- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: State filing - Residency Status

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State filing - Residency Status

I have SSN. My wife got ITIN just now. We filed jointly for 2019.

Now we started filing Indiana state return. It asks: "Your Indiana residency status". I lived in Indiana for the whole 2019 year but my wife arrived in USA for the first time in July 2019.

QUESTIONS:

1. Should I select "part-year resident"? Because I lived full year and my wife lived only 6 months in Indiana.

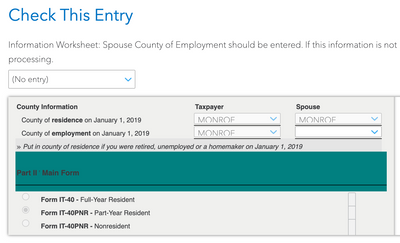

2. What about "County of Residence" on 1/1/2019? I know mine is MONROE county. But my wife wasn't even in USA on 1/1/2019. Should I select "No Entry" for her? When I do this, it says that my return can be delayed if I select "No Entry" for the county of residence and employment.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State filing - Residency Status

Form IT-40PNR for Part-Year and Full-Year

Nonresidents

Use Form IT-40PNR if you (and/or your spouse, if married filing

jointly):

• Were Indiana residents for less than a full-year or not at all, or

• Are filing jointly and one was a full-year Indiana resident and the

other was not a full-year Indiana resident

residency status - non-resident

use 00 for her county

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State filing - Residency Status

- Don't you think it should be part-year resident? I am not sure why you are suggesting "non-resident". I lived in Indiana for whole 2019 year and my wife lived starting 06/2019.

- Turbotax isn't allowing me to enter 00 for county for my wife. Also, I selected "No Entry" for resident county, it automatically changed it to MONROE. Screenshot attached.

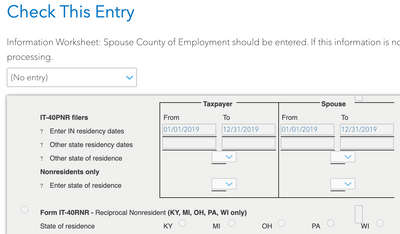

- Turbotax automatically changed the dates my wife lived in Indiana from "6/26/2019-12/31/2019" to "1/1/2019 - 12/31/2019".

Please help. @Anonymous

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State filing - Residency Status

Please let me know as mentioned in my previous post.

Summary of questions asked in the previous post:

[1] Shouldn't it be part-year resident?

[2] Turbotax isn't allowing me to put 00 for my wife's residence county and employment county.

[3] Turbotax automatically changes the dates my wife lived in Indiana from "6/26/2019-12/31/2019" to "1/1/2019 - 12/31/2019".

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

FlyingCat

Level 2

FlyingCat

Level 2

vnet1028

New Member

rogers_ken

New Member

kavouras34

New Member