- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Arizona State tax credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Arizona State tax credit

I am itemizing by return and I contributed $900 to organizations that qualify for the state tax credit. I included these contributions on the federal form. Do I need to make an adjustment on the state form since it is a dollar for dollar credit?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Arizona State tax credit

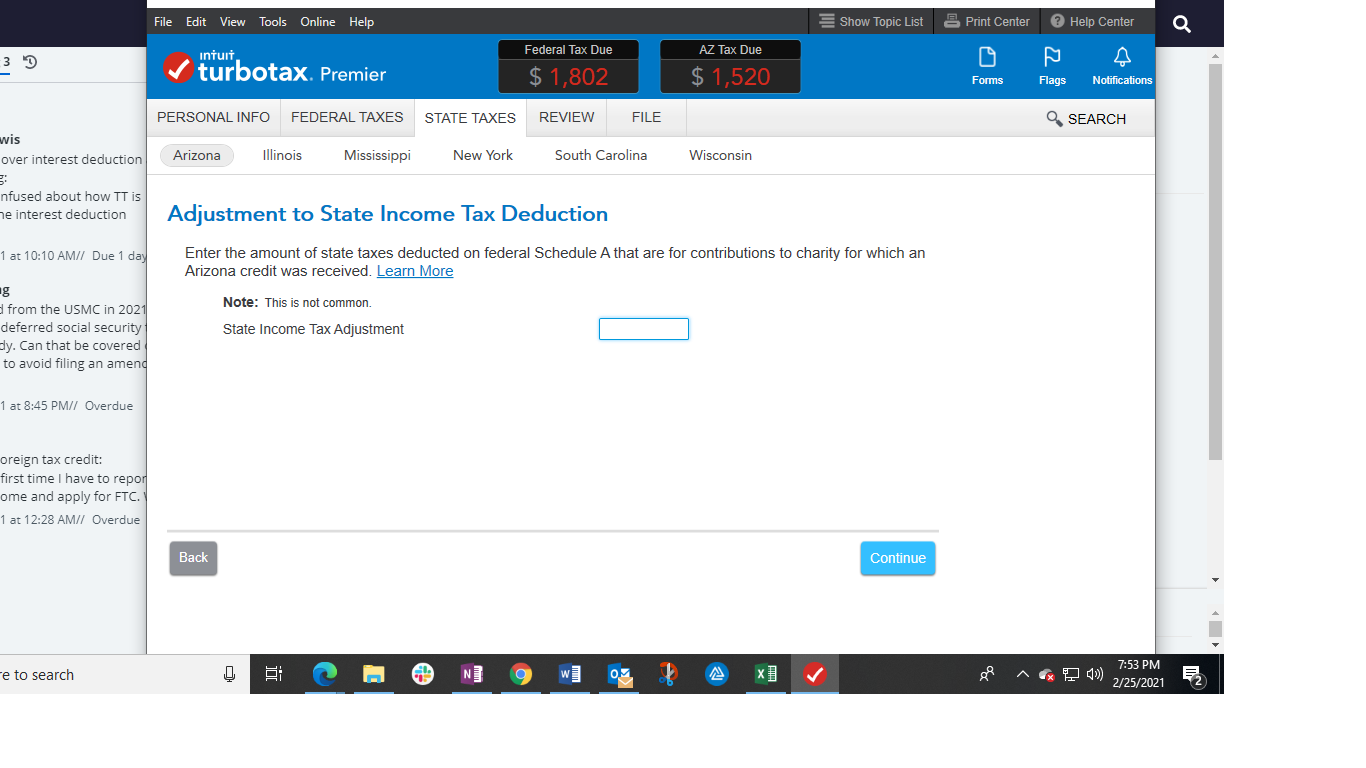

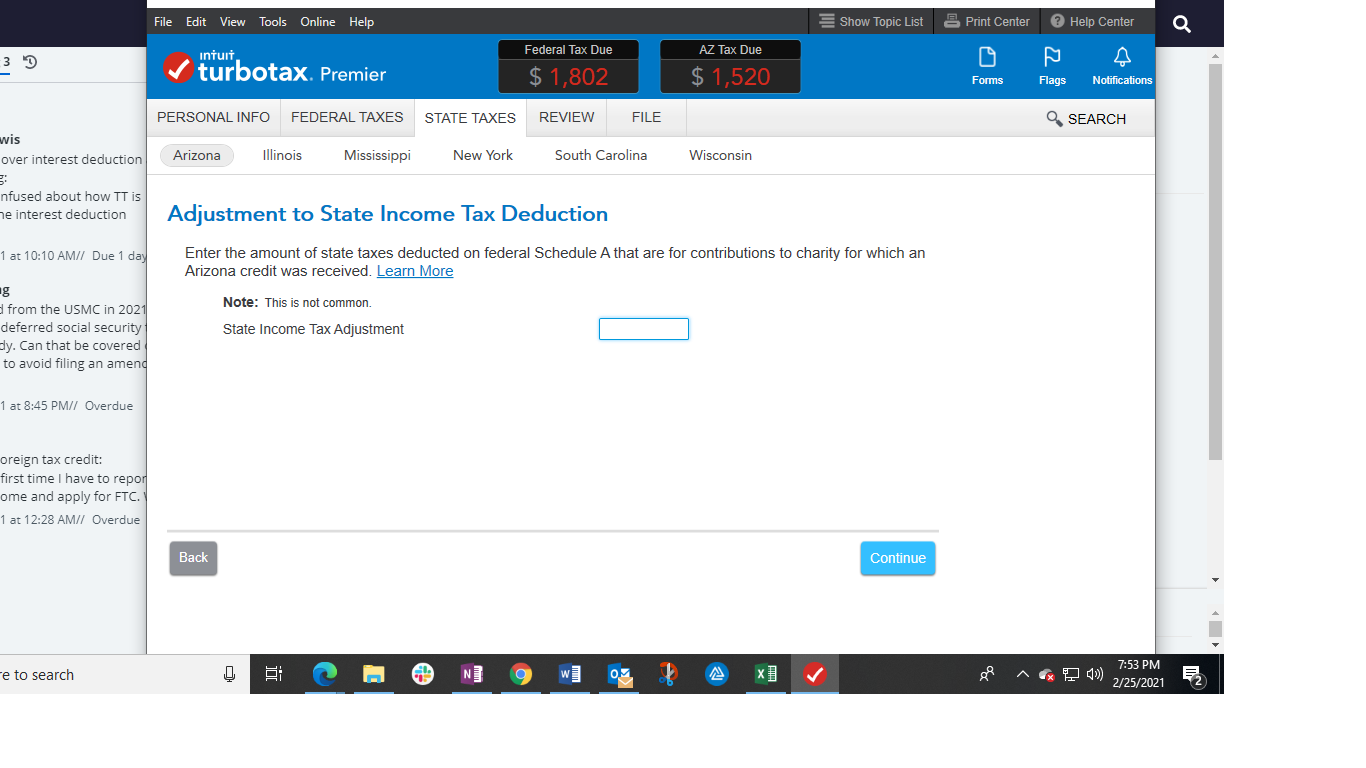

Yes, you do need to make this adjustment. As you prepare your Arizona state return, there will be a section that is entitled adjustment to state income tax deduction. Here is where you will enter $900. Here is a screenshot on what the screen looks like. Be sure to click on learn more to find out more details about this adjustment.

[Edited 02-25-2021|07:40 PM PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Arizona State tax credit

Yes, you do need to make this adjustment. As you prepare your Arizona state return, there will be a section that is entitled adjustment to state income tax deduction. Here is where you will enter $900. Here is a screenshot on what the screen looks like. Be sure to click on learn more to find out more details about this adjustment.

[Edited 02-25-2021|07:40 PM PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Arizona State tax credit

Hi @DaveF1006 ,

We completed that section adjustment to state income tax deduction, but our return doesn't seem to reflect that information. We are using Desktop Premier 2021 on a PC. After inputting that information, we checked the form view and there are no adjustments in the Schedule A(140). How can we be sure this information is being accurately represented in our return?

We know we can override the fields in the Schedule A(140), but it's very confusing and we're having difficulty.

Thanks in advance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Arizona State tax credit

After completing the credit section in the AZ state interview you will be presented with a question that asks for the amount of the credit on your return that should be removed from your AZ itemized deductions. It should prepopulate with an amount that you would verify.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Arizona State tax credit

Thanks for the response, but following those prompts doesn’t appear to calculate properly. We followed those prompts in the step-by-step portion of the TurboTax Desktop software and none of that information (amounts deducted on federal return) was populated in the corresponding form view for Schedule A(140) for Arizona. The form did not have any amounts listed in the adjustment section, specifically the box “adjustments to state income taxes” and Line 7 (should reflect whatever was put in the previous box). Thus the Adjusted Itemized Deductions section was also incorrect.

We called TurboTax and spoke with a live agent. We granted screen view access and sent the current version of our returns to her to review. She agreed that the step-by-step process wasn’t working correctly to populate the Schedule A(140) form. She told us to override the fields in the form view to input the correct information and walked us through doing that. When we did, the Adjusted Itemized Deduction calculations changed (notably Lines 10, 14, and 15 that rely on the deduction amounts) and our overall state tax burden changed (higher state tax burden). She put us on hold to contact someone from another team to look into whether this is a known bug, but the phone disconnected and we didn’t get a call back (she had our contact number). We didn’t attempt to call back because of the long wait times.

We’re pretty confident the agent’s advice produces a correct calculation by modifying the form view, but we’re concerned since the step-by-step is more convenient and is supposed to walk through everything. Given all the above, what are your thoughts? Is there a department we can contact to look into this matter more thoroughly? If TurboTax Desktop step-by-step instructions aren’t calculating our state tax burden correctly even though we are following the directions, we’ll have to submit amended returns for the last 3 years. A quick glance at our 2020 return also shows Schedule A(140) blank in the sections described above, and we itemized last year as well.

Thank you.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

girishapte

Level 3

jesse_garone

New Member

douglasjia

Level 3

user17525953115

New Member

user17525953115

New Member