- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Yes, you can do that using TurboTax.

Section 179 Deduction is technically a deduction, not depreciation, but it basically works the same way.

Section 179 Deduction cannot create a loss for the business.

If only part of the Section 179 can be used the first year, the remaining amount can be carried-forward and used indefinitely.

It sounds like you took the Section 179 the first year, but did not have enough income/profit to absorb the total deduction.

Then your accountant used the remaining amount of the deduction over the following years.

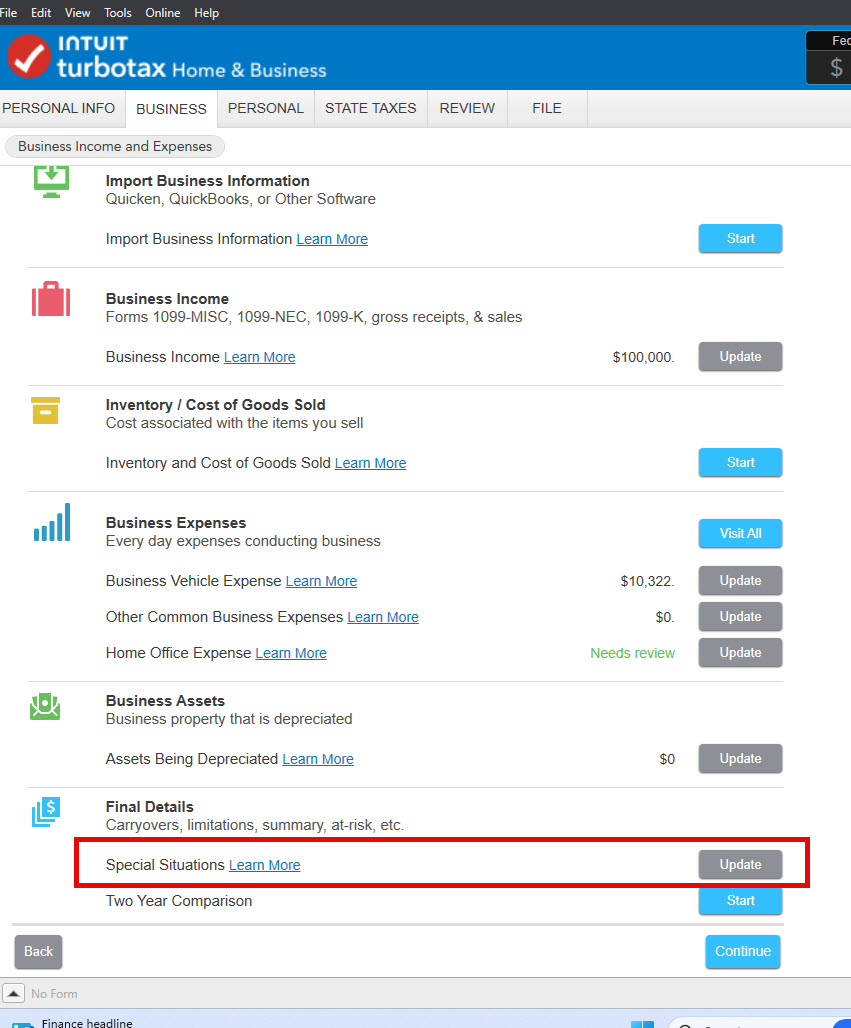

In TurboTax, you would enter the vehicle under the

Business Tab,

Business Income and Expenses,

Click into the desired business on the list

Scroll down to Business Expenses

Scroll down to Business Vehicle Expenses START

Going through that interview, you will have option of using the Standard Mileage Rate or Actual Expenses, you would need to choose Actual Expense to claim the Section 179 Deduction

The program will tell you how much of the deduction you can take depending on business income and percentage of business use of the vehicle

You can there enter the amount you wish (and are allowed) to claim.

Going forward, if there is remaining section 179, you can claim that by going to

Business Tab

Go to the job

Scroll down to Final Details

Scroll down to "Special Situations" listed under that

START

Check "I have unused section 179 expenses carrying over from 2023" and enter the amount you wish to take on the following screen

[Edited 02/08/2025 l 6:50am PST]

@Benny12

**Mark the post that answers your question by clicking on "Mark as Best Answer"