- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Depreciation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation

Prior to me using TT, my accountant depreciated a business truck using a section 179 deduction and the next two years two different amounts of depreciation and then the same amount for the following 10 years. I purchased a new truck at the end of 2024 took a smaller section 179 than I could have and would like to stretch the depreciation out like the prior truck. Of course it's a 5yr class. How do I accomplish what my ex-accountant did?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation

Yes, you can do that using TurboTax.

Section 179 Deduction is technically a deduction, not depreciation, but it basically works the same way.

Section 179 Deduction cannot create a loss for the business.

If only part of the Section 179 can be used the first year, the remaining amount can be carried-forward and used indefinitely.

It sounds like you took the Section 179 the first year, but did not have enough income/profit to absorb the total deduction.

Then your accountant used the remaining amount of the deduction over the following years.

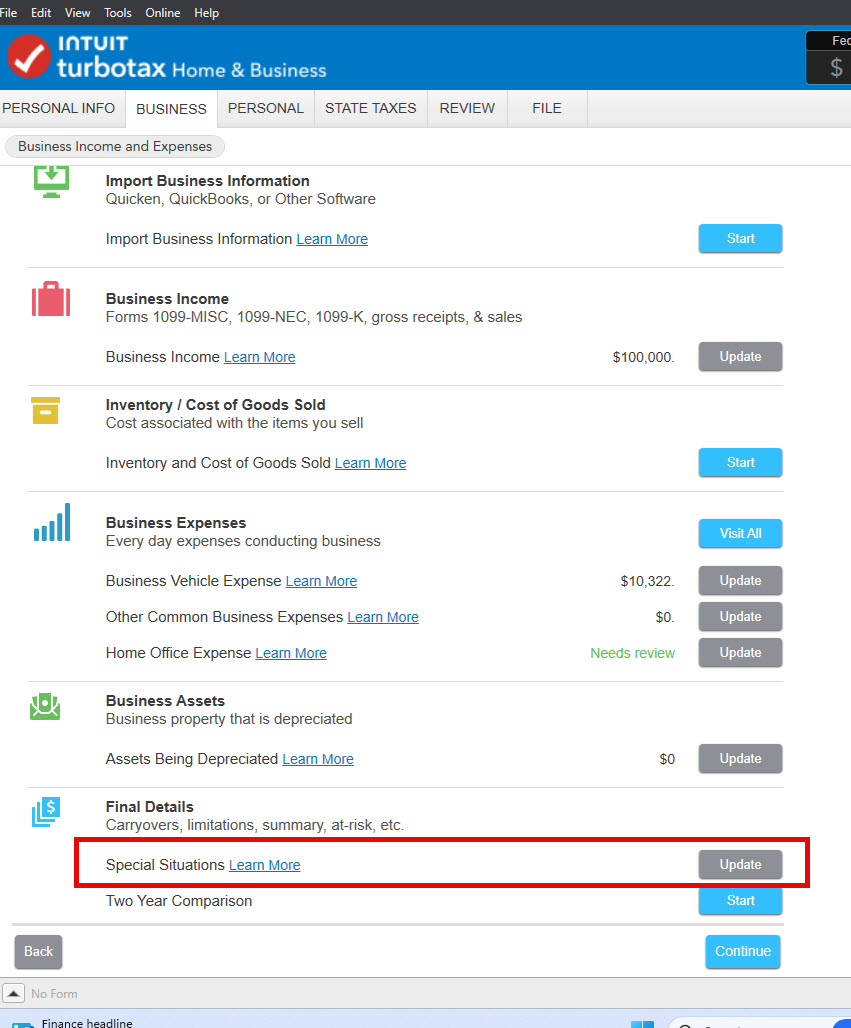

In TurboTax, you would enter the vehicle under the

Business Tab,

Business Income and Expenses,

Click into the desired business on the list

Scroll down to Business Expenses

Scroll down to Business Vehicle Expenses START

Going through that interview, you will have option of using the Standard Mileage Rate or Actual Expenses, you would need to choose Actual Expense to claim the Section 179 Deduction

The program will tell you how much of the deduction you can take depending on business income and percentage of business use of the vehicle

You can there enter the amount you wish (and are allowed) to claim.

Going forward, if there is remaining section 179, you can claim that by going to

Business Tab

Go to the job

Scroll down to Final Details

Scroll down to "Special Situations" listed under that

START

Check "I have unused section 179 expenses carrying over from 2023" and enter the amount you wish to take on the following screen

[Edited 02/08/2025 l 6:50am PST]

@Benny12

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation

Hi Kris: I read your original post yesterday in my email and then found this edited response this morning. I appreciate your time to help me. A couple things I didn't mention - I am an LLC. I am using TT Business Desktop for LLCs, corps etc. The input screens are pretty different. Anyway, you mentioned in your first post being able to use the forms mode and force my own numbers. I'm just wondering if it would let me do that. Sometimes TT just doesn't allow any changes - everything grayed out. I guess I won't know unless I try it. But I do know I don't want my new truck to be depreciated out in 5 years. Thanks for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation

It depends. You can only add information to forms where the lines are tan. If the lines are grayed-out, the information is calculated and can't be changed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sungbumpark

New Member

jayroberts55

New Member

indnyeal

New Member

corinneL

Level 2

carlRcraw

Level 1