listing of Federal Tax Form Availability

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 Schedule B can't file

This is unreal. I've been waiting two weeks for the Form 1116 to be released for TurboTax. But I had a carryover from 2020 for foreign taxes paid. So now I need Form 1116 Schedule B, which is not available until March 31st. I'm wondering if I can somehow undo the foreign taxes section in Turbotax and simply file without claiming the credit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 Schedule B can't file

In looking at the 1040 Form I do not find a foreign tax credit line. I that why my entire foreign taxes paid is shown as a carryover to 2022? In essence even if I file by paper I am not receiving a foreign tax credit. Should I just omit filing for such a credit so I may file online? Is the same thing likely to happen if I wait until the March 31st update. Just fell I am in limbo land.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 Schedule B can't file

There's another long thread about this. Check there for more discussion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 Schedule B can't file

Yes, you are correct, Form 1116 Foreign Tax Credit is now available but we are not expecting Form 1116 Schedule B until March 31st, when it will be available to Print and File by Mail but will be unsupported to e-file. Please see the image below. Filing by Mail generally has delays and the last two years it has had substantial delays. Depending on how it impacts your return, you may wish to e-file without the credit, then after all the forms are available and your e-filed return has been processed, file an amendment to claim the credit.

To revisit the section of the return for Foreign Tax Credit:

- Select Federal on the left menu bar

- Click on Deductions and Credits on the top

- Scroll down to the Estimates and Other Taxes Paid section and click on Show More

- Select Revisit/Start for Foreign Tax Credit

This should clear your return but if perhaps the form is still in your return and flags it in Review, you can manually delete the form.

- To Delete a Form go black menu bar on the left

- Click on Tax Tools

- Click on Tools

- Under Other helpful links, click on Delete a Form

- Scroll down and check for 1116 and 1116 Schedule B and if there is either, click on Delete

- Click on the blue Delete Selected Form

- At the bottom Continue

- Repeat until all the forms are deleted

- At the bottom Continue with my Return

This should remove all traces of the form and allow you to file without that error message.

When you come back to amend, this TurboTax Help article has step by step directions to amend your return. You will want to wait until your original return is processed before you submit the amendment. Amend a Return

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 Schedule B can't file

There is nothing to click on. How do I see this longer thread?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 Schedule B can't file

The Foreign Tax Credit shows on Schedule 3, Line 1. The total from this section on Line 8 transfers to Line 20 on Form 1040.

My test Form 1116 shows my 2021 Foreign Tax Credit as a Carryover for 2022, since it is not able to be used this year (at this point, anyway). My Carryover from 2020 shows as an error on the form.

If you delete Form 1116, you should be able to Efile and you could Amend to add it later.

Here's another thread on this issue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 Schedule B can't file

Does this mean that form 1116B will be updated in Turbo Tax on March 31? When does IRS have this form available? Is the issue Turbo Tax not updating quickly? Since we have to do this by mail now anyway, is it possible for us to complete the form by hand outside of Turbo Tax if it is Turbo Tax causing the delay and if yes any advice?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 Schedule B can't file

If you have to file by mail with the IRS, can you at least file your state tax electronically? I live in DC if that matters.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 Schedule B can't file

@DCtaxpayer wrote:

If you have to file by mail with the IRS, can you at least file your state tax electronically? I live in DC if that matters.

Sorry, no. If the federal tax return is not e-filed then the state tax return cannot be e-filed, only printed and mailed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 Schedule B can't file

This is a major disappointment for long term TT users. Particularly, the lack of Intuit's transparency/honesty on the actual status of Form 1116, including Schedule B. I received a TT e-mail announcing that the 1116 was available. Initially, very pleased to read that the one item delaying my e-filing of federal & state returns was available. Then came the edit check message that Schedule B is missing. Called TT and was told Schedule B would be available 3/31 and assured that it would support e-filing. Turns out that this is not true -- the Schedule B will only support mail filing (federal and state).

Intuit's customers deserve far better -- timely, accurate, and complete, information on the status and capabilities of this pricy product.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 Schedule B can't file

I want to add my voice to the many others that are dismayed that Form 1116 Schedule B expected on March 31 will not be suitable for e-filing. I've been using Turbotax Premier for decades; this is a first. Come on TT, fix this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 Schedule B can't file

It's the IRS you need to be "dismayed" with, as it's the IRS that does not support e-filing of Schedule B. Professional preparers have to create PDFs of the form to attach in order to get them to file because the IRS system is not able to accept this form by e-file (unless TT or someone else can convince them to reprogram mid-season, which they've been able to do in the past.)

The schedule is brand new - not a revision of a prior form - and the IRS didn't release it until after the e-file system was already programmed for 2021 tax returns.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 Schedule B can't file

How am I supposed to generate anything. It seems right now since the the schedule B is not available, the program just runs you around in circles and won't complete. I assume that when the form is available an update will incorporate it and allow completion the normal way even though they will have to be printed out. Confirm.

I am really disappointed that Turbotax cannot put resources into this and make the form available for electronic filing. Surely the IRS would accept it if Turbotax can produce it. We all know how many security issues there are for paper filing, plus mailing expense, plus the very long time to get refunds if lucky enough to have one.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

chjiii54

New Member

FuzzyDice

New Member

krazkat

New Member

danfloyd10

New Member

wolfgangzheng147

New Member