- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

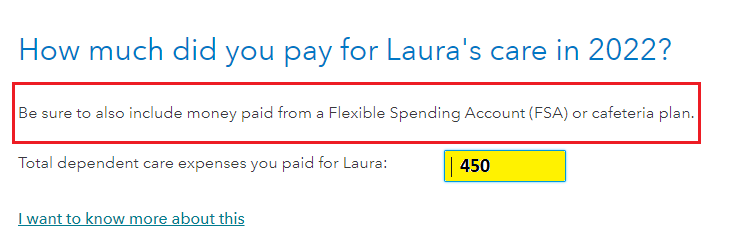

When you complete the Child and Dependent Care section of the return be sure to enter the amount paid for child care $450, which includes the amount provided by your employer, and then the care provider information. Of course if you should use your actual numbers if they are different than just the $450 paid by your employer.

Use this link for instructions to enter your child care information: How do I get to the child care?

Also see the image below. When I enter the information in all locations I do not receive an error when doing the 'Federal Review'.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

January 23, 2023

6:53 AM