- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

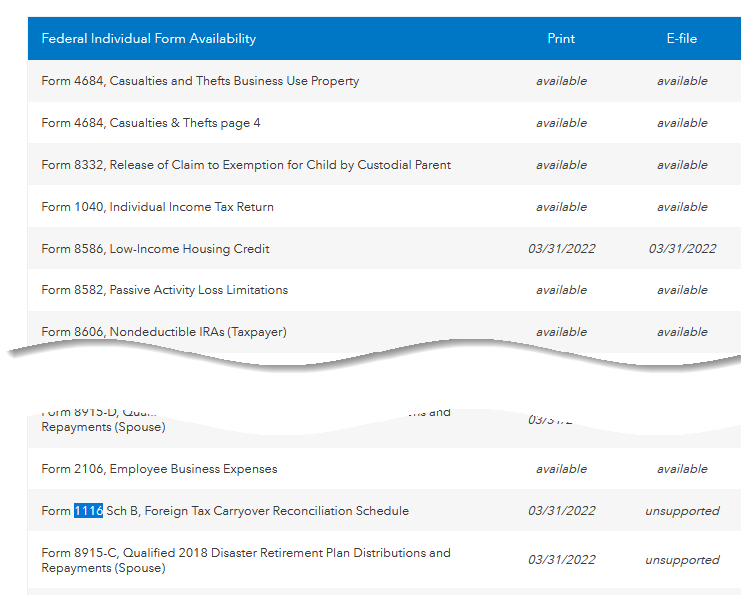

Yes, you are correct, Form 1116 Foreign Tax Credit is now available but we are not expecting Form 1116 Schedule B until March 31st, when it will be available to Print and File by Mail but will be unsupported to e-file. Please see the image below. Filing by Mail generally has delays and the last two years it has had substantial delays. Depending on how it impacts your return, you may wish to e-file without the credit, then after all the forms are available and your e-filed return has been processed, file an amendment to claim the credit.

To revisit the section of the return for Foreign Tax Credit:

- Select Federal on the left menu bar

- Click on Deductions and Credits on the top

- Scroll down to the Estimates and Other Taxes Paid section and click on Show More

- Select Revisit/Start for Foreign Tax Credit

This should clear your return but if perhaps the form is still in your return and flags it in Review, you can manually delete the form.

- To Delete a Form go black menu bar on the left

- Click on Tax Tools

- Click on Tools

- Under Other helpful links, click on Delete a Form

- Scroll down and check for 1116 and 1116 Schedule B and if there is either, click on Delete

- Click on the blue Delete Selected Form

- At the bottom Continue

- Repeat until all the forms are deleted

- At the bottom Continue with my Return

This should remove all traces of the form and allow you to file without that error message.

When you come back to amend, this TurboTax Help article has step by step directions to amend your return. You will want to wait until your original return is processed before you submit the amendment. Amend a Return

**Mark the post that answers your question by clicking on "Mark as Best Answer"