- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

Try typing 'home energy improvement' in the Search area, then 'Jump to home energy improvement'.

Choose the bubble 'Yes, we made energy improvements or have a carryforward'.

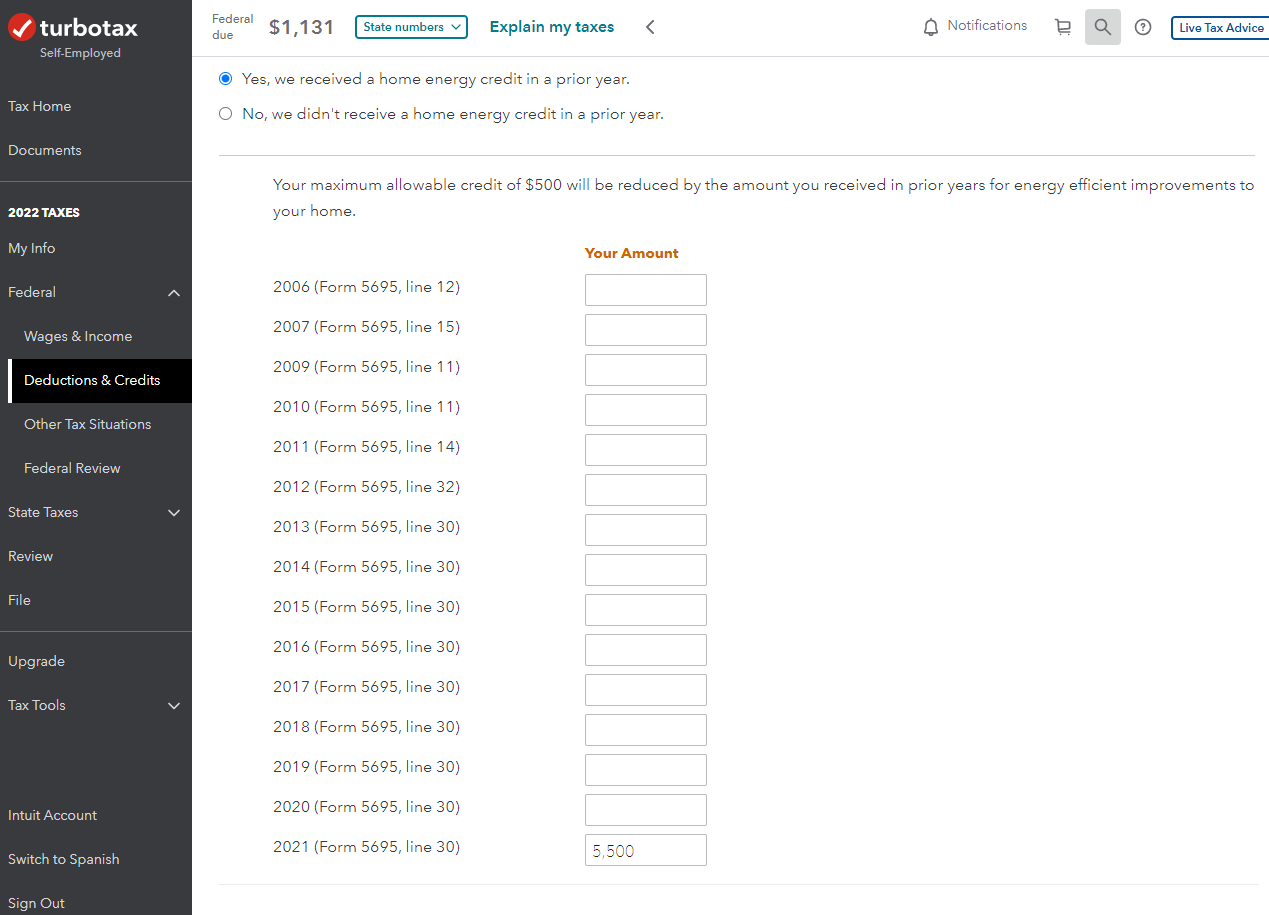

Continue, until you come to a screen where you can enter your Carryforward Amount for 2021 (from Form 5695, Line 30).

If this amount is less than shown on Form 5695, Line 30 for 2020, TurboTax may have applied some of the credit automatically in 2021. Check your 2021 Form 5695, Line 16 to verify this.

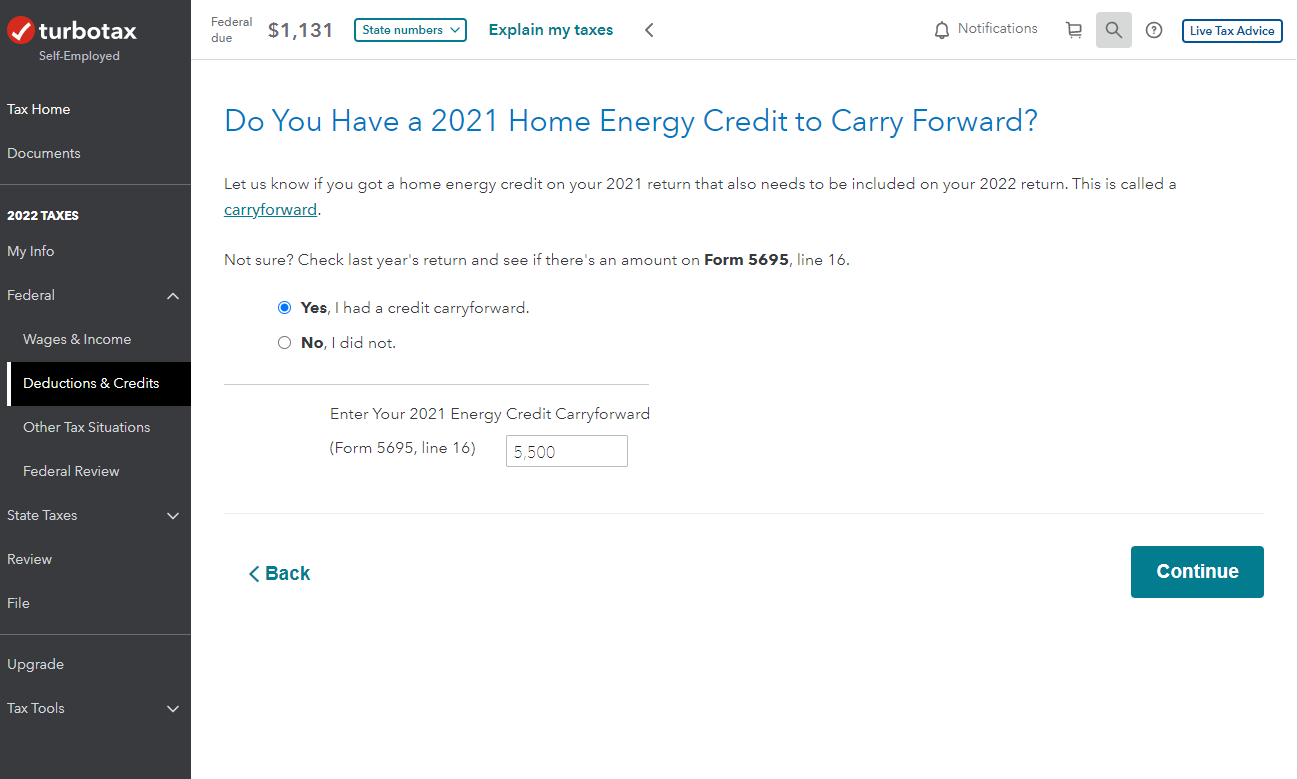

Continue, and you will come to another screen where you can enter your 2021 Carryforward Amount.

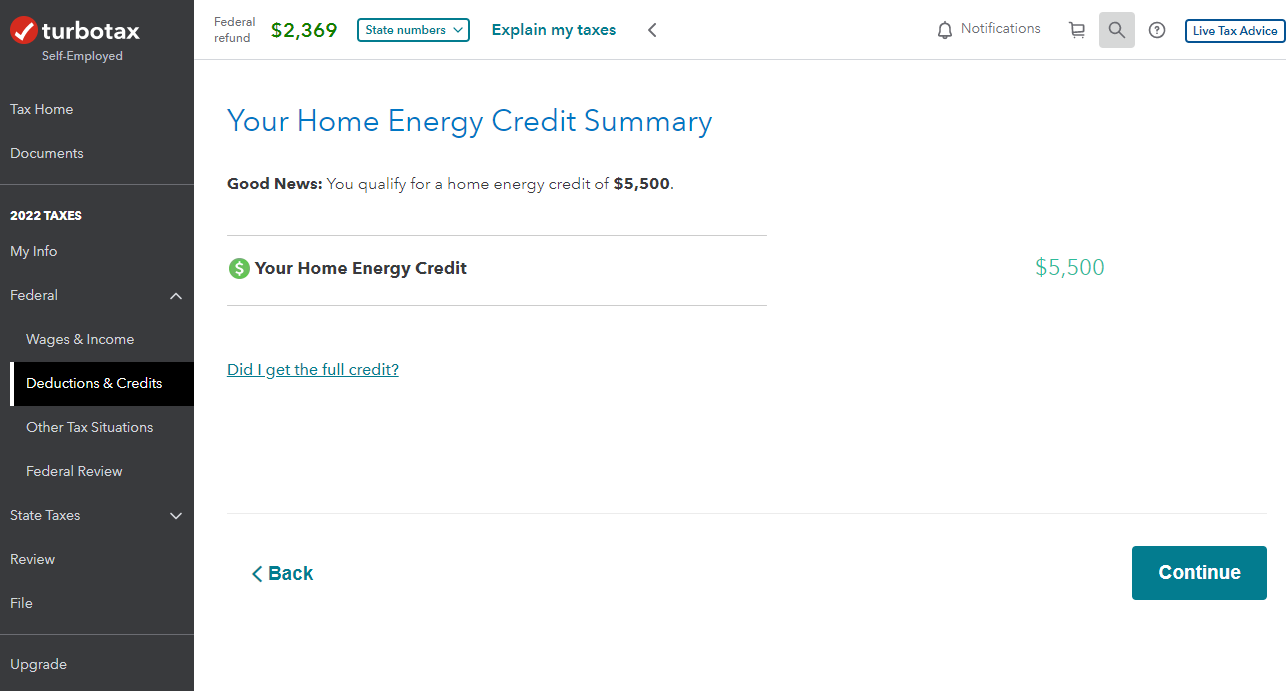

Then you will get a Home Energy Credit Summary screen telling you the amount of your credit.

Here's more info on Home Energy Credit (Form 5695).

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 3, 2023

10:41 AM