- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Backdoor IRA entry and Excess Contribution Penalty

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor IRA entry and Excess Contribution Penalty

So, I understand the Backdoor IRA contributions are to be entered as Traditional IRAs ( non deductibale contributuions). Then I am supposed to the enter the 1099-R info and the taxable income should essentially come down to 0.

The thing is TT keeps telling me that my "Income is too high to deduct the IRA contribuition" and it also says I have an excess contribution and will pay a 6% penalty. I just dont understand this.

Last year (2019), I made a back door IRA contribution of 5500 ( for TY 2018) and 6000 ( for TY 2019). So since the conversion happened in 2019, I received a 1099-R this year ( 2020), listing total distributions of 11500. I have gotten to the point where form 8606 basically says I owe no taxes but I am not sure why the Income is too high and excess contribution penalty assessed.

Please help. TT needs to have a designated Backdoor IRA Step by Step questions. Whats the point if the software cant make this easier

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor IRA entry and Excess Contribution Penalty

How do I enter a backdoor Roth IRA conversion?

A backdoor Roth IRA allows you to get around income limits by converting a Traditional IRA into a Roth IRA. Contributing directly to a Roth IRA is restricted if your income is beyond certain limits, but there are no income limits for conversions.

Doing a backdoor Roth conversion is a two step process.

TurboTax Online

Step 1: Enter the Non-Deductible Contribution to a Traditional IRA

- Open your return if it’s not already open.

- Inside TurboTax, search for ira contributions and select the Jump to link in the search results.

- Select Traditional IRA on the Traditional IRA and Roth IRA screen and continue.

- Answer Yes to Did you Contribute To a Traditional IRA?

- Answer No to Is This a Repayment of a Retirement Distribution?

- On the Tell Us How Much You Contributed screen, enter the amount contributed and continue.

- Answer No on the Did You Change Your Mind?

- Depending on your situation, answer the remaining questions.

Step 2: Enter the Conversion from a Traditional IRA to a Roth IRA

- Inside TurboTax, search for 1099-r and select the Jump to link in the search results.

- Answer Yes on the Your 1099-R screen and continue.

- If you land on the Your 1099-R Entries screen, select Add Another 1099-R.

- Select how you want to enter your 1099-R (import or type it in yourself) and follow the instructions.

- Answer No to Did You Inherit the IRA from (payer)?

- Answer I moved the money to another retirement account (or returned it to the same retirement account) on the What Did You Do With The Money From (payer)?

- Next, choose I converted all of this money to a Roth IRA account.

- Continue answering questions until you come to the Your 1099-R Entries screen.

To check the results of your backdoor Roth IRA conversion, see your Form 1040:

- On the left side of your screen, select Tax Tools, then Tools.

- Under Tool Center, select View Tax Summary.

- On the left side of your screen, select Preview my 1040.

- Your backdoor Roth IRA amount should be listed on 1040 Postcard, Line 4 as IRA distributions.

- Taxable amount should be zero unless you had earnings between the time you contributed to your Traditional IRA and the time your converted it to Roth IRA, then the earnings would be taxable.

- Schedule 1, Line 32 IRA deduction, should be blank.

- Select Back on the left side of your screen to return to where you left off in TurboTax.

TurboTax CD/Download

Step 1: Enter the Non-Deductible Contribution to a Traditional IRA

- Open your return if it’s not already open.

- Search for ira contributions and select the Jump to link in the search results.

- Select Traditional IRA on the Traditional IRA and Roth IRA screen and continue.

- Answer Yes on the Did you Contribute To a Traditional IRA? screen.

- Answer No on the Is This a Repayment of a Retirement Distribution?

- On the Tell Us How Much You Contributed screen, enter the amount contributed and continue.

- Answer No on the Did You Change Your Mind?

- Depending on your situation, answer the remaining questions.

Step 2: Enter the Conversion from a Traditional IRA to a Roth IRA

- Inside TurboTax, search for 1099-r and select the Jump to link in the search results.

- On the Your 1099-R screen, answer Yes to Did you have any of these types of income in 2018? and continue.

- If you land on the Your 1099-R Entries screen instead, select Add Another 1099-R.

- Select how you want to enter your 1099-R (import or type it in yourself) and then follow the instructions.

- You should get the following screen, Good News: You Don’t Owe Extra Tax on This Money. Continue.

- Answer No to Did You Inherit This IRA?

- On the What Did You Do With The Money From This Payer? screen, select I moved the money to another retirement account (or returned it to the same retirement account).

- Next, choose I converted all of this money to a Roth IRA account.

- Continue answering questions until you come to the Your 1099-R Entries screen.

To check the results of your backdoor Roth IRA conversion, see your Form 1040:

- Select Forms in the upper right hand corner of the screen.

- Select Form 1040 from the menu in the left side of the screen.

- Use the scroll bar to find:

- Line 4a IRAs, pensions, and annuities. Your backdoor Roth IRA amount should be listed.

- Line 4b Taxable amount should be zero unless you had earnings between the time you contributed to your Traditional IRA and the time you converted it to Roth IRA.

- Select Schedule 1 from the menu in the left side of the screen. Line 32 IRA deduction should be blank.

- To return to where you left off in TurboTax, select Step-by-Step in the upper right corner of the screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor IRA entry and Excess Contribution Penalty

For a backdoor to work it must be a non-deductible Traditional IRA contribution - you do not want not to be deducted.

It sounds like you might be entering both the $6,000 2019 contribution and the $5,500 2018 contribution made in 2019 in the 2019 interview. Only the $6,000 can be entered. The $5,500 2018 contribution can only be reported on your 2018 tax return and if for a backdoor Roth, must also be non-deductible and reported on a 2018 8606 form that is part of your 2018 tax return.

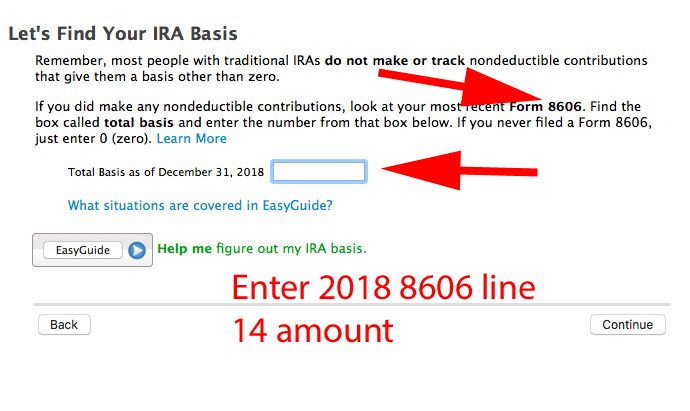

When entering the 1099-R for the conversion only the 2019 $6,000 contribution will be on the 2019 8606 line 1, the 2018 $5,500 contribution you enter when the 1099-R interview asks for prior year non-deductible contributions and you enter the 2018 8606 line 14 amount (which should be the $5,500) and that will go on the 2018 8606 line 2 so that the total $11,500 will be on line 3.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor IRA entry and Excess Contribution Penalty

How do I enter a backdoor Roth IRA conversion?

A backdoor Roth IRA allows you to get around income limits by converting a Traditional IRA into a Roth IRA. Contributing directly to a Roth IRA is restricted if your income is beyond certain limits, but there are no income limits for conversions.

Doing a backdoor Roth conversion is a two step process.

TurboTax Online

Step 1: Enter the Non-Deductible Contribution to a Traditional IRA

- Open your return if it’s not already open.

- Inside TurboTax, search for ira contributions and select the Jump to link in the search results.

- Select Traditional IRA on the Traditional IRA and Roth IRA screen and continue.

- Answer Yes to Did you Contribute To a Traditional IRA?

- Answer No to Is This a Repayment of a Retirement Distribution?

- On the Tell Us How Much You Contributed screen, enter the amount contributed and continue.

- Answer No on the Did You Change Your Mind?

- Depending on your situation, answer the remaining questions.

Step 2: Enter the Conversion from a Traditional IRA to a Roth IRA

- Inside TurboTax, search for 1099-r and select the Jump to link in the search results.

- Answer Yes on the Your 1099-R screen and continue.

- If you land on the Your 1099-R Entries screen, select Add Another 1099-R.

- Select how you want to enter your 1099-R (import or type it in yourself) and follow the instructions.

- Answer No to Did You Inherit the IRA from (payer)?

- Answer I moved the money to another retirement account (or returned it to the same retirement account) on the What Did You Do With The Money From (payer)?

- Next, choose I converted all of this money to a Roth IRA account.

- Continue answering questions until you come to the Your 1099-R Entries screen.

To check the results of your backdoor Roth IRA conversion, see your Form 1040:

- On the left side of your screen, select Tax Tools, then Tools.

- Under Tool Center, select View Tax Summary.

- On the left side of your screen, select Preview my 1040.

- Your backdoor Roth IRA amount should be listed on 1040 Postcard, Line 4 as IRA distributions.

- Taxable amount should be zero unless you had earnings between the time you contributed to your Traditional IRA and the time your converted it to Roth IRA, then the earnings would be taxable.

- Schedule 1, Line 32 IRA deduction, should be blank.

- Select Back on the left side of your screen to return to where you left off in TurboTax.

TurboTax CD/Download

Step 1: Enter the Non-Deductible Contribution to a Traditional IRA

- Open your return if it’s not already open.

- Search for ira contributions and select the Jump to link in the search results.

- Select Traditional IRA on the Traditional IRA and Roth IRA screen and continue.

- Answer Yes on the Did you Contribute To a Traditional IRA? screen.

- Answer No on the Is This a Repayment of a Retirement Distribution?

- On the Tell Us How Much You Contributed screen, enter the amount contributed and continue.

- Answer No on the Did You Change Your Mind?

- Depending on your situation, answer the remaining questions.

Step 2: Enter the Conversion from a Traditional IRA to a Roth IRA

- Inside TurboTax, search for 1099-r and select the Jump to link in the search results.

- On the Your 1099-R screen, answer Yes to Did you have any of these types of income in 2018? and continue.

- If you land on the Your 1099-R Entries screen instead, select Add Another 1099-R.

- Select how you want to enter your 1099-R (import or type it in yourself) and then follow the instructions.

- You should get the following screen, Good News: You Don’t Owe Extra Tax on This Money. Continue.

- Answer No to Did You Inherit This IRA?

- On the What Did You Do With The Money From This Payer? screen, select I moved the money to another retirement account (or returned it to the same retirement account).

- Next, choose I converted all of this money to a Roth IRA account.

- Continue answering questions until you come to the Your 1099-R Entries screen.

To check the results of your backdoor Roth IRA conversion, see your Form 1040:

- Select Forms in the upper right hand corner of the screen.

- Select Form 1040 from the menu in the left side of the screen.

- Use the scroll bar to find:

- Line 4a IRAs, pensions, and annuities. Your backdoor Roth IRA amount should be listed.

- Line 4b Taxable amount should be zero unless you had earnings between the time you contributed to your Traditional IRA and the time you converted it to Roth IRA.

- Select Schedule 1 from the menu in the left side of the screen. Line 32 IRA deduction should be blank.

- To return to where you left off in TurboTax, select Step-by-Step in the upper right corner of the screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor IRA entry and Excess Contribution Penalty

For a backdoor to work it must be a non-deductible Traditional IRA contribution - you do not want not to be deducted.

It sounds like you might be entering both the $6,000 2019 contribution and the $5,500 2018 contribution made in 2019 in the 2019 interview. Only the $6,000 can be entered. The $5,500 2018 contribution can only be reported on your 2018 tax return and if for a backdoor Roth, must also be non-deductible and reported on a 2018 8606 form that is part of your 2018 tax return.

When entering the 1099-R for the conversion only the 2019 $6,000 contribution will be on the 2019 8606 line 1, the 2018 $5,500 contribution you enter when the 1099-R interview asks for prior year non-deductible contributions and you enter the 2018 8606 line 14 amount (which should be the $5,500) and that will go on the 2018 8606 line 2 so that the total $11,500 will be on line 3.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor IRA entry and Excess Contribution Penalty

You are exactly right - the conversion occurred in 2019 but for amounts for 2018 and 2019. What I am unable to figure out is how to enter these figures into TT so that it does not think I have made an excess contribution. Honestly, this is exactly why we pay to get these issues figured out and I'm afraid TT has fallen short.

My 1099-R has 11500 listed as the distribution so that's what was imported. But it thinks this is for 2019 and anything made between Jan 1, 2020 and April 15, 2020. How do I indicate in TT that only 6000 is for 2019 and 5500 is for 2018. I am unable to figure out where to do this. The 1099-R interview does not make it as obvious as you've indicated.

Can someone help me out with instructions on how to accomplish this? I am using TT Premier CD version

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor IRA entry and Excess Contribution Penalty

My post tells you how to do it. Enter the $6,000 2019 contribution in the IRA contribution interview and the $5,500 2018 contribution in the 1099-R interview using the 2018 8606 form line 14 amount.

Enter a 1099-R here:

Federal Taxes,

Wages & Income

(I'll choose what I work on - if that screen comes up)

Retirement Plans & Social Security,

IRA, 401(k), Pension Plan Withdrawals (1099-R).

OR Use the "Tools" menu (if online version left side) and then "Search Topics" for "1099-R" which will take you to the same place.

Be sure to choose which spouse the 1099-R is for if this is a joint tax return.

Be sure to pick the correct 1099-R type: Standard 1099-R, CSA-1099-R, CSF-1099-R, RRB-1099-R.

[NOTE: When you get to the "Your 1099-R Entries" screen where you can add another 1099-R, use "continue" to keep going as there are additional interview questions after that screen in most cases. You can always return as shown above.]

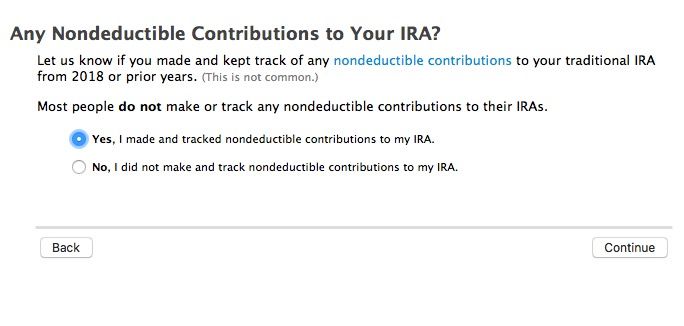

You will be asked of you had and tracked non-deductible contributions - say yes. The enter the amount from the last filed 8606 form line 14 if it did not transfer. Then enter the total value of any Traditional, SEP and SIMPLE IRA accounts that existed on December 31, 2019.

That will produce a new 8606 form with the taxable amount calculated on lines 6-15 and the remaining carry-forward basis on line 14.

NOTE: If there is an * next to line 15 then 6-15 will be blank and the calculations will be on the "Taxable IRA Distributions worksheet instead.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor IRA entry and Excess Contribution Penalty

Thanks for that - I don't mean to come across as dense but it is clear you know exactly what the issue is and I am struggling.

Here's what I did.

1) In the 1099-R section, I imported the 1099-R, it shows 11500 ( 6000 + 5500) as total distributions

2) I said Yes to whether I tracked non-deductible contributions

3) In the area where it says to enter 2018 Total basis - I do not have a 2018 Form 8606 to copy this from but rather than saying 0 , I entered 5500 this is what I understood I should enter based on the last post.

In the IRA interview

1) I did say 6000 is what I put in 2019

2) It once again asks if I track nondeductible contributions and pulled the number of 5500 that I entered from the 1099 R interview.

3) It did ask a question - What is the value of your traditional IRA as of Dec 31, 2019 - I did not know what to enter here - would it be 6000, 11500 or zero considering it was all converted? None of the values seemed to impact my tax liability which was much higher because TT calculates a taxable income of USD 3943 ( see below)

The net effect of all of this 1) it removed the penalty which is great 2) It said that I do not qualify for an IRA deduction because of my income. Fine but when I look at form 8606 line 18 now has a taxable amount of USD 3943 ( with an asterisk) when I would have expected a zero dollar taxable amount - I just don't understand this. Here are some other numbers from my form 8606

Line 1: 6000

Line 2: 5500

Line 13: 7557

Line 14 : 3943

None of this should be taxable if the numbers were reconciled correctly. USD 5500 should go towards 18, 6000 towards 19 - no excess, no taxes. I am just not sure why the numbers pan out this way.

Thanks in advance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor IRA entry and Excess Contribution Penalty

@DrDeadPan wrote:

3) In the area where it says to enter 2018 Total basis - I do not have a 2018 Form 8606 to copy this from but rather than saying 0 , I entered 5500 this is what I understood I should enter based on the last post.

3) It did ask a question - What is the value of your traditional IRA as of Dec 31, 2019 - I did not know what to enter here - would it be 6000, 11500 or zero considering it was all converted? None of the values seemed to impact my tax liability which was much higher because TT calculates a taxable income of USD 3943 ( see below)

In order to claim the 2018 non-deductible basis you can only do that if you reported it to the IRS on a 2018 8606 form of the IRS will disallow it and it will be lost. You can either amend 2018 to add the 8606 or just download and manually fill out a 2018 8606 and mile it separately to the IRS.

https://www.irs.gov/pub/irs-prior/f8606--2018.pdf

https://www.irs.gov/pub/irs-prior/i8606--2018.pdf

A backdoor Roth ONLY works if the 2019 December market value of all existing Traditional IRA accounts was zero. You get that amount from the year end statement for your 2019 IRA Dec 31 balance that the financial institution that holds the IRA issues.

As I said above: "NOTE: If there is an * next to line 15 then 6-15 will be blank and the calculations will be on the "Taxable IRA Distributions worksheet instead."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor IRA entry and Excess Contribution Penalty

That is just crazy - I have a Form 5498 from the IRS for 2018 anyway and no one has said this can't be recouped. Because of the way conversions are done and since 5498 are not always available, I was told that the IRS will accept good faith entries. And how on earth is the end user supposed to know that an 8606 is required to be filed. I appreciate your help but this just a pain .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor IRA entry and Excess Contribution Penalty

Reporting Traditional IRA contribution on the tax return for the year that the contribution was for has ALWAYS been required for as long as Traditional IRA's have existed.

The 8606 requirement for non-deductible contributions has been the law since 1987 (prior to 1987 non-deductible contributions were not allowed). A 5498 is information only and does not go on a tax return. There is noting on a 5498 that says the contribution is deductible or not deductible. Only you can tell the IRS that and only on a 8606 form.

"I was told that the IRS will accept good faith entries."

I don't know who told you than but it is not true.

See IRS Pub 590A page 15

https://www.irs.gov/pub/irs-pdf/p590a.pdf

[quote]

Form 8606. To designate contributions as nondeductible,

you must file Form 8606.

You don’t have to designate a contribution as nondeductible

until you file your tax return. When you file, you

can even designate otherwise deductible contributions as

nondeductible contributions.

You must file Form 8606 to report nondeductible contributions

even if you don’t have to file a tax return for the

year.

There is also a $50 penalty for failing to file a 8606 when required.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor IRA entry and Excess Contribution Penalty

Understood - my point was I consider myself reasonably competent in understanding rules and using tools to file taxes but I work off of documentation that was supplied to me and I think most of the non-tax law inclined as well do the same. In this case, the 8606 popped up because I was issued a 1099-R. I was issued no such document for my 2018 contribution made in April of 2019 because the conversion occurred in May 2019. So, I am supposed to know that I need to file an 8606 so that I can use that for my 2019 returns? That's where I struggle in reconciling how useful the tool is.

In any case, your point is not lost on me. When I said "good faith" entries - my point was the IRS knows that I made a traditional IRA contribution in 2018. I am now telling them that it was non-deductible when I dont have a valid 8606 for that. If it costs be $50 so be it but it would be great if TT could have a custom section for BackDoor IRA's and tailor the questions so that such situations are accounted for. Considering I have imported my prior years returns, it should be able to create an additional 8606 for me as needed. The whole point of this tool is to sell it to consumers, not accountants and to do everything to facilitate that. I dont mean to bash the product - it does a number of things extremely well but most tend to use the tool to simplify the complex stuff and I still find may areas that have not changed in 10 years or so and the complex stuff remains.

Thank you for you help and comments.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor IRA entry and Excess Contribution Penalty

@DrDeadPan wrote:

Understood - my point was I consider myself reasonably competent in understanding rules and using tools to file taxes but I work off of documentation that was supplied to me and I think most of the non-tax law inclined as well do the same. In this case, the 8606 popped up because I was issued a 1099-R. I was issued no such document for my 2018 contribution made in April of 2019 because the conversion occurred in May 2019. So, I am supposed to know that I need to file an 8606 so that I can use that for my 2019 returns? That's where I struggle in reconciling how useful the tool is.

The 2019 conversion has nothing to do with the 2018 contribution. Even though you had until the April 15, 2019 due date to make a 2018 contribution, it was still a 2018 contribution that has to be reported on your 2018 tax return whether it was a deductible or non-deductible contribution. Had you simply entered in into your 2018 tax return using TurboTax would indeed ask if you wanted to deduct it or make it non-deductible and automatically add the required 8606 for for you.

You failed to comply with the tax law that has ALWAYS required reporting Traditional IRA contribution on the tax return for the year the contribution was for - not the year made. That has been the law since 1975.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor IRA entry and Excess Contribution Penalty

@DrDeadPan wrote:

it would be great if TT could have a custom section for BackDoor IRA's and tailor the questions so that such situations are accounted for.

There is nothing magic or special about the so-called "back door Roth" which is simple using a non-deducted Traditional IRA contribution to offset the tax from converting the Traditional IRA to a Roth IRA.

The contribution is entered into the IRA contributions section and the conversion into the 1099-R section. However, the contribution and conversion might both be for the same tax year or two different tax years depending on the year that the contribution was for and the year that the conversion was done.

For a backdoor to work, ALL traditional IRA account values must be zero the end of the year of the conversion.

Before taking advantage of a "loophole" in the tax law, one should research and fully understand that loophole and the law to be sure that they can use it for their situation. Many people find out that their situation does not fit the loophole only after they have done it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor IRA entry and Excess Contribution Penalty

I'm not sure where this is going.

"Simple" to whom? Relational Databases, web technologies and the like might be simple to me but is not to everyone on Coursera and to people not in that line of work. So rather than proselytizing what one should do, it would be good to see things from another point of view. You think Intuit would advise it's buyers to "research what you do before you buy this" ?.

I am not taking advantage of any loop hole as you suggest - all I am trying to do is to be as honest as I can in the process and hence the questions. And there lies the problem - if I did not have a clue as to what should be happening, I would punch some numbers and be on my merry way but the fact is I know when things are remiss because I care - care to understand, care to ask - but it gets difficult when it's not something I am intimately familiar with.

So, while I appreciate your insight and assistance thus far I think the point has been made and belaboring the same over and over does not make it right. The fact remains that TT can and does need to improve. This sentiment is obviously shared by folks at Intuit because it is light years ahead of where it was and has evolved. You cannot rest on past successes - the product has to iterate to make things easier - every product does.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tianwaifeixian

Level 4

user17538294352

New Member

tcondon21

Returning Member

march142005

New Member

jliangsh

Level 2