- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- 2021 Form 1116 Schedule B (carryovers) can't efile

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

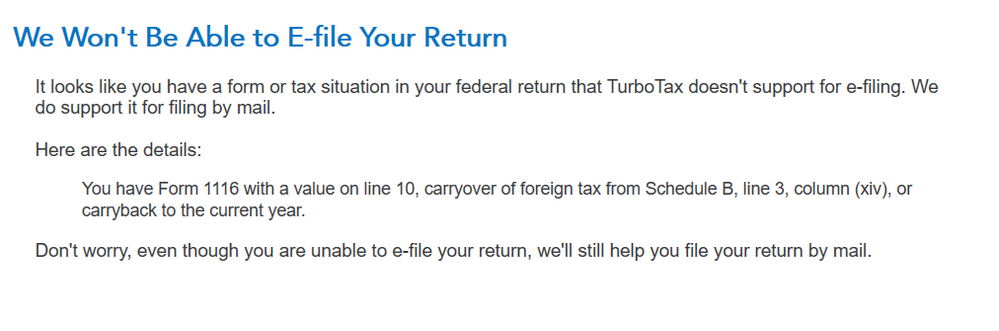

I'm getting a message that TT doesn't support e-filing because I have a value on line 10 of Form 1116, carryover of foreign taxes from Schedule B. A screenshot of the actual message is below.

Is this expected to change? In other words, will TT be supporting e-filing in this case when it releases Form 1116, now scheduled for March 3?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

Possibly. The foreign tax credit section is not final in TurboTax. The expected date is March 3. Form 1116 Schedule B is a brand new form for 2021.

Schedule B is used to "reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Taxpayers are therefore reporting running balances of their foreign tax carryovers showing all activity since the filing of their prior year income tax return."

For the latest update see IRS forms availability table for TurboTax individual (personal) tax products.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

"Possibly" is hardly a reassuring answer.

If Turbotax is not going to support Form 1116 for e-filing, it should not advertise that it supports 1116 (https://turbotax.intuit.com/personal-taxes/irs-forms/) and that it supports e-filing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

@Payer06 wrote:

"Possibly" is hardly a reassuring answer.

If Turbotax is not going to support Form 1116 for e-filing, it should not advertise that it supports 1116 (https://turbotax.intuit.com/personal-taxes/irs-forms/) and that it supports e-filing.

Form 1116, Foreign Tax Credit for tax year 2021 is estimated to be finalized and available for E-Filing in TurboTax on 03/03/2022

Go to this TurboTax website for IRS forms availability - https://care-cdn.prodsupportsite.a.intuit.com/forms-availability/turbotax_fed_online_individual.html

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

See the reply from the Employee Tax Expert above. The answer was "possibly" not "yes", his reply links the same page as you link.

How do you explain the screenshot from Turbotax I posted? I'm current on updates.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

@Payer06 wrote:

See the reply from the Employee Tax Expert above. The answer was "possibly" not "yes", his reply links the same page as you link.

How do you explain the screenshot from Turbotax I posted? I'm current on updates.

The link you posted shows the forms and schedules supported when using the TurboTax CD/Download editions. It does not indicate one way or the other whether those forms and schedules can be e-filed.

What I posted is the IRS Forms availability and also shows if the form or schedule is supported for printing and/or e-filing. As shown in the link the Form 1116 is both supported for printing and e-filing - https://care-cdn.prodsupportsite.a.intuit.com/forms-availability/turbotax_fed_online_individual.html

Also, the Form 1116 has always been supported for e-filing for at least the last 20 years that I am aware of.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

https://care-cdn.prodsupportsite.a.intuit.com/forms-availability/turbotax_fed_online_individual.html now says 1116 Sch B will not be supported for e-filing. It feels very bait and switch that this only shows up now, especially since it had been saying 1116 was supported for e-filing and it has been supported for e-filing for many years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

@Payer06 wrote:

https://care-cdn.prodsupportsite.a.intuit.com/forms-availability/turbotax_fed_online_individual.html now says 1116 Sch B will not be supported for e-filing. It feels very bait and switch that this only shows up now, especially since it had been saying 1116 was supported for e-filing and it has been supported for e-filing for many years.

Form 1116 Schedule B Foreign Tax Carryover Reconciliation Schedule is new for tax year 2021 so has never been available for e-filing.

Form 1116, Foreign Tax Credit for tax year 2021 is still estimated to be available on 03/03/2022

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

Let’s put it a different way: TurboTax has historically supported E-filing when customers had foreign tax credit carryovers. Now, TurboTax will not support that. There is a $10 online tax program that will e-file tax returns when a person has foreign tax credit carryovers. Surely Intuit could restore this functionality if it wanted to.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

Are you referring to OLT.com, taxachusetts?

Have you used it or tried it out?

If so, could you please post your impressions here. I am looking for a cost effective alternative to Intuit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

This is very frustrating. I've already paid TurboTax for 2021 and now I'm not sure if I can even use it. I have an 1116 carryover from 2020.

At no point, before or after TurboTax asked for my money, did it tell me about the limitation. I filed with TurboTax last year, so you can't say you didn't know.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

@rifi I'm trying OLT. I filled out my information and it came up with the same results as turbotax. It's a bit of a transition if you're used to TT, but not bad.

Sch B to 1116 is trivial. Transferring the numbers from TT's explanation statement took a minute or two.

E-filing is very important to me, especially given the current IRS situation with processing paper returns.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

Does anyone know if you can skip a year with a Foreign Tax Credit Carryover? For example, I have a 2020 carryover (minimal amount) that I've read you can use up to 10 years. Is it possible to ignore it for the 2021 return and then show it for the 2022 return? Just trying to figure out a workaround to this form debacle.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2021 Form 1116 Schedule B (carryovers) can't efile

If the question is: "what can I get away with?" then I can't say. But the instructions for this new Schedule B says that you have to file it if you had prior-year carryovers or will generate a carryover this year.

Also, if TurboTax knows that you have a prior-year carryover, it might not give you the option of e-filing while omitting Schedule B.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

irkedtaxpayer

New Member

kh77777

Level 2

user17578962018

Returning Member

Sarmis

Returning Member

dinesh_grad

New Member