- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- The solar energy tax credit carry forward on my 2021 return was less than the amount TurboTax reported on my 2020 return. Can I take the remaining amount in 2022?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The solar energy tax credit carry forward on my 2021 return was less than the amount TurboTax reported on my 2020 return. Can I take the remaining amount in 2022?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The solar energy tax credit carry forward on my 2021 return was less than the amount TurboTax reported on my 2020 return. Can I take the remaining amount in 2022?

Try typing 'home energy improvement' in the Search area, then 'Jump to home energy improvement'.

Choose the bubble 'Yes, we made energy improvements or have a carryforward'.

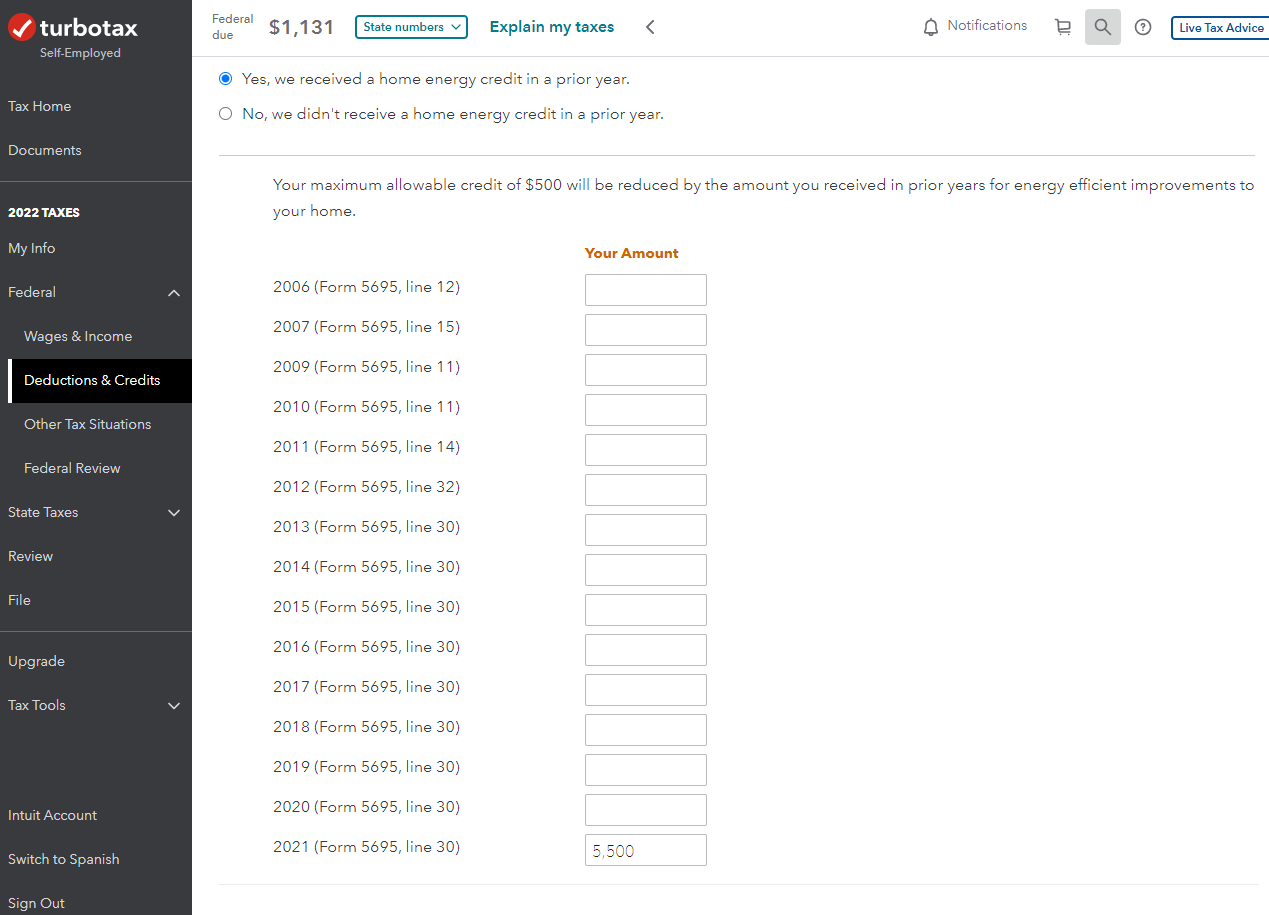

Continue, until you come to a screen where you can enter your Carryforward Amount for 2021 (from Form 5695, Line 30).

If this amount is less than shown on Form 5695, Line 30 for 2020, TurboTax may have applied some of the credit automatically in 2021. Check your 2021 Form 5695, Line 16 to verify this.

Continue, and you will come to another screen where you can enter your 2021 Carryforward Amount.

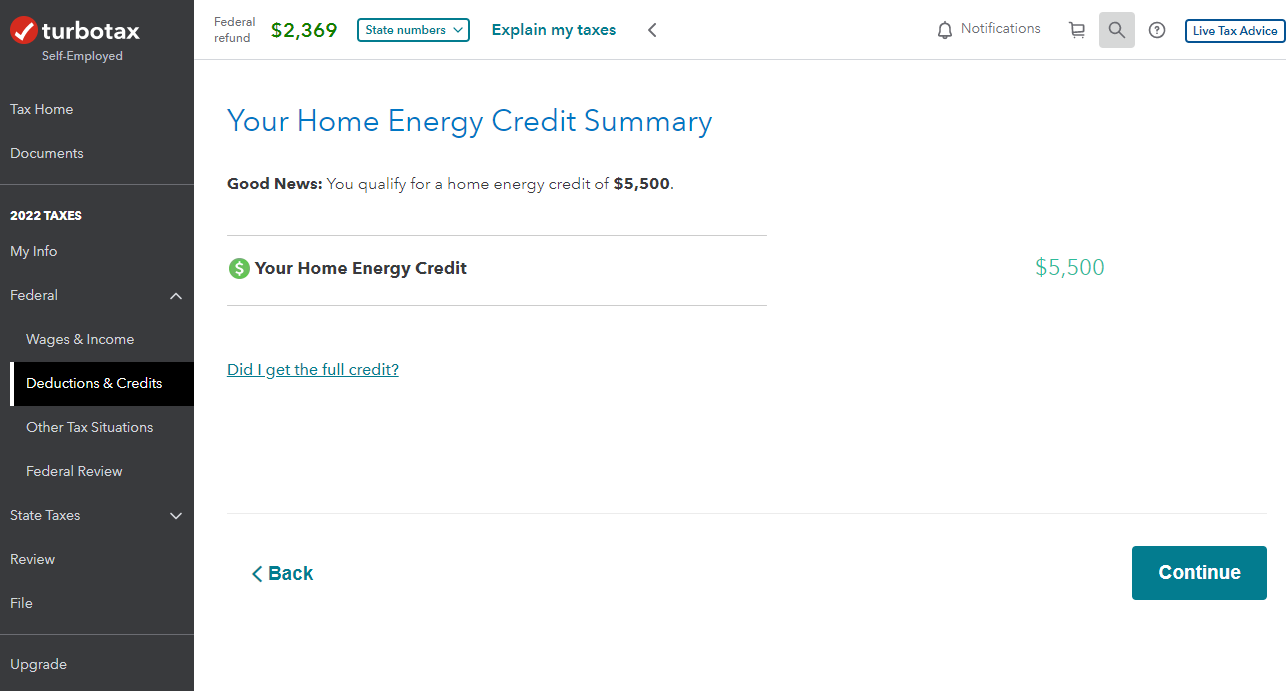

Then you will get a Home Energy Credit Summary screen telling you the amount of your credit.

Here's more info on Home Energy Credit (Form 5695).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The solar energy tax credit carry forward on my 2021 return was less than the amount TurboTax reported on my 2020 return. Can I take the remaining amount in 2022?

Thank you, but when I select "Search," I'm getting a help chat window and can find no way to enter home energy improvement so that I can "jump to" that topic.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The solar energy tax credit carry forward on my 2021 return was less than the amount TurboTax reported on my 2020 return. Can I take the remaining amount in 2022?

To enter your energy credit carryover in TurboTax Online:

- If you don’t see 2022 TAXES in the left pane, scroll down and select the dropdown to the right of Deductions & Credits and select Let’s get started, Pick up where you left off, or Review/Edit.

- Otherwise, in the left pane, select the dropdown to the right of Federal, then select Deductions & Credits

- On the Your tax breaks page, scroll down and select Edit to the right of Home Energy Credits

- On the Energy-Saving Home Improvements page, select Yes, we made energy-efficient improvements or have a carryforward, then select Continue

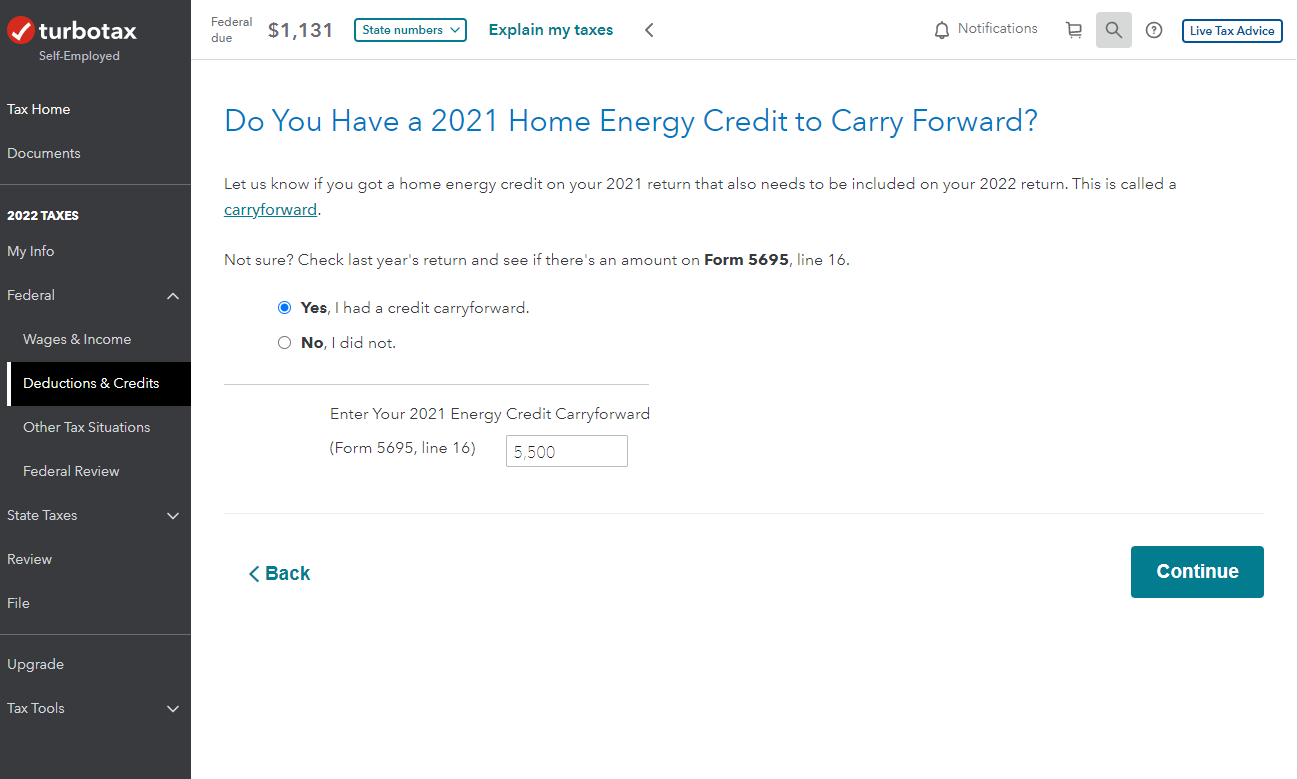

- Work your way through the pages until you reach the Do You Have a 2021 Home Energy Credit to Carry Forward? screen, and select Yes, I had a credit carryforward. In the box that generates below, you can enter the carryforward amount. Then, select Continue

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17552925565

Level 1

tianwaifeixian

Level 4

ilenearg

Level 2

Lukas1994

Level 2

rodiy2k21

Returning Member