- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: TurboTax does not recognize that I successfully e-filed my return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax does not recognize that I successfully e-filed my return

I e-filed 3 weeks ago, and received the confirmation from TurboTax that it had been accepted. I received my refund today and went to e-file my State return but TT won't let me because it says I haven't e-filed my Federal Return. I don't want to e-file my Federal Return a second time just to be able to e-file my State return (probably illegal anyway)

Is there a way to inform TT that I have already e-filed and want to e-file my State return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax does not recognize that I successfully e-filed my return

Your post doesn't indicate whether you're using TurboTax Online or Desktop (CD/Download) edition. I'll share below a TurboTax FAQ that gives instructions for checking e-file status of your return, regardless of the platform. Please post back if you continue to have difficulty.

How do I check my e-file status?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax does not recognize that I successfully e-filed my return

Thanks for the quick response and the link. It is the Mac download version.

when I check the efile status it says it has not yet been filed. But I have the email from TT saying it has been filed and accepted. I also now have the refund as proof the return has been filed. It took 3 weeks after the acceptance email for the refund to hit my bank account. Is there no way to let the program that it has been filed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax does not recognize that I successfully e-filed my return

Did you check the e-file status from INSIDE the software program? I use the Desktop for Windows.

For me, I select the FILE tab, then near the bottom you'll see "Electronic Filing". Hover over that and you'll see the option to check the e-file status. Once the program has recognized that your return has been accepted, you should see a check mark on your return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax does not recognize that I successfully e-filed my return

I know there have been some users who are experiencing issues with the desktop software not displaying the successful e-file status of their federal returns. I am not sure how to "fix" that. But one suggestion would be to just print and mail the state return instead of e-filing it. That would also save you the $25 state e-file fee that you have to pay if you e-file the state using the CD/download.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax does not recognize that I successfully e-filed my return

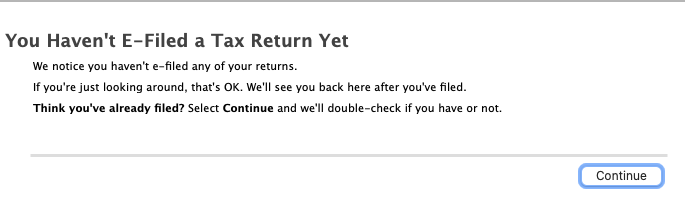

I just tried those exact steps and still get the message that "You haven't E-Filed a Tax Return yet"

If I lived in the USA I might do just that but I live in England so printing and mailing the return is not only a similar price to $25 but is very inconvenient. "Letter" size paper is not available at all in the UK so it would have to be printed on the larger A4 paper plus if I wanted it to be signed for on arrival I would have to take a trip to a nearby large town to a FedEx or UPS office.

I had to do this a few years ago when TT declared that the foreign tax credit forms 1116 would not be fixed for overseas residents so I had to paper file both Federal and State returns.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax does not recognize that I successfully e-filed my return

Your issue is more complex than your original post indicated. Since you are abroad, it may be difficult for you to seek customer support, but you can try these avenues:

https://twitter.com/TeamTurboTax

or

https://www.facebook.com/turbotax

And....another workaround....and you may not like this but it could work.....use the tax website of the state for which you need to file a return. (And if you live in England....not sure why you need to file a state return....but assume you have your reasons...)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax does not recognize that I successfully e-filed my return

Thanks again for the suggestions. A number of States including California and Louisiana tax non-residents if they receive income from an employer registered in the State. We moved from Louisiana to Texas in 2010 and have never been back but have paid Louisiana State taxes on my W2 income (a non-qualified pension) from my ex-employer ever since.

We moved to England in 2016 but the USA is the only country in the world, apart from Eritrea, to tax its citizens on their worldwide income regardless of where they live. It is what it is.

I tried Googling what would happen if I e-filed my federal return twice and I believe it will simply be rejected, no penalty or anything so I think I will try e-filing both returns together like TurboTax prefers and see if that works.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax does not recognize that I successfully e-filed my return

@am1169 What a mess for you. (BTW, I'm from Louisiana originally, so shout-out to a homie!)

I'm just curious: Where in the program are you receiving an error message, or whatever you're seeing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax does not recognize that I successfully e-filed my return

The error message appears when I check my e-file status, or when I attempt to file my LA return.

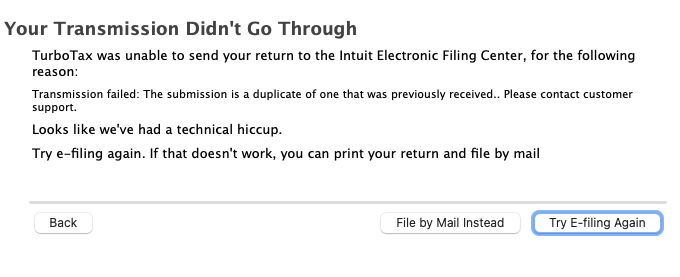

I decided to just now submit them both again but have now failed because it says that the transmission did not go through to the Intuit Electronic filing center because it is a duplicate of one already received.

So, TurboTax (Intuit) actually does know that I have already submitted a Federal return through them when I try to file, but won't let me submit a Louisiana return because it says I haven't filed a Federal return. This is very crap programming. It obviously knows I have submitted a Federal return because it tells me that, but still won't let me submit a State return.

I'll look for other ways to submit my return now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax does not recognize that I successfully e-filed my return

@am1169 You sound like you're savvy on using TurboTax. But just to make sure:

You are NOT using the ONLINE platform (web version) by mistake either to file the original federal return or trying to file the state return now? You need to use the TT icon on your desktop to open the Desktop program.

This is my last thought on the issue. I am so sorry for the frustration you've experienced.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax does not recognize that I successfully e-filed my return

Hi Kat.

I can confirm that I am ABSOLUTELY NOT using the web version of TurboTax. I always buy the download version which sits installed on my laptop. I do this for a couple of reasons. I create an estimated tax return during the year so I can model my taxes for things like selling equities, IRA to Roth conversions etc. You are allowed to file up to 5 tax returns with the download version so I always let our son use it on my laptop to file his return, and this year our daughter, who has moved back from California, used it successfully to e-file both her Federal and California State returns.

I decided to just use the Post Office international tracked mail so I could print my LA return, attach my W2, and walk to the local Post Office. Cost was £9.75. I've done this before and will watch it arrive in New York within 48 hours and then spend up to 6 weeks bouncing around various USPS sorting offices until it eventually arrives in Baton Rouge. I'm only owed $38 so no big deal.

Thanks to all for trying to help. When I did file by printing out my return I took the opportunity offered to write a TurboTax review stating my problems this year.

I also saw on this forum another person who was trying and failing to do similar. TurboTax does not support efiling IRS form 8333 so he had to print out and send in his return, but then he was unable to efile his NY State return because he had not efiled his Federal return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ajax010

Returning Member

JustmeBG

New Member

John_Davis

New Member

Ciao4

Level 3

ronhowco

New Member