- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Minnesota M1 Line 4

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota M1 Line 4

The standard deduction for married filing jointly is coming up as 25050 instead of 25100. Should I change it? And if so how?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota M1 Line 4

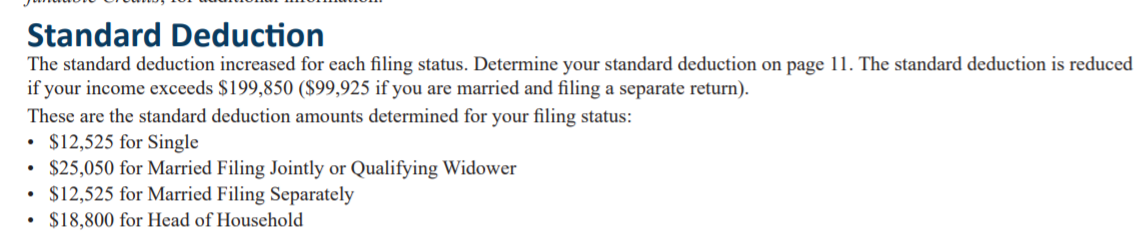

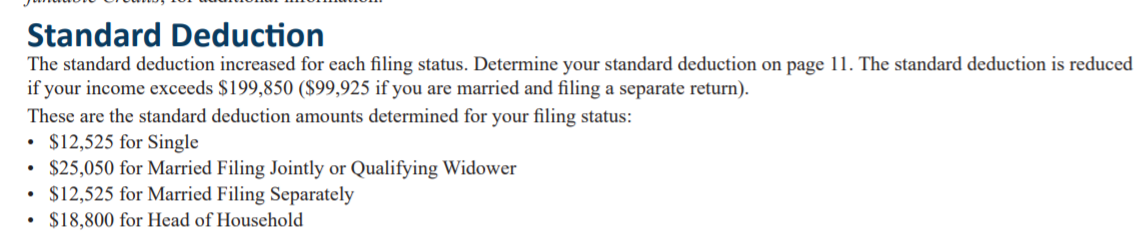

@ANB the Minnesota standard deduction for married filing joint is $25,050 in 2021 per the instructions for form M1.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota M1 Line 4

I guess the $25,050 is correct for Minnesota as per the www.revenue.state.mn.us/minnesota-standard-deduction

Amount of Minnesota's Standard Deduction

IF YOUR FILING STATUS IS THEN YOUR MINNESOTA STANDARD DEDUCTION IS

Single or | $12,525

|

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota M1 Line 4

You're right. It should be 25100. I would change it.

https://www.kiplinger.com/taxes/tax-deductions/602223/standard-deduction

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota M1 Line 4

Also had trouble with Federal 1040, line 12b and the charitable contribution if you take the standard deduction and file married filing jointly, and have given more than $600 you should be able to record $600 on line 12b and then on line 12c add 12a standard deduction amount and 12b the charitable contribution amount. At the final review, the number populates back to $300. It then continues to show up as an error. So, I had to manually change the number and fix the errors but not run the error check again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota M1 Line 4

@ANB the Minnesota standard deduction for married filing joint is $25,050 in 2021 per the instructions for form M1.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota M1 Line 4

I guess the $25,050 is correct for Minnesota as per the www.revenue.state.mn.us/minnesota-standard-deduction

Amount of Minnesota's Standard Deduction

IF YOUR FILING STATUS IS THEN YOUR MINNESOTA STANDARD DEDUCTION IS

Single or | $12,525

|

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sheilacohen

New Member

WadeReece

New Member

aburtonworks

New Member

rkcassie

New Member

danikin1

New Member