- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

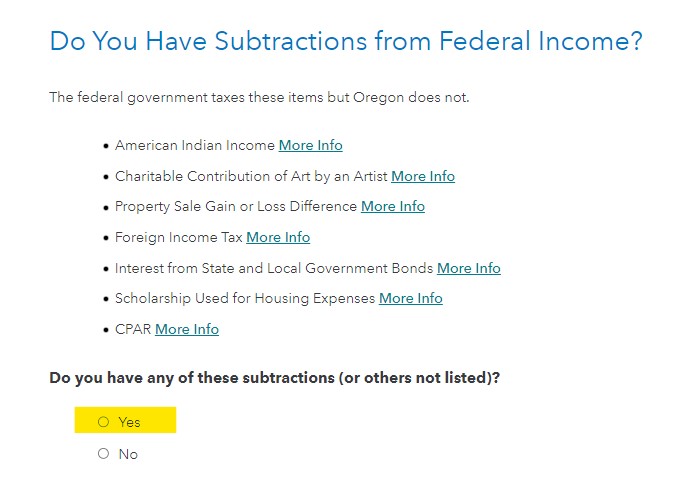

Foreign income tax (Subtraction code 311 – Modification code 603). A taxpayer can subtract taxes paid to a foreign country if on the federal return:

- The taxpayer claimed a foreign tax credit, or

- The taxpayer did not claim a credit for tax paid to a foreign country and the taxpayer did not claim the foreign taxes as an itemized deduction.

Your foreign tax plus your current federal tax (and any additional federal tax paid for a prior year) cannot be more than $7250 ($3625 if married filing separately) for 2022.

If you claimed foreign taxes as an itemized deduction on your federal return, they are allowed in full on your Oregon return. The amount shown on your federal Schedule A is not subject to the limit. If you claimed the foreign taxes as an itemized deduction, you may not also claim them as a subtraction.

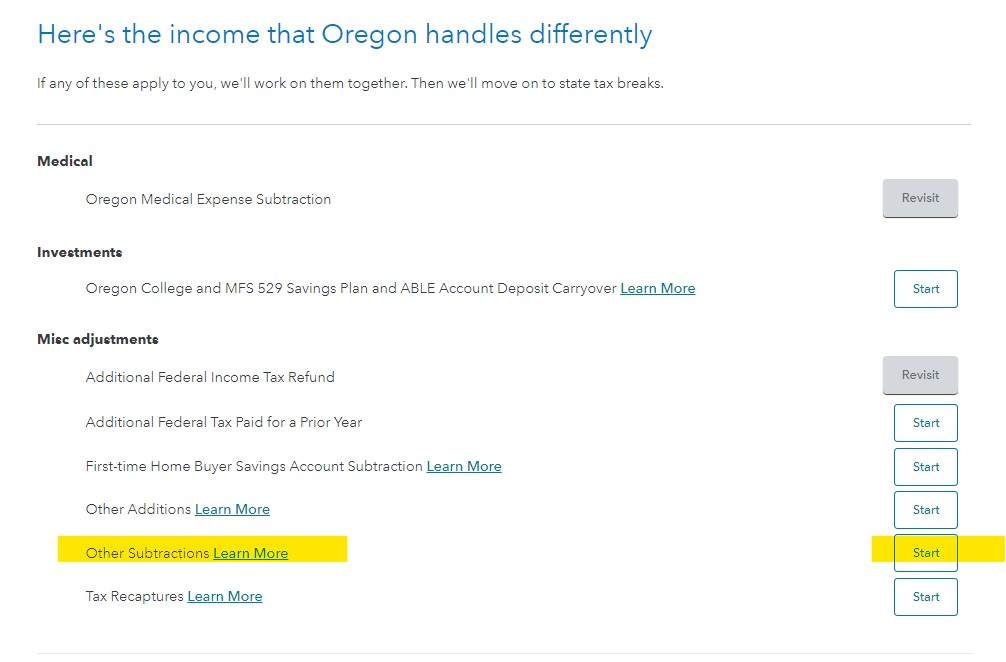

On the page titled Here's the income that Oregon handles differently, look for Other Subtractions to review this.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 10, 2023

6:57 PM