- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: NH Form DP-2210 uses WRONG penalty rate

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NH Form DP-2210 uses WRONG penalty rate

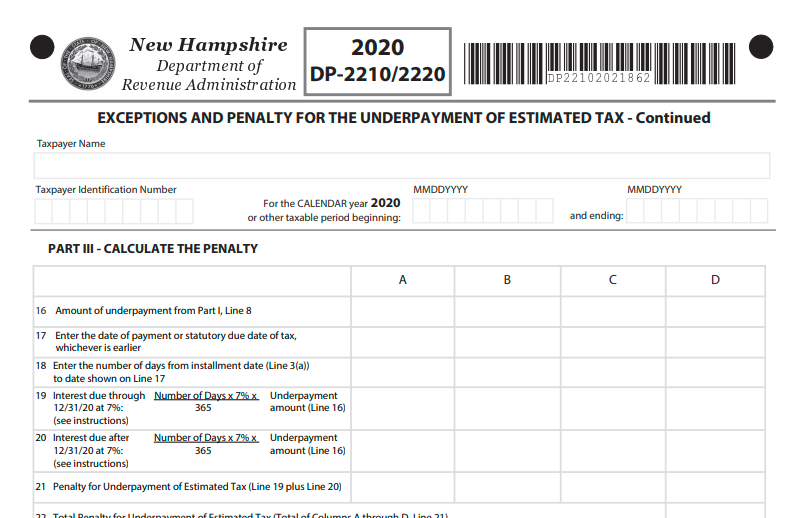

The NH DP-2210 Turbo tax form claims that the penalty rate is 7% for underpayments through 12/31/2020 (line 17) and that the rate for underpayments from 1/1/2021 through 4/15/2021 (line 20) is ALSO the same 7%.

BUT - when you read the instructions from the NH Tax authority, they show that the penalty rate for the period from 1/1/2021 to 12/31/2021 is only 5%. https://www.revenue.nh.gov/forms/2021/documents/dp-2210-2220-instructions-2020.pdf SO, what is the scoop? Is it 5% or is it 7%.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NH Form DP-2210 uses WRONG penalty rate

Yes. The 5% underpayment penalty is for payments that cover tax year 1/1/21-12/31/21, not payments that were made in 2021.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NH Form DP-2210 uses WRONG penalty rate

The New Hampshire penalty is 7% for the entire year.

The link for the instructions you gave, as well as the instructions I tried to pull from the website, do not seem to work at the moment, but I have attached a picture below of the 2020 DP-2210 form. As shown below, the rate assessed (as shown on Line 19 and 20) is 7% for the entire year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NH Form DP-2210 uses WRONG penalty rate

Here is the chart that raised the question in my mind. It give the appearance that there is a different rate (5%) for that part of the late pre-payments that occurred from 1/1/2021 to 12/31/2021 (which also includes the time from 1/1/2021 to 4/15/2021 - when the final tax payment is made).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NH Form DP-2210 uses WRONG penalty rate

Yes. The 5% underpayment penalty is for payments that cover tax year 1/1/21-12/31/21, not payments that were made in 2021.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Newby1116

New Member

mandocash187

New Member

Major1096

New Member

tianwaifeixian

Level 4

az148

Level 3