- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- State e-file fee $25

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State e-file fee $25

When you purchase the software, the Turbotax Premier label states Federal +State. There is no clear advertising that there is an additional extra $25 fee for e-filing. I hope lawyers sue Intuit for their deceiving advertising. I will avoid Turbotax and any other Intuit software platform moving forward.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State e-file fee $25

The purchased software states that you get a free Federal program and one free State program, it does not state you get a free State return e-file. There has always been a charge to e-file a State return with the Desktop version. If you print and mail the State return there is no charge.

The following is what is stated about the desktop software:

Includes 5 federal e-files & 1 State download

State e-file additional

CD or Download

Exclusive annual benefits include:

- Free Audit Defense ($45 value)

- Dedicated phone support

- Lock in next year’s software at November’s early season pricing

- Automatic renewal each November

- Option to purchase unlimited, live expert tax advice**

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State e-file fee $25

I purchased the TurboTax Premier 2023 Federal +E-file State Desktop version on 11/03/2023 at Costco and paid $25 extra for e-file and $35 ($45-$10 Credit) for Audit Defence.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State e-file fee $25

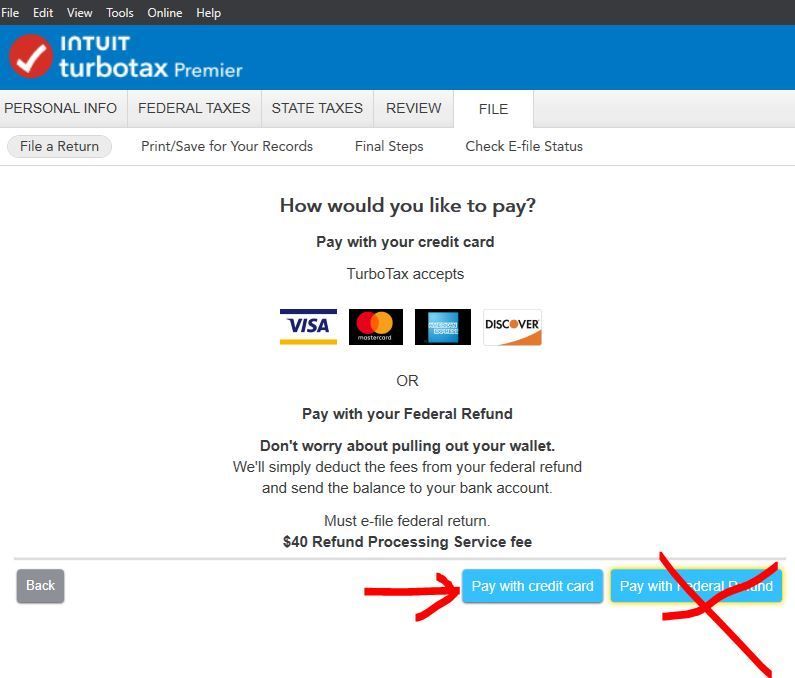

Yes? Do you have another question? That only says State Download. Not a State Efile. Are you in California? If you want to have the $25 state efile fee deducted from your federal refund there is an Extra $40 (45 in CA) Refund Processing Service charge to have it deducted. In California you have to take Audit Defense. You can avoid the extra $45 by paying upfront with a credit card. Or you can print and mail state for free.

You have to watch out when you file. There is one screen that can trip you up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State e-file fee $25

@VolvoGirl Imaging at the Intuit car dealership: "Premium cars come with an engine and transmission, but only 2 wheels. You can bring the other two wheels yourself or buy them from us. If we install two wheels, we will charge you an additional fee. ABS is also extra."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State e-file fee $25

Yes, most products come in multiple “levels” and/or with options. Cars certainly have a lot of them. There are dozens of threads at my car’s forum which go like: “Why doesn’t my car have the X feature???” with the answer “If you had bought the next trim level (or two, or three) up, it would have!”

I do remember when ABS used to be an option, but I believe it’s been mandatory since 2013, so I guess if you want e-filing to be mandatory, talk to your congress person. (Keeping in mind, of course, that mandatory doesn’t mean that it doesn’t cost you anything. I’m certain ABS still costs money, but making something standard does tend to make it cheaper.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State e-file fee $25

I have never paid to file either return. Had I known, I wouldn't have chosen TurboTax. What a rip off! I only needed to prepare 1 fed and 1 state. What I paid for not preparing 4 addl fed returns TT should have let me efile both.

This is the last time I use this and I will be sure to inform everyone I know NOT to purchase it either!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State e-file fee $25

2023 Turbotax package purchased at Costco says "Federal Returns + Federal E-File". Below that it reads "State Returns". Seems very clear to me that the meaning is "Federal E-File included, State is NOT". There is a banner that says "Includes $10 credit for in-product add-ons". Since the State E-File was a $25 add-on, less $10, I expected to pay $15 for both E-Files. However, the TPG leaches charged me an additional $40, just because they could. They had a circuitous logic to justify their theft. Now I'm caught in the old "You'll have to call Turbotax, you'll have to call IRS, you'll have to call TPG" run-around. Whatever happened to truth in advertising?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State e-file fee $25

Finally got to the bottom of this: I finished both Fed and State returns on a Premier version, then came to the last couple of screens where I was asked if I wanted to also E-File my State return. It would cost $25, less $10 credit from Costco. I thought ok, quicker, and saves me a trip to the post office. Then, Turbo apparently asked if I wanted to pay the $15 by credit or debit card or have it deducted from my refund. Also apparently, there was text that I didn't see stating that if it was deducted from my refund, there was a $40 fee for doing so. FATAL MISTAKE! So I wound up paying $40 to have the $15 paid out of my refund!

My own carelessness and haste to get my taxes done cost me $40 that I normally never would have spent. Turbo was actually happy to explain how stupid I was that I missed the critical text, and that they, of course were blameless.

Still, I suspect I am not alone, and I would think Turbo would realize that something in their software could be tweaked to avoid making unhappy customers.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State e-file fee $25

It’s misleading and obviously TurboTax knows it too. The excuse TurboTax will use it “well that’s your fault you fell for our scam misleading ad”. I too thought it was free included with my purchase, but I had to pay 25 dollars for efile or mail in for free was the other option. Hopefully some lawyer get a hold of this and sue TurboTax for deceiving their customers

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State e-file fee $25

That statement is not true. Before last year State filing was included.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State e-file fee $25

@jamescable1 What you used last year was not TurboTax or you did not e-file a state tax return.

I have been using the TurboTax desktop editions for at least the past 29 years and e-filing of a state tax return has always had an e-file fee. In tax year 1998 the state e-file fee was $9.95, in tax year 2024 the state e-file fee is $25.00

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State e-file fee $25

@jamescable1 There has always been a fee to efile a state return from the Desktop program except in New York. Did you used to live in New York? Check your credit card statements or you could have had the fees deducted from a federal refund. Or you printed and mailed the state return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17724059922

New Member

anonymousecho102

New Member

dlezon

New Member

buzz5

New Member

jborbon82

New Member