- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: URGENT REPLY NEEDED: Unable to e-file due to form 2441/forfeited dependent care

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

URGENT REPLY NEEDED: Unable to e-file due to form 2441/forfeited dependent care

Good evening,

Can you please advise how to resolve this issue so I can successfully report the $450 and e-file my return? Thank you.

Due to the attached screenshots, I am unable to e-file my return due to issues stemming from forfeited dependent care expenses/form 2441.

$450 is reported on line 10 of my W-2. I selected yes that I have employer paid dependent care, no to onsite care, and listed $0 in dependent care expenses.

On a similar issue, I followed the guidance a TurboTax expert suggested from this link to no resolve: https://ttlc.intuit.com/community/tax-credits-deductions/discussion/employer-contributed-to-dependen...

I

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

URGENT REPLY NEEDED: Unable to e-file due to form 2441/forfeited dependent care

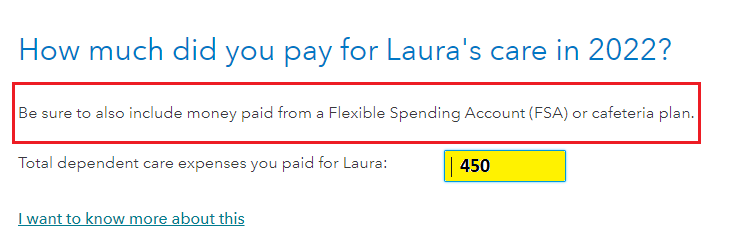

When you complete the Child and Dependent Care section of the return be sure to enter the amount paid for child care $450, which includes the amount provided by your employer, and then the care provider information. Of course if you should use your actual numbers if they are different than just the $450 paid by your employer.

Use this link for instructions to enter your child care information: How do I get to the child care?

Also see the image below. When I enter the information in all locations I do not receive an error when doing the 'Federal Review'.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

URGENT REPLY NEEDED: Unable to e-file due to form 2441/forfeited dependent care

Hi there,

The thing is I did not have child care expenses this tax year. I attempted to put zero for expenses, N/A on the childcare provider information, zeros for the social, and used my city and zip, but it still kicked it back for review. What do I need to do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

URGENT REPLY NEEDED: Unable to e-file due to form 2441/forfeited dependent care

First, try out by not putting in any information at all for the Child and dependant care credits. If that doesn't work, then see if you can delete the Form 2441 in its entirety see HERE https://ttlc.intuit.com/community/tax-credits-deductions/discussion/employer-contributed-to-dependen...

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17573551077

New Member

user17572772311

New Member

user17571045865

New Member

fuad

New Member

user17570167794

New Member