- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Error in TuboTax OR State. If your fed income tax subtraction is $0 (due to a high income), you can still deduct your foreign tax. TT would not let me override on form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in TuboTax OR State. If your fed income tax subtraction is $0 (due to a high income), you can still deduct your foreign tax. TT would not let me override on form.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in TuboTax OR State. If your fed income tax subtraction is $0 (due to a high income), you can still deduct your foreign tax. TT would not let me override on form.

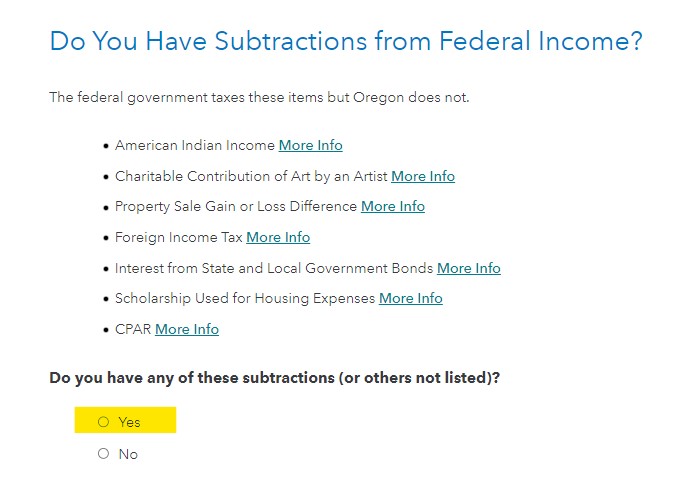

Foreign income tax (Subtraction code 311 – Modification code 603). A taxpayer can subtract taxes paid to a foreign country if on the federal return:

- The taxpayer claimed a foreign tax credit, or

- The taxpayer did not claim a credit for tax paid to a foreign country and the taxpayer did not claim the foreign taxes as an itemized deduction.

Your foreign tax plus your current federal tax (and any additional federal tax paid for a prior year) cannot be more than $7250 ($3625 if married filing separately) for 2022.

If you claimed foreign taxes as an itemized deduction on your federal return, they are allowed in full on your Oregon return. The amount shown on your federal Schedule A is not subject to the limit. If you claimed the foreign taxes as an itemized deduction, you may not also claim them as a subtraction.

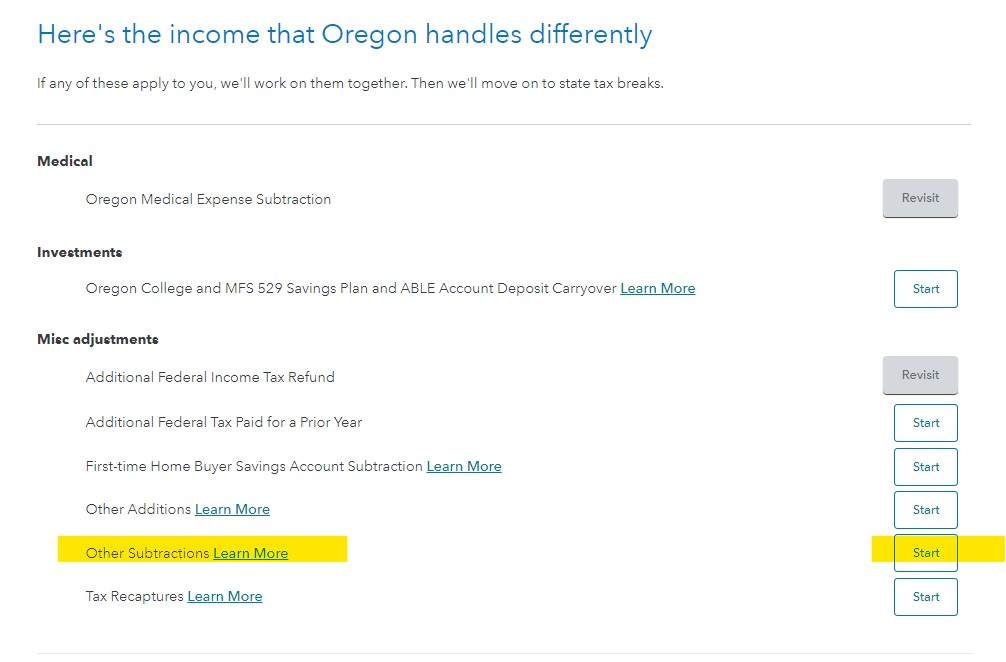

On the page titled Here's the income that Oregon handles differently, look for Other Subtractions to review this.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in TuboTax OR State. If your fed income tax subtraction is $0 (due to a high income), you can still deduct your foreign tax. TT would not let me override on form.

That is where I was in TurboTax but it would not let me subtract my foreign tax from my income on my Oregon return. I was not able to subtract any of my federal tax due to my income, so I was no where near the 7250 limit. I took a tax credit for my foreign tax on my federal return. TT would not even let me override it and manually enter it as a subtraction. I verified with OR Dept of Revenue that I could tract up to $3K of foreign tax, even though I was not allowed to subtract any of what I paid in federal tax due to my income. If I changed my 1040 to an itemized deduction for Foreign tax, then TT took it as a deduction on my state return. But that was way less money to take it as a deduction instead of a credit on the 1040.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mr-brian-j-clark

New Member

JAC191

New Member

May507

Level 2

rcsaal

Returning Member

fisicaligal

Level 1