- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Need some details on how to enter reconciliation amounts on NJ K-1 worksheet

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need some details on how to enter reconciliation amounts on NJ K-1 worksheet

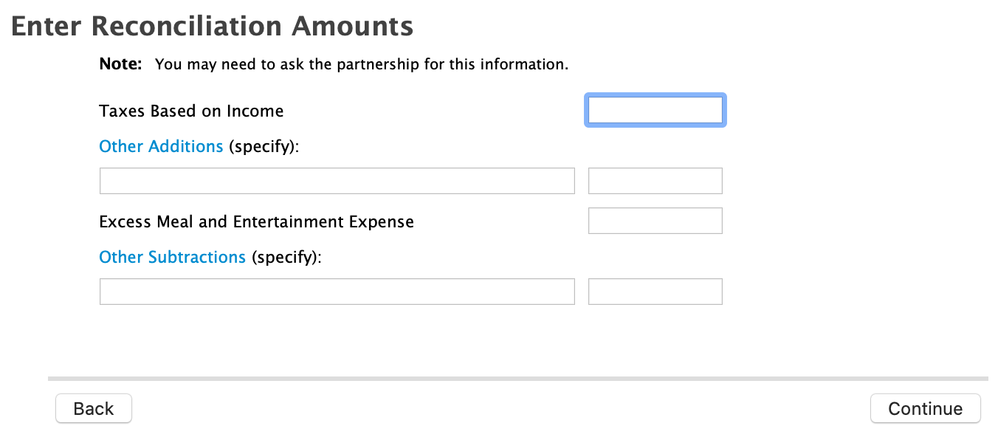

During NJ state tax preparation if you have an imported K-1 from Federal Tax Return you are asked if you got NJK-1 form with your K-1 and if you answer "No" - you get a screen named "Enter Reconciliation Amounts" with fields:

- Taxes Based on Income

- Other Additions

- Excess Meal and Entertainment Expense

- Other Subtractions

It's clear that if K-1 is coming from PTP or other passive partnerships - it's likely mostly inapplicable.

But what is "Taxes Based on Income" means here? Also, would be great to get a confirmation that I shouldn't worry too much about this information and screen in case of PTP.

If it matters, please answer for both cases: when the K-1 has an income coming from NJ State and when it doesn't.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need some details on how to enter reconciliation amounts on NJ K-1 worksheet

These answers are going to pertain directly to New Jersey activity of the partnership. If you have specific questions about a PTP, I would defer to the PTP for further guidance on how to report activity pertinent to New Jersey. It appears that it involves residency of partners as well as business activity in New Jersey.

Per the Instructions for NJ-1065 Partnership Return and New Jersey Partnership NJK-1 beginning on page 7:

Taxes based on income will be added back as the amount of taxes based on income which were deducted to determine ordinary income (loss) on Line 1, Ordinary Income (Loss) From Trade or Business Activities. This will be the amount reported on line 1, Schedule K, federal Form 1065.

Line 13b – Other Additions – Specify Enter on line 13b any other items deducted from or not included on lines 1 through 11 that are not excludable under the New Jersey Gross Income Tax Act. If an asset has been placed in service since January 1, 2004, refer to Worksheet GIT-DEP. This worksheet is available on the Division’s website. Include any net addition adjustment from Worksheet GIT-DEP, if applicable, if federal income included deduction of federal special depreciation allowance or IRC Section 179 expense; federal Section 179 recapture income; or a gain or loss on disposition of such asset. Specify each item reported. If the amount reported on line 12, NJ-1065, included any loss incurred in connection with the disposition of exempt New Jersey or federal obligations, you must add back the amount of such loss on this line.

Line 15g – Other Subtractions – Specify Enter on line 15g any other items that are excludable or deductible from the income included in the subtotal reported on line 12 for New Jersey Gross Income Tax purposes. Specify each item subtracted. Examples of some items that might be reported on this line are: • Dividends from exempt federal and New Jersey obligations described at N.J.S.A. 54A:6-14. • Gains from the sale of exempt federal and New Jersey obligations excludable pursuant to N.J.S.A. 54A:5-1c. • Meal and entertainment expenses that constitute ordinary business expenses incurred in the conduct of 2019 Form NJ-1065 8 a trade or business that are not deductible for federal purposes. • If an asset has been placed in service since January 1, 2004, refer to Worksheet GIT-DEP. This worksheet is available on the Division’s website. Include any net subtraction adjustment from Worksheet GIT-DEP, if applicable, if federal income included deduction of federal special depreciation allowance or IRC Section 179 expense; federal Section 179 recapture income; or a gain or loss on disposition of such asset.

Note: A partnership is not entitled to a basis adjustment in the calculating and reporting of partnership gain or loss from the sale or disposition of partnership assets as was extended to individuals, as in the Koch case, on the sale or disposition of a partnership interest. The partnership must always use federal adjusted basis when determining gain or loss. Only taxpayers as defined pursuant to N.J.S.A. 54A:1-2.l are entitled to a Koch-type adjustment.

Please see page 2 of the instructions for who must file. Since you are a resident partner and reside in New Jersey, then Form NJ-1065 must be filed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need some details on how to enter reconciliation amounts on NJ K-1 worksheet

Thank you for your answer. But the document you refer to is "Instructions for NJ-1065 Partnership Return and New Jersey Partnership NJK-1". So, this document describes what and how partnerships should put into NJ-1065 (NJK-1). And yes, it looks like all partnerships suppose to send NJ-1065 (NJK-1) if they have partners in NJ.

But I just file a personal tax return as a partner, not a partnership. And I didn't get NJ-1065 /NJK-1 in any K-1 tax package from any of PTP partnerships. Should I contact each of them and request an NJ-1065 /NJK-1 that they suppose to provide me according to this NJ state instructions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need some details on how to enter reconciliation amounts on NJ K-1 worksheet

I contacted my partnerships and some of them were responsive and actually sent me NJK-1 forms.

Fundrise was able to provide NJK-1 forms in a day.

But some of the partnerships have no clue what NJK-1 is at all looks like.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need some details on how to enter reconciliation amounts on NJ K-1 worksheet

Hi, just wondering for those partnerships that didn't provide the NJK-1, is it ok to just leave all the adjustment fields empty?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need some details on how to enter reconciliation amounts on NJ K-1 worksheet

Yes. I would just assume that the reason they did not provide the form is because there are no adjustments.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need some details on how to enter reconciliation amounts on NJ K-1 worksheet

Hello - which turbotax product do I purchase to be able to generate/file the NJ-1065? I have TT Business and TT Premier purchased. When I finished filing my Federal 1120S, it only gave me two options to file for NJ: State S Corp and State Corp. I bought the latter since my LLC is not an S Corp for NJ purposes, only federal, but it did not have the 1065 option.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need some details on how to enter reconciliation amounts on NJ K-1 worksheet

Yes . You need to use the Premier version of TurboTax to enter a Schedule K-1 in TurboTax. There are three types of K-1s, depending on the type of entity creating the K-1: partnership, S-corporation and trust/estate must use the proper form. If you have NJ partnership income, you need to use form NJ 1065 K-1. The form 1120 S is for S corp.

See, instructions on NJ Partnership return and NJ 1065 K1, link

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need some details on how to enter reconciliation amounts on NJ K-1 worksheet

thank you - but to clarify - I am a single member LLC and am looking to generate the NJ-1065 from my business for my personal income tax return. I purchased both Premier and TT Business and can't seem to figure out how to generate the NJ-1065. I don't know if it is complicated by the fact that I am not an S corp for NJ purposes, only for federal.

ok update - I understand how to get the right software to get the NJ 1065 to trigger. (I have to enter my corporation as a partnership on the federal side in TT Business.) However, that is my dilemma. If I am not an S Corp for the State of NJ, what state tax form am I supposed to file. And the state dept tax phone lines say "too busy, call back later." ARGH.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need some details on how to enter reconciliation amounts on NJ K-1 worksheet

It depends. If you have Turbo Tax Business and prepared a partnership return(1065), that should flow into the New Jersey return also as a partnership return (NJ-1065). You need to purchased the state separately but once you prepare the federal return, the information should flow seamlessly into your NJ return. Are you sure you didn't pick S-Corp as the type of return you are wishing to prepare?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need some details on how to enter reconciliation amounts on NJ K-1 worksheet

Thank you Dave. you are right - when I dummied up entering in my business info as a Partnership, it triggered the option to purchase NJ1065. The problem lies in the fact that I am an S Corp for Federal purposes but not for NJ. I read a document on the NJ tax site that says a single member LLC is not required to file a state corp form, and rather it just flows in through the K-1 info on the NJ personal income tax state form. So hopefully that information is correct, and I do not need to file anything for NJ State business...

Appreciate the reply!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need some details on how to enter reconciliation amounts on NJ K-1 worksheet

Proshares also had nothing, even logging in online nothing for NJ, so I will leave it blank in TurboTax.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

garne2t2

Level 1

wttm2003

New Member

Blue Storm

Returning Member

RandlePink

Level 2

in Education

RandlePink

Level 2