- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Where do I enter contributions to a 529 plan for tax year 2020? On the Federal and/or Colorado state return. I only see the option to report distributions from a 529.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter contributions to a 529 plan for tax year 2020? On the Federal and/or Colorado state return. I only see the option to report distributions from a 529.

where do I enter 529 contribution to edvest in wisconsin return? I am non-resident with a taxable rental income from wisconsin that I would like to offset with 529 contribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter contributions to a 529 plan for tax year 2020? On the Federal and/or Colorado state return. I only see the option to report distributions from a 529.

In the WI program under income.

- The program says "Here's the income that WI handles differently"

- Scroll down to Education

- Click on College Savings Account

- Click Yes to college savings account program

- Enter beneficiary and information

- Continue

For more information, Wisconsin 529 College Savings Program

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter contributions to a 529 plan for tax year 2020? On the Federal and/or Colorado state return. I only see the option to report distributions from a 529.

I'm trying to figure this out in Texas, I haven't been given any of the paperwork by the family member who set this up for me and I'm seriously lost, please help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter contributions to a 529 plan for tax year 2020? On the Federal and/or Colorado state return. I only see the option to report distributions from a 529.

There's no 529 deduction on your federal return, and Texas has no income tax. So there's nothing for you to input regarding your 529 plan.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter contributions to a 529 plan for tax year 2020? On the Federal and/or Colorado state return. I only see the option to report distributions from a 529.

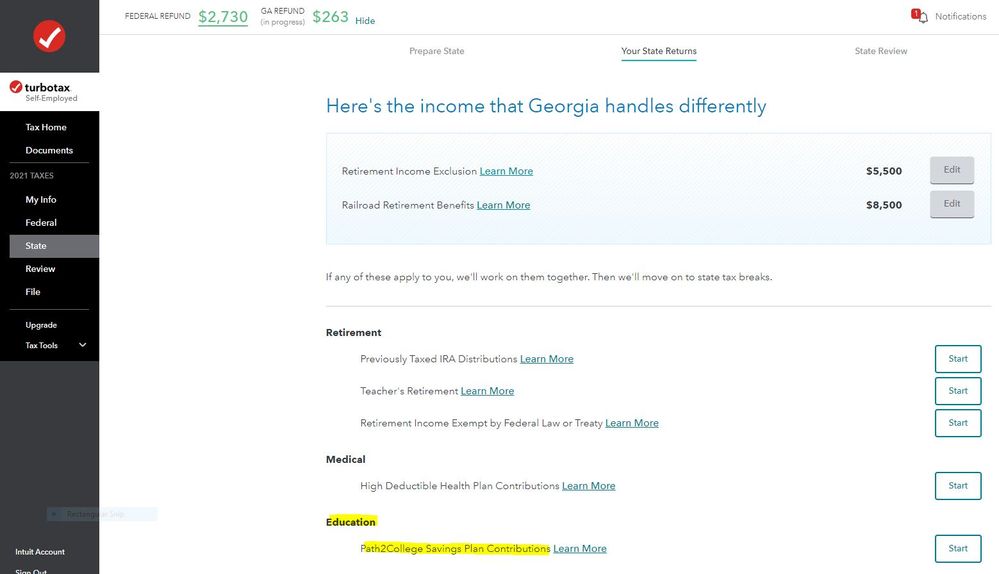

I am having the same problem with Georgia. I have clicked on every button. I do not see a message that says how to handle Georgia differently and I do not have a State Tax Interview. Tried the help section but it said nothing. I don't want to call. I have done that before and the person was just giving answers that I could have found in the help section. Can anyone here help me? I must be missing something here. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter contributions to a 529 plan for tax year 2020? On the Federal and/or Colorado state return. I only see the option to report distributions from a 529.

@clebrady wrote:

I am having the same problem with Georgia. I have clicked on every button. I do not see a message that says how to handle Georgia differently and I do not have a State Tax Interview. Tried the help section but it said nothing. I don't want to call. I have done that before and the person was just giving answers that I could have found in the help section. Can anyone here help me? I must be missing something here. Thanks!

If you are using the TurboTax software for the state of Georgia you do have a state interview. In the section of the Georgia state program on the screen labeled Here's the income that Georgia handles differently under the section for Education, on Path2College Savings Plan Contributions, click on the start button.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter contributions to a 529 plan for tax year 2020? On the Federal and/or Colorado state return. I only see the option to report distributions from a 529.

I am having the same problem on my New York state portion in turbo tax. The education part is there but there is no box to click to add the info. Any ideas how to enter this? Is it a Turbo Tax online bug that needs fixing? Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter contributions to a 529 plan for tax year 2020? On the Federal and/or Colorado state return. I only see the option to report distributions from a 529.

This a possible deduction on State return(s) only. The deduction for placing money in a 529 plan is allowed on most, if not all, state returns. It is not a deduction on the federal return.

- NY State Instructions for line 30 - 529 Contributions (and withdrawals if applicable)

- CO State Instructions for CollegeInvest 529 Contributions (page 12)

Continue to check the availability for each state since it's early for some to be completely ready for filing in every way.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter contributions to a 529 plan for tax year 2020? On the Federal and/or Colorado state return. I only see the option to report distributions from a 529.

There is no place to enter 529 contributions for Georgia. It is deductible.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter contributions to a 529 plan for tax year 2020? On the Federal and/or Colorado state return. I only see the option to report distributions from a 529.

@Anonymous wrote:

There is no place to enter 529 contributions for Georgia. It is deductible.

Start your Georgia tax return again. On the screen Here's the income that Georgia handles differently under Education on Path2College Savings Plan Contributions, click on the start button

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter contributions to a 529 plan for tax year 2020? On the Federal and/or Colorado state return. I only see the option to report distributions from a 529.

Where do I enter contributions to a 529 plan for tax year 2021nOn the Federal and/or state return. I only see the option to report distributions from a 529.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter contributions to a 529 plan for tax year 2020? On the Federal and/or Colorado state return. I only see the option to report distributions from a 529.

There's no 529 deduction on your federal return. However, some states let you deduct all or part of your 529 plan contributions.

If your state is one of those states, we'll prompt you to enter your 529 contributions when you get to the credits and deductions portion of your state taxes.

Which state return are you filing?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter contributions to a 529 plan for tax year 2020? On the Federal and/or Colorado state return. I only see the option to report distributions from a 529.

This doesnt work.

I click on Revisit, and Turbo Tax says I dont have any Tuition Account Refunds in Federal Income.

click continue and it take me back to the

Heres how Virginia handles income differently.

I didnt have any income. I made contributions... which in the past have always been deductible in Virginia

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter contributions to a 529 plan for tax year 2020? On the Federal and/or Colorado state return. I only see the option to report distributions from a 529.

If you click on Virginia 529 or ABLEnow Distribution or Refund, it will be followed by the screen about tuition account refunds in federal income.

However, you have to choose the option above it - Virginia College Savings Prepaid Tuition (Section 529) Plan. I have attached a screenshot of the line item below. There is no income requirement for Virginia's 529 plan deduction.

Please click Start or Revisit next to this line item and enter the applicable information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter contributions to a 529 plan for tax year 2020? On the Federal and/or Colorado state return. I only see the option to report distributions from a 529.

I already did my taxes. But I need to amend them, because I need to enter my 529 contribution. I live in New Mexico but can’t find the place to enter it and was never prompted to enter it. Can someone help me.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

WDM67

Level 3

xhxu

New Member

christoft

Returning Member

CRAM5

Level 2

Gary2173

New Member