- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Wages Allocation between states.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wages Allocation between states.

During the first half of the year, I worked in North Carolina and lived in South Carolina. The second half, I moved to the state I work in. When filling out the Wages Allocation page, the first box was automatically filled in with my total income. When filling out the page, do I leave that box filled or do I clear it as I fill out the other boxes allocation which income was earned while living out of state vs in state?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wages Allocation between states.

For more specific advise, please identify the two states.

That said, the usual rule is that the state you moved to and worked in all year will tax all your wage income and probably not separate which income was earned while living out of state vs in state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wages Allocation between states.

Worked in North Carolina all year. Lived in South Carolina the first few months, then moved to NC and ended the year there.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wages Allocation between states.

The screen Part-Year and Nonresident Income in the North Carolina state income tax return states:

You will need to enter amounts for the income earned while a North Carolina resident, including North Carolina source income you earned while a nonresident.

North Carolina will tax the income earned while you were a nonresident and the income earned while you were a resident.

South Carolina has a claim on the income earned while you were a resident of South Carolina. Income taxed by South Carolina may qualify you for a North Carolina credit if you paid income tax on income that was taxed by, both North Carolina and South Carolina.

In the North Carolina income tax return, at the screen Other State or County Tax Credit, select Yes. Report the amount of income and tax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wages Allocation between states.

How do I fill out the page? Turbotax gives me NO direction. It just takes me to a page called "Wages Allocation" and has a box filled with my total annual revenue already filled in. Do I erase this and fill out the separate amounts in their own boxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wages Allocation between states.

Yes, erase the data that is prepopulated in those boxes. You have to separate the amount of income earned in North Carolina while you were a resident of South Carolina and the amount of income you earned in North Carolina while a resident of North Carolina.

As an example, if I earned $50,000 total in North Carolina and moved to the state after living in South Carolina for three months, then I would allocate 3 months of income as a Nonresident of North Carolina (with NC source income) and 9 months of North Carolina Resident Income. Since you earned your full wage in North Carolina, don't choose Not NC source income for either of your entries.

Please see the screenshot below for additional clarification.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wages Allocation between states.

I am trying to do this step on this page in the Mac version of TurboTax Desktop Deluxe. We moved from Virginia to NC halfway through the year. The Virginia state wage allocation is easy to separate, with fillable boxes. On this page for NC wage allocation, the fields appear the same as your screenshot above, but they cannot be edited. There is line of blank fields at the bottom that also cannot be edited.

I need to be able to adjust one of the W-2 incomes to split it 1/2 and 1/2 between PY NC resident income and non-NC source income.

Do you know how I can do that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wages Allocation between states.

I would like to take a deeper look at this. However, I need a diagnostic file which is a copy of your tax return that has all of your personal information removed. You can send one to us by following the directions below:

TurboTax Online:

- Sign into your online account.

- Locate the Tax Tools on the left-hand side of the screen.

- A drop-down will appear. Select Tools

- On the pop-up screen, click on “Share my file with agent.”

- This will generate a message that a diagnostic file gets sanitized and transmitted to us.

- Please provide the Token Number that was generated in the response.

TurboTax Desktop/Download Versions:

- Open your return.

- Click the Online tab in the black bar across the top of TurboTax and select “Send Tax File to Agent” *

- This will generate a message that a diagnostic copy will be created. Click on OK and the tax file will be sanitized and transmitted to us.

- Please provide the Token Number (including the dash) that was generated in the response.

*(If using a MAC, go to the menu at the top of the screen, select Help, then, “Send Tax File to Agent”)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wages Allocation between states.

I've attempted this, but every time I erase the data in the boxes and separate the income, the website undoes what I've filled in and replaces it with what was originally there (the total amount earned all year into one box).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wages Allocation between states.

Token number: 1289695

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wages Allocation between states.

The wage allocation is not working because the box is checked that you did not live in North Carolina and only worked there. With this notation, you will be taxed by North Carolina on your income earned in North Carolina. This is indicated by your W-2. Then you can received a credit for taxes paid to another state on your resident tax return. If you were a part time resident of North Carolina you will need to change the selection and then you can allocate your wages between states.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wages Allocation between states.

Which box is this and how do I change it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wages Allocation between states.

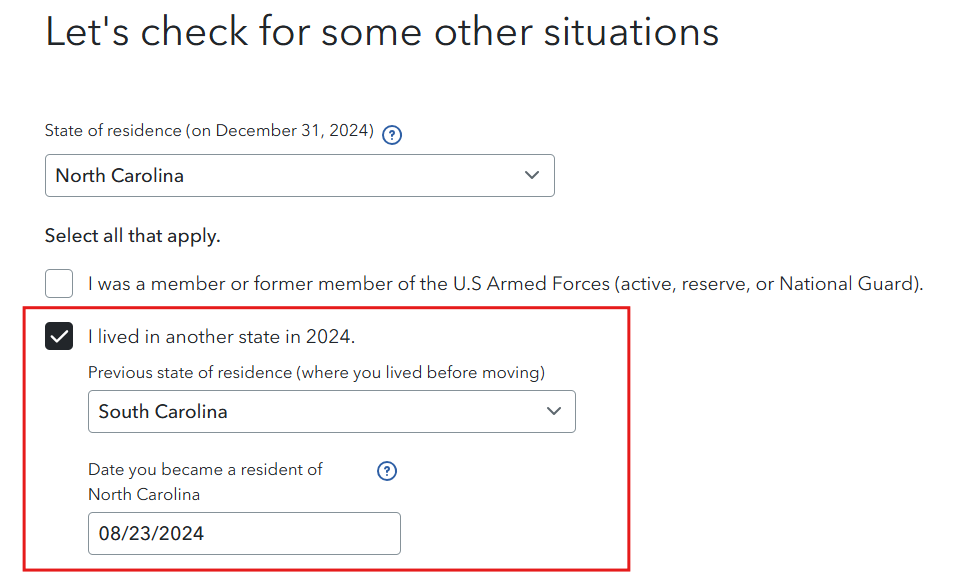

A screenshot of the particular screen BrittanyS is referring to can be found below.

You will have to indicate "I had more than one state of residence" if you moved in or out of North Carolina during 2024.

To get to this screen, please do the following:

- Open your North Carolina return.

- On the first screen Did you make money in NC in 2024, but never live there? Answer No.

- The next screen will be What was your state of residence in 2024? Answer accordingly.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wages Allocation between states.

Made sure I did this and issue persists.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wages Allocation between states.

Check your personal info section at the very beginning of your return (before the federal section) to see if you've entered that you were a resident of multiple states during 2024 (see screenshot). This should flow over to the state return so that it sets the return up as a part year return. It will also add the South Carolina return to your account.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

smarder21

New Member

zsuarez1222

New Member

user17714257763

New Member

rmhoff1976

New Member

stacygilbert

New Member