- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need some details on how to enter reconciliation amounts on NJ K-1 worksheet

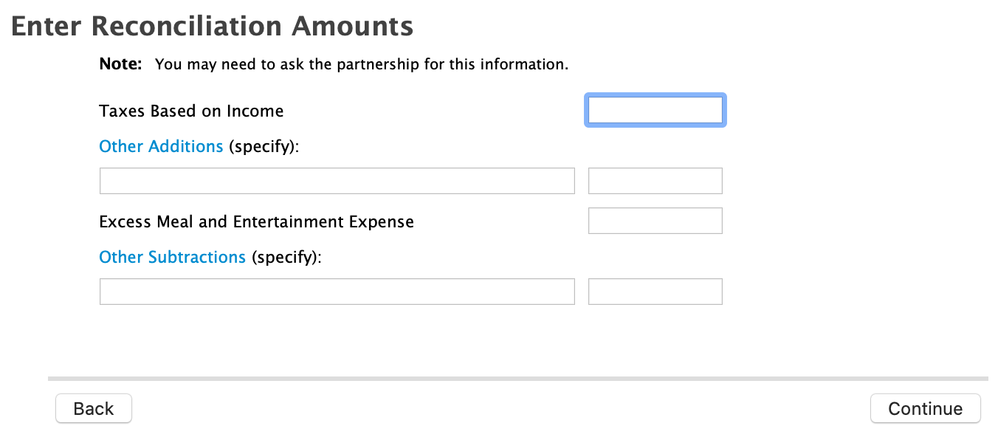

During NJ state tax preparation if you have an imported K-1 from Federal Tax Return you are asked if you got NJK-1 form with your K-1 and if you answer "No" - you get a screen named "Enter Reconciliation Amounts" with fields:

- Taxes Based on Income

- Other Additions

- Excess Meal and Entertainment Expense

- Other Subtractions

It's clear that if K-1 is coming from PTP or other passive partnerships - it's likely mostly inapplicable.

But what is "Taxes Based on Income" means here? Also, would be great to get a confirmation that I shouldn't worry too much about this information and screen in case of PTP.

If it matters, please answer for both cases: when the K-1 has an income coming from NJ State and when it doesn't.

Topics:

March 15, 2020

6:15 PM