- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- 2nd Stimulus, Tracing and Filing

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2nd Stimulus, Tracing and Filing

Hi,

The IRS Get My Payment tool shows that my second stimulus was mailed in January, but we moved last year and it is being mailed to the wrong address. I have not received it yet and am thinking it will probably not arrive to my new house. IRS says I can trace the payment after March 10. Can I file my taxes with the recovery rebate credit prior to March 10 or do I need to wait until after I've tracked the payment?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2nd Stimulus, Tracing and Filing

You may file the tax return with the Rebate Recovery Credit (RRC). However, if you file your 2020 Federal tax return stating that you have not received the second stimulus payment, we do not know how much delay, if any, your refund may experience.

I would expect the IRS to scrutinize stimulus payments that were issued against the tax returns that claim the Rebate Recovery Credit (RRC). This is what the IRS calls the stimulus payments that are issued through the 2020 Federal tax return. The IRS may or may not be able to correct your tax return and your refund much like it corrects tax returns and refunds which misstate Federal withholding tax.

Follow the TurboTax COVID Tax Center and IRS Economic Impact Payment Information Center for the latest information on these issues.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2nd Stimulus, Tracing and Filing

Thanks! Now, to complicate the situation - our 2020 income is too high to be eligible for either stimulus. Our 2019 income was not too high. Will we have to repay the first stimulus that we did receive? And how does this affect whether we should file for the tax credit for the second stimulus that we have not yet received?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2nd Stimulus, Tracing and Filing

You will not have to repay any stimulus amounts received. The Recovery Rebate Credit on your 2020 tax return is reduced by any payments received in rounds one and/or two, but not below zero. The stimulus payments will not reduce your refund or increase your tax.

My suggestion, since you know the payment has been mailed, would be to claim the amount on your tax return as received and then initiate any tracer actions on the payment, if not actually received by the March date.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2nd Stimulus, Tracing and Filing

I went through the federal review section on TurboTax and did not see any questions related to the recovery rebate credit, as described here: https://ttlc.intuit.com/community/tax-credits-and-deductions/help/how-do-i-claim-the-recovery-rebate.... Does that mean that I am not eligible for the credit? My IRS account shows $0 for the second stimulus (it said $600 a couple weeks ago), but my husband's still shows $600. This has got me all confused 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2nd Stimulus, Tracing and Filing

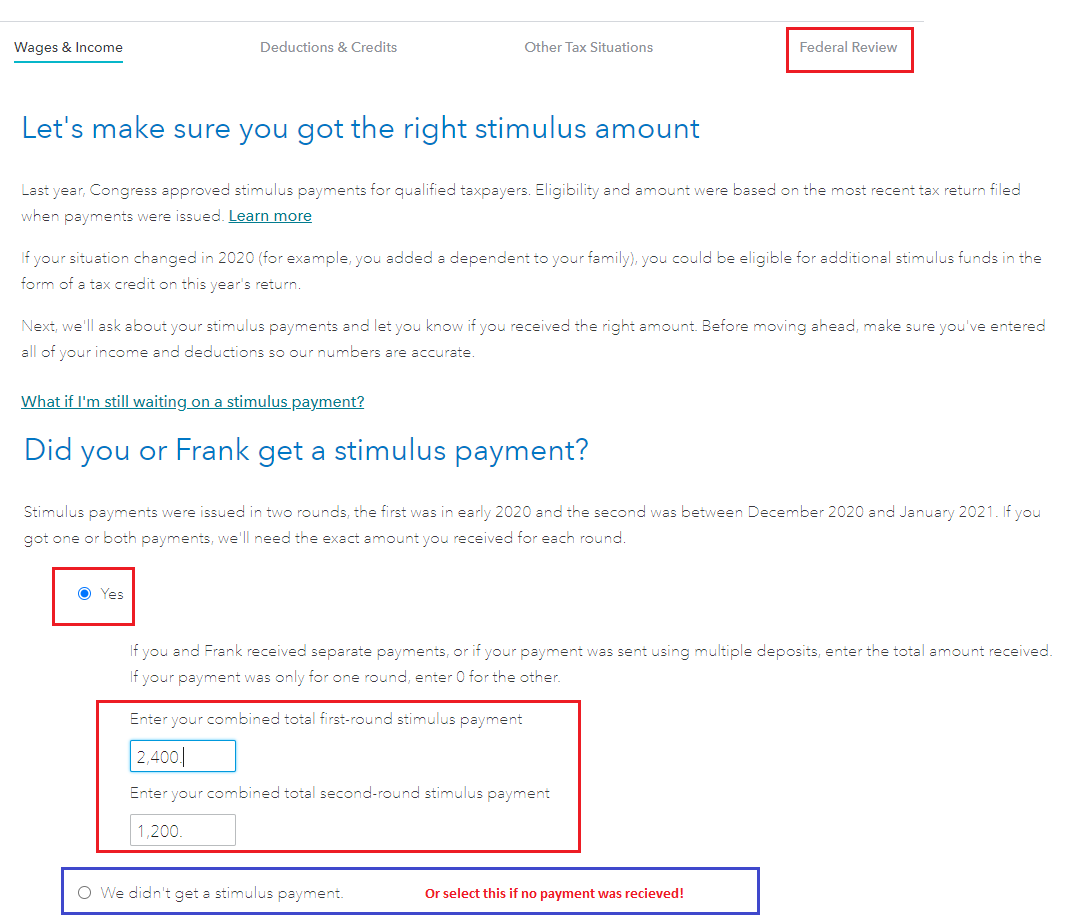

The Federal Review does take you through the stimulus questions to determine the amount you received. Be sue to answer the question 'yes or no' when TurboTax asks you whether the amounts they calculated were correct. If you answer 'no' then you can enter exactly what you did receive.

You can use your actual amount you know you received in each round (1st and 2nd) or use the IRS site to determine what to use on your return. If you know what you received then use those figures.

- Get My Payment - Select the button Get My Payment to see if your information is current based on the payments you noted that you did receive.

- In TurboTax Online once your return is open, select Wages & Income (to enter the tax return).

- Select Federal Review at the top of the page > Continue to answer the questions for Let's make sure you got the right stimulus amount

- TurboTax will then include any stimulus amount due on your 1040 form - either added to your refund or reduce the amount due.

- See the image below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2nd Stimulus, Tracing and Filing

I'm not seeing a question where TurboTax asks whether the amounts it calculated are correct. I do not get the page asking to make sure I get the right stimulus. Here is what I see when I go through the Federal Review.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2nd Stimulus, Tracing and Filing

See if you can provoke the question about stimulus checks at the end of Other Tax Situations and at the beginning of Federal Review.

Access your stimulus check choices by following these steps:

- Across the top of the screen, click on Personal.

- Across the top of the screen, click on Other Tax Situations.

- Scroll to the bottom of the screen. Click on Done with other.

- At the screen IIt looks like you qualified for the stimulus, click Yes.

TurboTax will compare your two payment amounts to the computation within TurboTax. The computations within TurboTax are based upon the information that has been entered into the tax software. If you are due an additional amount, it will be issued as a Recovery Rebate Credit (RRC) on line 30 of the 2020 1040 tax return.

See also this TurboTax Help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2nd Stimulus, Tracing and Filing

I tried this but haven't been able to figure out how to get to the stimulus questions. I'm not sure I'm eligible to file for the recovery rebate credit anyway since my 2020 income is over the limit. I think at this point, I will just wait to file my taxes until I can complete the IRS trace and go from there.

Thanks for all of yalls help on this!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2nd Stimulus, Tracing and Filing

Perhaps these steps will allow you to access your stimulus check choices:

- Down the left side of the screen, click on Federal.

- Across the top of the screen, click on Other Tax Situations.

- At the screen Let’s keep going to wrap up. Click on Let’s keep going.

- At the screen Let’s make sure you got the right stimulus amount, click Continue.

- At the screen Did you get a stimulus payment? you can update your stimulus check entries.

If you have not received one or more of your stimulus checks, you may receive your payment in the form of a Recovery Rebate Credit on line 30 of your 2020 Federal tax return when you file.

TurboTax will compare your two payment amounts to the computation within TurboTax. The computations within TurboTax are based upon the information that has been entered into the tax software. If you are due an additional amount, it will be issued as a Rebate Recovery Credit (RRC) on line 30 of the 2020 1040 tax return.

See also this TurboTax Help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

woodywayme

New Member

1122miara

New Member

tuffy7999

New Member

Sotokatrina2

New Member

mikedwards406

New Member