in Events

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- 2020 Turbotax Deluxe charitable donations CARES ACT

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Turbotax Deluxe charitable donations CARES ACT

The CARES Act allows cash donations up to 100% of AGI. Currently Turbotax Deluxe does not mark the Charity type as a 100% Charity (type C on the form). It also does not handle Contribution Limit calculation correctly either when there is non cash contributions also. Calling Support has them refer me to a Tax Professional and the Tax Professional refers me to Support, since it is a software issue. When will Turbotax get this corrected?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Turbotax Deluxe charitable donations CARES ACT

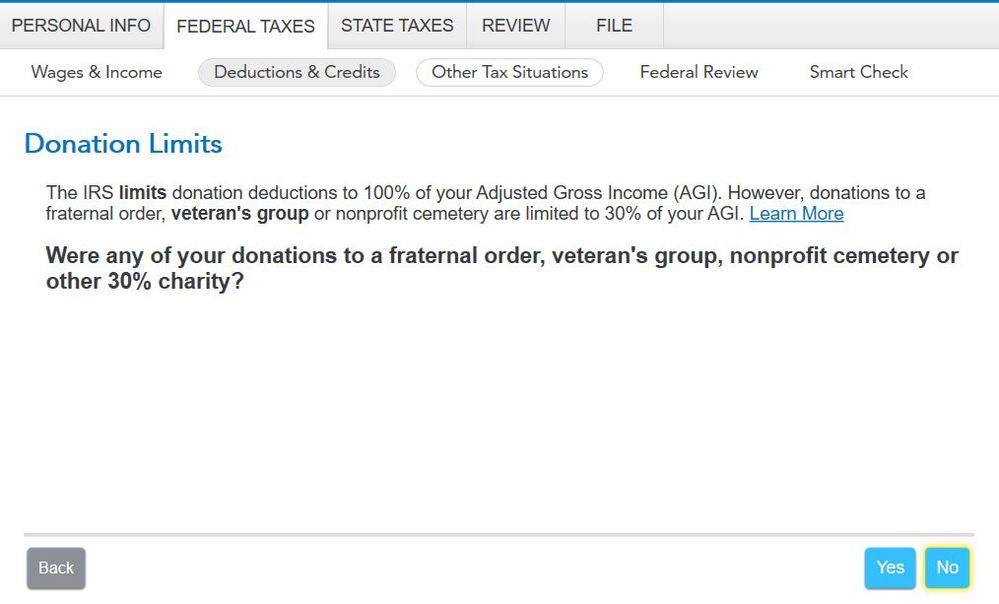

Okay, I figured it out. When asked if there were any donations to a 30% Charity, I kept answering "No" because I didn't donate to a 30% charity. If I answer "Yes", then I get to the screens that were referred to earlier. Still think this is wrong in the program. I will start a separate conversation on the potential error on the contribution limit form since that seems to be lost here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Turbotax Deluxe charitable donations CARES ACT

It seems to be working although not the way I would have thought. Apparently with each donation you can choose whether you want it classified as a 100% type charity or a 50% charity. The IRS rules give you that flexibility. The Turbo tax default previously was 50% and now is 100% if you answer the Donation Limits question as "No". When Turbotax ask the Donations Limits question "Were any of your donations to ... a 30% charity", if you answer "Yes", you can choose how to classify each charity whether a 50% or 100%.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Turbotax Deluxe charitable donations CARES ACT

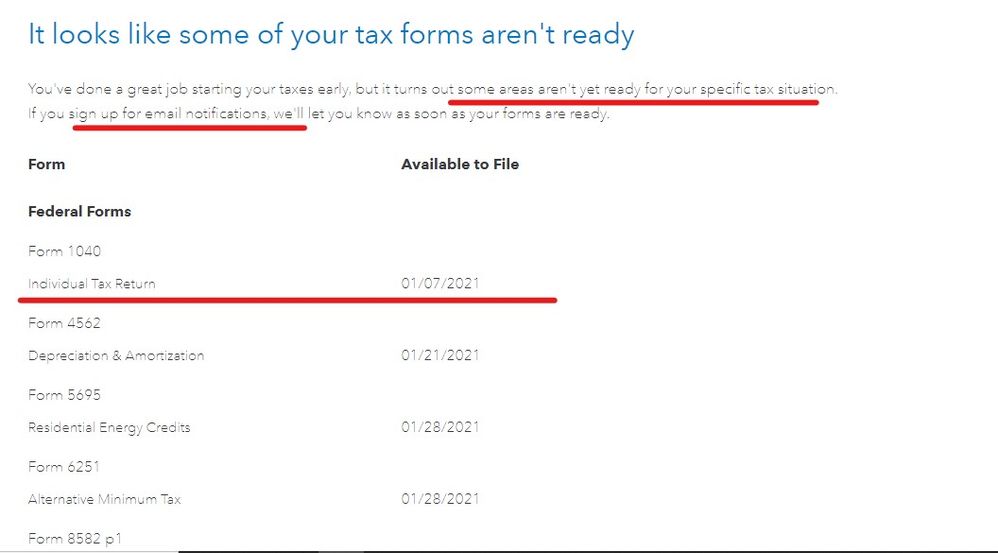

The Sch A is estimated to be ready 1/21 however dates are always subject to change. However since the IRS will not start processing returns until 2/12 this is not an issue. In fact the program should warn you in the Federal Review tab that the Sch A is not ready and offer to send an email alert when it is.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Turbotax Deluxe charitable donations CARES ACT

Well I waited until 1/21 to reply and as expected the handling of the 100% cash contribution limit is still not handled correctly within the program. So how does this issue get communicated to the appropriate people in Turbotax and when will it be fixed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Turbotax Deluxe charitable donations CARES ACT

it depends how you enter your information in Turbo Tax. Once you enter the money amounts and the name of a charitable contribution, you will see a screen that appears below. Here is where you can elect to take the 100% AGI contribution limit. in this scenario, i checked the box within Turbo Tax and was able to claim the 100% AGI contribution limit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Turbotax Deluxe charitable donations CARES ACT

That would be great, but unfortunately I am using the PC Deluxe version. Not the online version that your screenshot showed. T

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Turbotax Deluxe charitable donations CARES ACT

The procedure @DaveF1006 mentioned works with TurboTax Deluxe CD/Desktop. After entering your charitable contributions, and hitting Done with Charitable Donations, you will be taken to the Donation Limits screen where you can select the type of charity.

If for some reason you do not see this screen,

- Click on Forms Mode in the upper right.

- In Forms in My Return in the left column, look for the Charitable Org worksheet for your charity.

- Click on the worksheet. At the bottom you will see Charitable Organization Questions.

- Go to line 4.

- Select (c) 50% Charity, 100% donation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Turbotax Deluxe charitable donations CARES ACT

Thanks, I was aware that I could go to the form and check the "C type" as mentioned in my original post. What you showed on the image is what would be great, but I am seeing the screen below (my version WinPerRelease Msi [phone number removed]) which I updated today. When I updated it defaulted back to charity type "A" 50% charity. Do you have a non released version? Even with that change, Shouldn't the Limitation calculation on Line 17 and 24 of the Charity Limit Worksheet include line 1 (like it included line 7)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Turbotax Deluxe charitable donations CARES ACT

Version 020 3 zeros 1583

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Turbotax Deluxe charitable donations CARES ACT

The Donation Limits screen shown above by ErnieS0 is in Version 020.000.1586 of TurboTax Deluxe (PC version).

To get updates in TurboTax Business:

- Click the Online button in the black toolbar at the top of your screen.

- Click Check for Updates.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Turbotax Deluxe charitable donations CARES ACT

Interesting. I had updated my version the following day (22nd) and now have version 1586. However, I still get the old screen. I tried adding another charity, but that did not help. I wonder why I would get a different screen if the versions are the same. Still not fixed. Maybe the update that comes tomorrow will fix it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Turbotax Deluxe charitable donations CARES ACT

Okay, I figured it out. When asked if there were any donations to a 30% Charity, I kept answering "No" because I didn't donate to a 30% charity. If I answer "Yes", then I get to the screens that were referred to earlier. Still think this is wrong in the program. I will start a separate conversation on the potential error on the contribution limit form since that seems to be lost here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Turbotax Deluxe charitable donations CARES ACT

Just an addendum. If you later select "No" to the question on any donations to a 30% Charity, it changes all the 100% Donations back to 60%.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Turbotax Deluxe charitable donations CARES ACT

I am using TurboTax Home and Business 2020 on my desktop. I downloaded my cash charitable deductions from Quicken and was never given the opportunity to say if they were anything (30% 60%, etc) so I cant find a way to get the 100% deduction. I have looked at all the replies and see no way to recover except to start all over and enter the deductions manually one at a time. HELP turbotax!!!!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Turbotax Deluxe charitable donations CARES ACT

Yes. There is a problem with Contributions and no date released yet. Manually entering is not necessary and will not help at this point. Once the fix is launched, your entries should automatically be corrected. Check back weekly.

There is a problem with the Contributions section of the Itemized deductions and also the above the line $300.00 deduction. Because of the many changes due to the CARES Act, IRS is still developing the forms and publications on this issue. Last update was January 13th where everything is still in draft. Once IRS finalizes the forms, we will be able to update TurboTax to accurately reflect your Contributions deduction.

Here are some of the changes due to the CARES ACT

The new legislation allows tax deductions on two types of charitable gifts. First, it allows up to $300 given to a qualified charity to be claimed as an above-the-line deduction. After the Tax Cuts and Jobs Act, which went into effect in 2018, increased the standard deduction, many taxpayers had less incentive to donate to charities. Instead, they took the standard deduction and stopped itemizing.

For taxpayers who will itemize deductions, the CARES Act effectively suspends the limit on deductions for cash contributions to public charities for 2020. “That allows individuals to completely wipe out their AGI, and their tax liability, with a charitable contribution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Turbotax Deluxe charitable donations CARES ACT

When will this be corrected for those using desktop Deluxe 2020 turbo tax? It has not been corrected as of Feb 27, 2021.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Raph

Community Manager

les_matheson

Level 2

fldcdeb

Level 1

wresnick

New Member

ChemCorr

New Member