- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- employer contributed to dependent care FSA but I had no claims. TurboTax is asking for provider details in final review form 2441

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

employer contributed to dependent care FSA but I had no claims. TurboTax is asking for provider details in final review form 2441

My employer contributed $1200 to a dependent care FSA. I did not use any of it, and entered $1200 as forfeited in the w2 interview. Now I'm up to the final review and TurboTax is asking me to fill in provider details for form 2441, but I had no providers. How should I handle this? Can I delete the form 2441 or do I need to keep it to show the $1200 contribution that I forfeited? Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

employer contributed to dependent care FSA but I had no claims. TurboTax is asking for provider details in final review form 2441

No, do not delete form 2441. Since you have 1200 in box 10 on your W-2, the IRS knows that you have a dependent care FSA, so they will expect the 2441.

Try to go through the rest of the dependent care interview. Indicate that you have a dependent (you probably did or else you would have not had the account), then when you are asked about providers, enter NONE and no numbers...

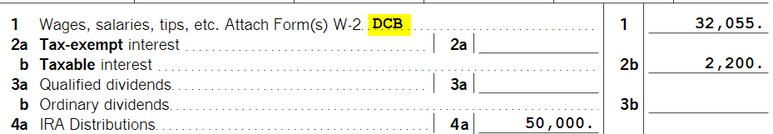

You may have to work at this, but you want the result to be that you have a 2441, NONE listed for the provider, no money spent on them, and $1,200 added to line 1 on your 1040 with a code (to the left of the dollar amount) of "DCB".

Let me know if this works for you, if it doesn't I will rerun through this and give you better instructions...

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

employer contributed to dependent care FSA but I had no claims. TurboTax is asking for provider details in final review form 2441

when I try to go through the dependent care interview again it only asks if my wife and I are full time students or disabled. I entered NONE directly on form 2441 but turbo tax still complains it wants provider address and amount in the final review. Line 1 of my 1040 matches box 1 of my w2 and I don't see any lines with $1200 or "DCB" notations. the w2 has the $1200 in box 10.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

employer contributed to dependent care FSA but I had no claims. TurboTax is asking for provider details in final review form 2441

schedule 3 shows $0 credit for child and dependent care expenses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

employer contributed to dependent care FSA but I had no claims. TurboTax is asking for provider details in final review form 2441

The DCB is to the left of the numbers; it is printed on Line 1 of Form 1040.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

employer contributed to dependent care FSA but I had no claims. TurboTax is asking for provider details in final review form 2441

1. Enter your W-2 with the box 10 amount too

2. Answer the question 2 screens later on whether or not your employer provided onsite daycare.

3. Answer YES to you having an FSA

4. Answer 1200 to the money left over in your FSA

** Be sure to add your dependents now - otherwise you will have to add them in the dependent care interview, which is not as nice. I am assuming that these dependents lived with you all year and have SSNs.

5. Now go to Deductions & Credits->You and Your Family->Child and Dependent Care Credit and click Start (or Revisit or whatever the button says).

6. Answer YES to Did you pay for child and dependent care in 2020? You have to do this to get into the interview.

7. Answer "None of the above" or whatever is correct to you and your spouse being full-time students or disabled or whatever.

8. Then choose your first (or only) dependent whose care you paid for.

9. Hit Continue

10. Enter 0 (zero) for total expenses paid for this dependent

11. If that is your only dependent, hit Done (otherwise do the same thing for the next dependent).

12. On "Let's get some info about your care provider", Click on Other (as opposed to EIN or SSN)

13. For Provide Name, enter NONE, and enter "n/a" for address and city, your home state and zip, and 0.00 (zero) paid to this provider - then hit Continue.

14. Click on Done on the next screen.

15. On the next screen, answer NO (I assume that this is true)

16. On the next scree, enter ) (zero) - I assume that this is true

Next your dependent care summary should show zero dependent care credit (which is right).

This what the top of your 2441 should look like:

There is no change on the 1040, if you indicated that you would carry over or forfeit the 1,200 to next year. It occurs to me that you won't see the DCB yet because you still might be able to use the carryover next year. If you don't, then you will see the DCB and the amount added to line 1 next year. (Because of law changes, this has been changing every year - up until recently, you had to use it or lose it by March 15th)

Please don't try to make the changes in Forms mode - this just won't work... please do it in the Step by Step mode.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

employer contributed to dependent care FSA but I had no claims. TurboTax is asking for provider details in final review form 2441

so the problem I'm having now is that when I go to Deductions & Credits->You and Your Family->Child and Dependent Care Credit and click Update, all it asks is the question about whether we are disabled, it doesn't ask if we paid for child and dependent care

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

employer contributed to dependent care FSA but I had no claims. TurboTax is asking for provider details in final review form 2441

OK, are you filing married joint? Did you both have earned income? If not, then the one without earned income has to indicate that he/she was either (1) disabled or (2) a full-time student all year.

If you don't answer this right, then the interview abruptly stops, because you don't qualify for the Child Tax Credit.

So do both of you have earned income? Was the person without earned income disabled or a full-time student?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

employer contributed to dependent care FSA but I had no claims. TurboTax is asking for provider details in final review form 2441

Ah, we are filing joint but my spouse's only income was from her business that lost money so I guess that doesn't count.

I tried saying that she was a student to get through the interview. I answered as suggested above but the final review complains that "Provider EIN must be entered" and that "Provider amount paid is too small"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

employer contributed to dependent care FSA but I had no claims. TurboTax is asking for provider details in final review form 2441

Yes, it does do that...I don't normally run stuff through the Review.

However, I am puzzled - I thought you said that "it doesn't ask if we paid for child and dependent care". So you didn't go through the interview and make any of the entries I suggested (like NONE and n/a)?

On those two screens in the Review (Provider amount is too small and no EIN) are there any other entries on the 2441? Did you leave the entries on there that you made in Forms mode previously?

If so, I would encourage you to go into Forms mode, delete the 2441, and start over and see what happens. If TurboTax abruptly discontinues the child and dependent care interview because your spouse had no earned income, then the forms should either be all blank or just not there...but the Review should not catch it like this...

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

employer contributed to dependent care FSA but I had no claims. TurboTax is asking for provider details in final review form 2441

yeah, last time I said my wife was a student to try to fix 2441, intending to come back and change it.

Now I

* went to the dependent care interview and said neither of us are students/disabled

* deleted form 2441,

* went through the w2 interview again

* went through the the dependent care interview again and said neither of us are students/disabled so it didn't ask about expenses but

* the federal review now complains about all the provider fields being empty.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

employer contributed to dependent care FSA but I had no claims. TurboTax is asking for provider details in final review form 2441

also, I get the same complaints in the review if I delete 2441, go thru the w2 interview and go to the review without visiting the dependent care section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

employer contributed to dependent care FSA but I had no claims. TurboTax is asking for provider details in final review form 2441

Yeah, I see. The fact that you have an amount in box 10 causes TurboTax to automatically recreate the 2441 even after you delete it. I will have to give some thought as to have to work through this so that you can e-file.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

employer contributed to dependent care FSA but I had no claims. TurboTax is asking for provider details in final review form 2441

If it's a use it or lose it situation (forfeiture at year end of unused FSA), then employer should not reporting the 1200.00 as additional income. I would of contacted the employer for a corrected W-2. You could leave it off and make sure you keep documentation that this benefit was never used during that year. Otherwise, the employer should leave it available for you spend in the following year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

employer contributed to dependent care FSA but I had no claims. TurboTax is asking for provider details in final review form 2441

How do I delete Form 2441 in TurboTax Online?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

amf100

Level 1

atxhorn17

New Member

bhsong206

Level 2

alyssahernandez1370

New Member

mamabear401

New Member