- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

- Don't you think it should be part-year resident? I am not sure why you are suggesting "non-resident". I lived in Indiana for whole 2019 year and my wife lived starting 06/2019.

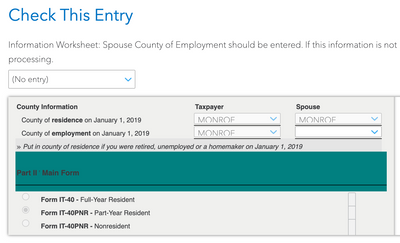

- Turbotax isn't allowing me to enter 00 for county for my wife. Also, I selected "No Entry" for resident county, it automatically changed it to MONROE. Screenshot attached.

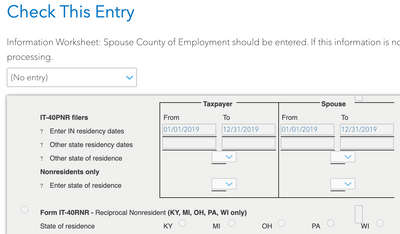

- Turbotax automatically changed the dates my wife lived in Indiana from "6/26/2019-12/31/2019" to "1/1/2019 - 12/31/2019".

Please help. @Anonymous

November 21, 2020

9:46 AM