- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: NC State taxes Bailey Vested - not showing on TT

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NC State taxes Bailey Vested - not showing on TT

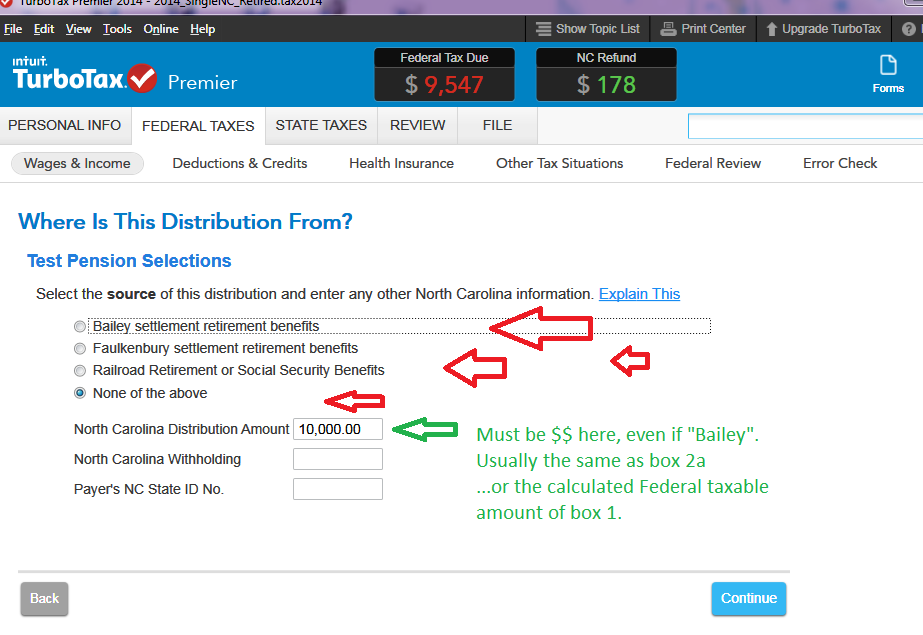

I am a widow and my husband's pension was Bailey Vested - I double checked with the retirement system and I do not have to pay State taxes, but TT shows that I owe almost $1000 for a $21,215 pension.

I checked the Bailey Vested box and it isn't changing ??

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NC State taxes Bailey Vested - not showing on TT

It may because you need to upgrade to the Deluxe version of TurboTax. I notice you are in the Free Edition which only supports W-2 Wages and the Earned Income Credit.

Once you update the program, you should be able to generate the additional forms required to report your 1099-R distribution. This should also correct your state issue and allow you to report the exemption of the retirement income from taxes in North Carolina.

Forms included in TurboTax products

How to upgrade in TurboTax online

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NC State taxes Bailey Vested - not showing on TT

Your mistake may be in the NC distribution amount you entered lower on the page. NC starts with the Federal AGI as the starting point, and when you enter your pension form in the Federal section, IF you put in a zero for the NC Distribution amount, then zero is subtracted from the Federal AGI to reduce it to a lower NC AGI value.

_________________________________

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

itr674

Returning Member

mlrancourt

New Member

Junebug-goestotown1

Returning Member

tarheelrick

New Member

johnsantaclara1

Level 4