- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- For reporting foreign bank accounts. An account has no income, but money was withdrew sent to my another foreign bank account, does it mean deductions for this account?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For reporting foreign bank accounts. An account has no income, but money was withdrew sent to my another foreign bank account, does it mean deductions for this account?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For reporting foreign bank accounts. An account has no income, but money was withdrew sent to my another foreign bank account, does it mean deductions for this account?

Yes, if you withdrew money from the account that would be considered a deduction.

A deposit would be a credit. Interest earned on it would be income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For reporting foreign bank accounts. An account has no income, but money was withdrew sent to my another foreign bank account, does it mean deductions for this account?

Hello Vanessa,

Thanks for your reply.

This account is an electrical wallet. It is tied with an App. I used it to buy things (for personal use), money was deducted from my another foreign bank account. Then, when I returned things, money was deposited to this electrical wallet account. But it did not produce an interest income. I transferred the money back to the bank foreign bank account.

Please correct me if I am wrong, Thanks.

For this electrical account, it does NOT have an income.

The money was transferred to the foreign bank account. As it is considered as a deduction, so I should select "YES" for the question: is this account has any income, deduction or credits associated with it?

My concern is that: if I select "YES", how do I specify that it is NOT an income but a deduction? I mean, for the other foreign bank accounts (that I selected "YES" for this question), I could enter interest income for them. It will be reflected as interest income in the report. However, for this account, it was ONLY total value change, and it was between my own foreign bank accounts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For reporting foreign bank accounts. An account has no income, but money was withdrew sent to my another foreign bank account, does it mean deductions for this account?

Hello @Vanessa A

Thanks for your reply.

This account is an electrical wallet. It is tied with an App. I used it to buy things (for personal use), money was deducted from my another foreign bank account. Then, when I returned things, money was deposited to this electrical wallet account. But it did not produce an interest income. I transferred the money back to the bank foreign bank account.

Please correct me if I am wrong, Thanks.

For this electrical account, it does NOT have an income.

The money was transferred to the foreign bank account. As it is considered as a deduction, so I should select "YES" for the question: is this account has any income, deduction or credits associated with it?

My concern is that: if I select "YES", how do I specify that it is NOT an income but a deduction? I mean, for the other foreign bank accounts (that I selected "YES" for this question), I could enter interest income for them. It will be reflected as interest income in the report. However, for this account, it was ONLY total value change, and it was between my own foreign bank accounts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For reporting foreign bank accounts. An account has no income, but money was withdrew sent to my another foreign bank account, does it mean deductions for this account?

If you don't have any foreign financial assets, skip the screen that asks you to enter credits, deduction, etc. Proceed to the screen that asks you enter the maximum value in your bank account and acct #. See the screenshots below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For reporting foreign bank accounts. An account has no income, but money was withdrew sent to my another foreign bank account, does it mean deductions for this account?

Hello @FangxiaL

Thank you very much for your reply.

Yes, I need to report my foreign bank accounts.

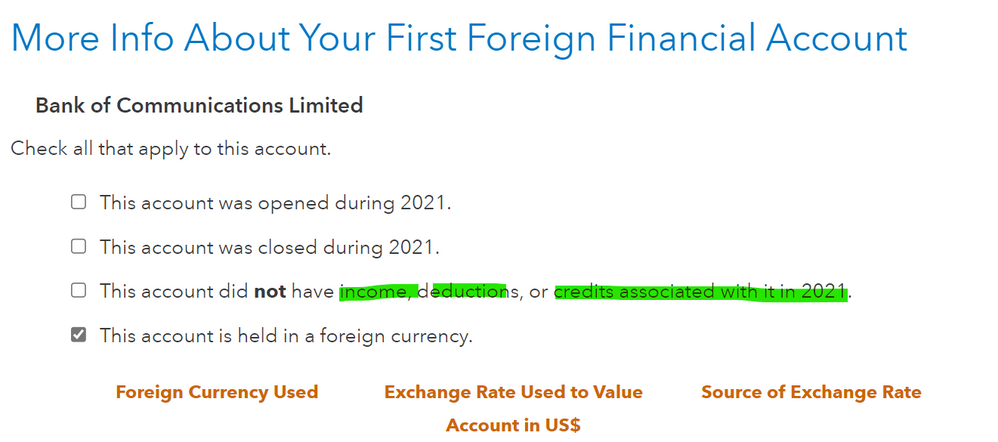

As shown below, it is the next page as your showed in your reply. I need to choose if "This account did not have income, deductions, or credits associated with it in 2021.".

I withdrew money from this foreign account (electrical wallet) and sent it to another foreign bank account, is it considered as "Deduction"?

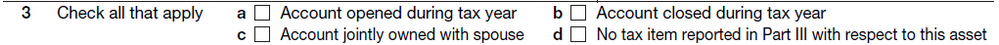

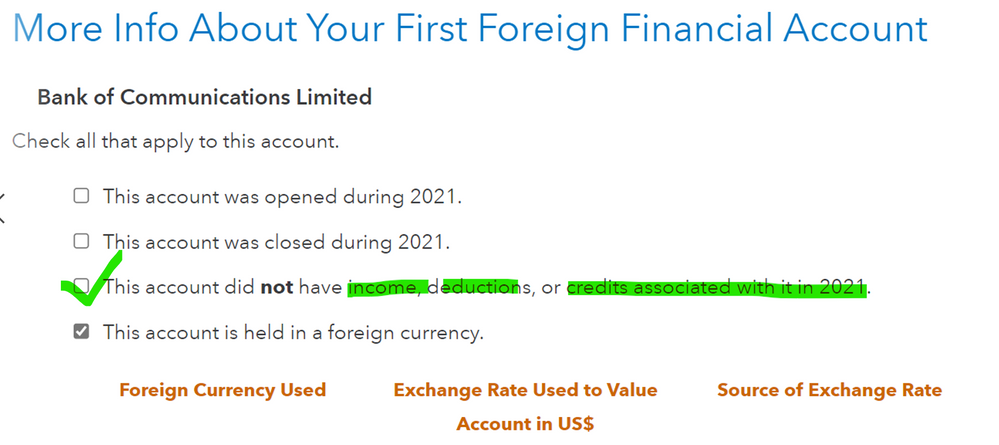

If "YES"- it is considered as a deduction, then, I need to leave a blank for the above highlighted option, Then, in the 8983 form, it will show as below.

However, should I enter the deduction value in the deductions? Is this deductions the SAME as "money transfer between your own foreign bank accounts? Thanks.

Best regards,

Renee

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For reporting foreign bank accounts. An account has no income, but money was withdrew sent to my another foreign bank account, does it mean deductions for this account?

No, you don't need to report your transfer to another Foreign Bank as a 'deduction'.

As @FangxiaL suggests above, just enter the 'Maximum Account Value in 2021' for each of your foreign accounts; the original one and the new one that you transferred funds into.

If you had more than $10,000 as a Maximum Balance in either of your accounts, you do not need to file a Form 8938 "Statement of Specified Foreign Financial Assets", which TurboTax handles.

However, you would need to file a FinCENForm 114, which is not handled by TurboTax. Click here to file FinCENForm 114: https://bsaefiling.fincen.treas.gov/main.html

File your Form 1040 as directed and file the FinCENForm 114 from the above-attached link. Also, see this for reference: Comparison of Form 8938 and FBAR Requirements.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For reporting foreign bank accounts. An account has no income, but money was withdrew sent to my another foreign bank account, does it mean deductions for this account?

Hello @MarilynG1

Thanks for your reply.

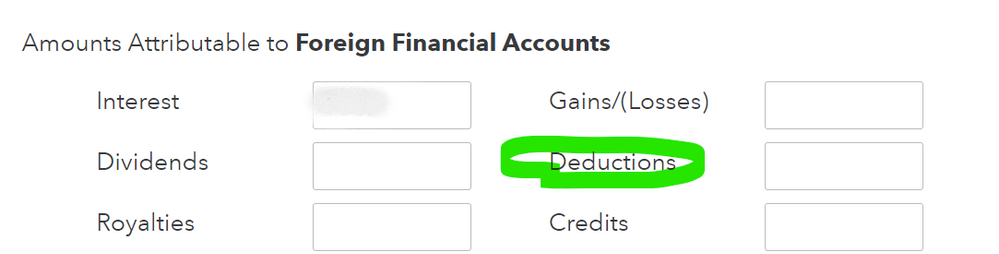

So, for this electrical wallet account (money being withdrew, but no income), I could select "This account did not have income, deductions or credits associated with it in 2021", as shown below (this is the next page after entering the max. amount value in 2021 for the account). Is it correct?

For my foreign bank account that the money was transferred into, I will report the interest income as normal. Is it correct?

Yes, I will report 8938 form and FinCENForm 114 form. Thanks.

Best regards,

Renee

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For reporting foreign bank accounts. An account has no income, but money was withdrew sent to my another foreign bank account, does it mean deductions for this account?

Yes, that is correct!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For reporting foreign bank accounts. An account has no income, but money was withdrew sent to my another foreign bank account, does it mean deductions for this account?

I'm sure you are aware of this but just to be clear for anyone else finding this, many people do not need to fill out a form 8938. You need more than $50k of foreign accounts if you live in the US and $200k if you don't. (Double if married and filing jointly). This is different than the $10k FBAR reporting requirement, which TT does not support.

https://www.irs.gov/instructions/i8938#en_US_2020_publink100049974

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

q1williams

New Member

Newby1116

Returning Member

tandtrepairservices2020

New Member

ripepi

New Member

itsagirltang69

New Member