- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Where do I enter contributions to a 529 plan for tax year 2020? On the Federal and/or Colorad...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter contributions to a 529 plan for tax year 2020? On the Federal and/or Colorado state return. I only see the option to report distributions from a 529.

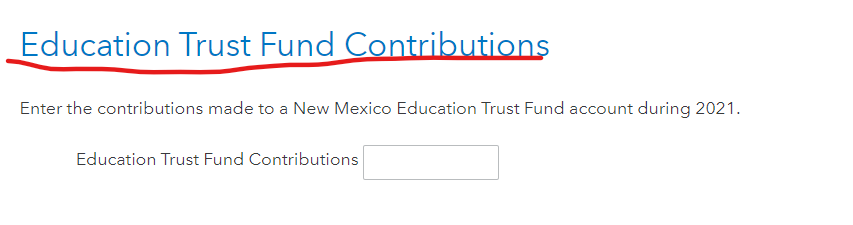

You can enter your 529 contributions on the screen that asks Education Trust Fund Contributions. New Mexico is one of only four states in the nation to provide an unlimited state tax deduction for contributions to its 529 plan.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter contributions to a 529 plan for tax year 2020? On the Federal and/or Colorado state return. I only see the option to report distributions from a 529.

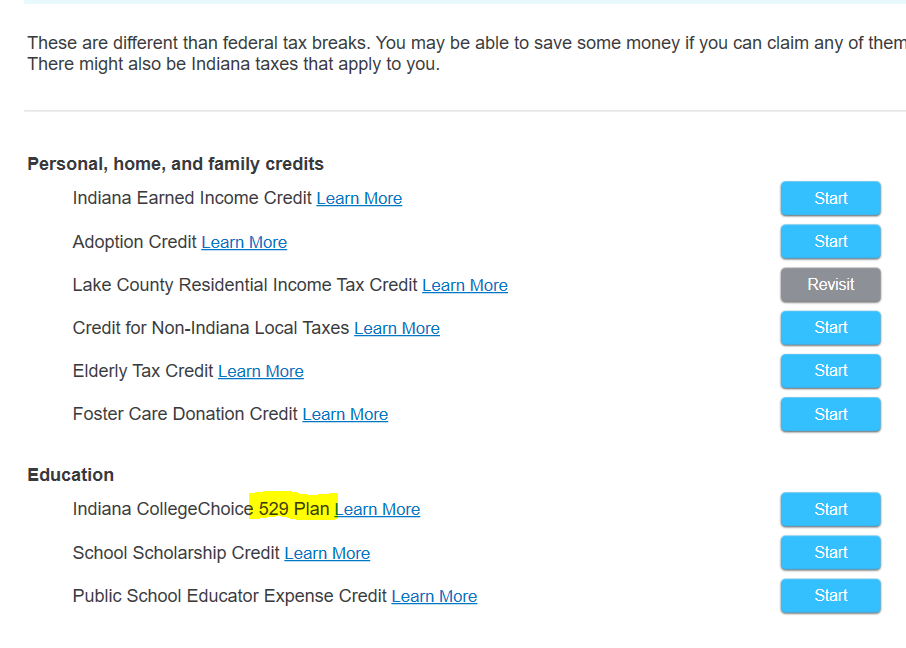

Hello I don't see anywhere that I can put in my 529 contributions in Indiana? What should I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter contributions to a 529 plan for tax year 2020? On the Federal and/or Colorado state return. I only see the option to report distributions from a 529.

Continue past the income section you are in. The 529 is a credit and appears after all income additions and subtractions. You can verify the credit shows on Schedule 6, line4.

For more on requirements, see here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter contributions to a 529 plan for tax year 2020? On the Federal and/or Colorado state return. I only see the option to report distributions from a 529.

Thank you. However, I don't see any of that as an option.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter contributions to a 529 plan for tax year 2020? On the Federal and/or Colorado state return. I only see the option to report distributions from a 529.

Go to your state taxes tab to prepare your Colorado State return. Go to the section that says Here is the income that Colorado Handles Differently. Go to education>529 CollegeInvest Program Contributions. Click the learn more button to see if your particular plan qualifies for this contribution. If it does, report it!!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter contributions to a 529 plan for tax year 2020? On the Federal and/or Colorado state return. I only see the option to report distributions from a 529.

It is not there for Virginia. Please post the exact path. I have been working on this for 2 hours, reading and rereading posts on the forum. I DO NOT SEE ANY INFO ANYWHERE ON MY PENDING RETURN THAT SAYS "HERE IS THE INCOME THAT VIRGINIA HANDLES DIFFERENTLY "!

I do see a section that asks about coverdell distributions.

This is bad Turbo Tax...c'mon guys.

Thanks in advance

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter contributions to a 529 plan for tax year 2020? On the Federal and/or Colorado state return. I only see the option to report distributions from a 529.

For Virginia, which I just found.........here is where it was located on my 2022 tax year Virginia return and you may need to mess with it a few times going back and forth. Absolutely ridiculous:

Go to:

State Taxes

Your State Return

You will see this at the top of the page:

"Your 2022 Virginia taxes are ready for us to check"

Then you will see the following list:

General InfoLearn More

Residency status

IncomeLearn More

Retirement income, college savings plans, and other state tax differences

Credits and taxesLearn More

Payments, credits and taxes

Other situationsLearn More

Extension, estimated payments and contributions

I find nothing that says "Here's the Income..........."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter contributions to a 529 plan for tax year 2020? On the Federal and/or Colorado state return. I only see the option to report distributions from a 529.

In Virginia, I set up a 529 plan four years ago but I have never entered the amount as a deduction on my VA state taxes. Can I enter the whole amount now for the 2022 tax return for Virginia?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter contributions to a 529 plan for tax year 2020? On the Federal and/or Colorado state return. I only see the option to report distributions from a 529.

To enter the Virginia 529 Account Contributions, you will enter the lesser of $4,000 or the amount contributed during the taxable year for each Virginia 529 account. If you contributed more than $4,000 per account during the taxable year, you could carry forward any undetected amount until the contribution has been fully deducted. So you can deduct up to $4,000 and carry forward any remaining amount.

For more information, see the link below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

CTinHI

Level 1

jayduran

New Member

av8rhb

New Member

jyeh74

Level 3

Benjamine

Level 4