- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Michigan e-file MI-1040D line 1E and line 2E appear to be transposed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan e-file MI-1040D line 1E and line 2E appear to be transposed

TurboTax error check found Michigan tax to be error free. However, when I try to efile, TurboTax reports a 1040D form entry error for line 2E and requests for it to be on line 1E. The error popup shows it on line 1E not line 2E.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan e-file MI-1040D line 1E and line 2E appear to be transposed

Yes, this can be fixed. Above the error popup, there should be a white box to enter in the line 2E amount, presuming you only have short term gains to report. This should resolve the error.

In general, all Federal Schedule D transactions should be identified as short-term or long-term and as covered or noncovered based on the input in this area. There may be a transaction that is missing this information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan e-file MI-1040D line 1E and line 2E appear to be transposed

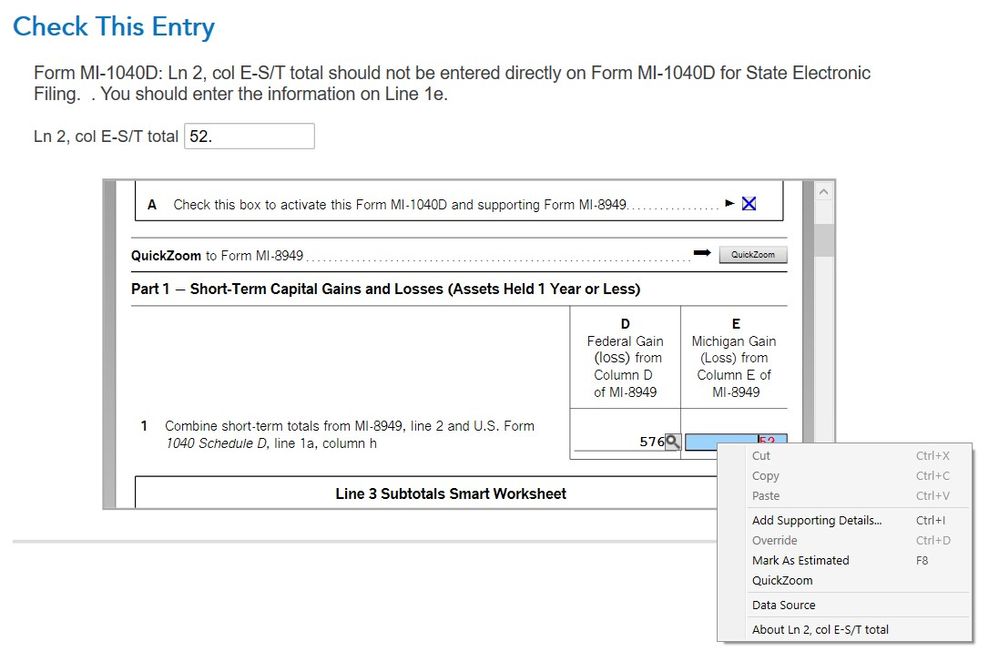

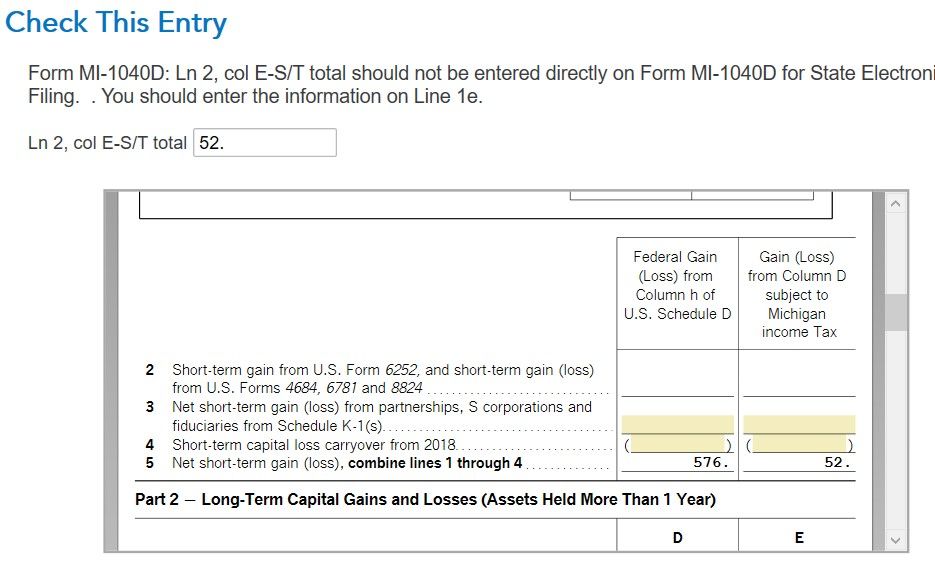

Thanks for the quick response KathrynG3, but I do not think that this resolves the issue. The first image below shows the line 1E contents (52) and the second image shows the line 2E contents (empty). It appears that TurboTax is interpreting line 1E and line 2E both as line 2E. I filed another return without any issues. Any ideas?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan e-file MI-1040D line 1E and line 2E appear to be transposed

Yes, the screenshots are very helpful.

Scroll to the MI-8949 line 2 and compare that to the U.S. Form 1040 Schedule D, line 1 a, column h. (as depicted on your first screenshot, line 1) to verify $52.

Next, in forms mode, check for values entered by double clicking Open Forms or by scrolling to:

- U.S. Form 6252 Installment Sale

- U.S. Form 4684 Casualties and Thefts

- U.S. Form 6781 Gains and Losses From Section 1256 Contracts and Straddles

- U.S. Form 8824 Like-Kind Exchanges

If possible, you could delete these forms or return to the Federal interview to adjust an answer in the Stocks, Mutual Funds, Bonds, Other section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan e-file MI-1040D line 1E and line 2E appear to be transposed

Hello Again KathrynG3. Thanks for the response. I have inserted my comments after your suggested steps below.

Scroll to the MI-8949 line 2 and compare that to the U.S. Form 1040 Schedule D, line 1 a, column h.

(as depicted on your first screenshot, line 1) to verify $52.

This MI-8949 line 2 is blank. U.S. Form 1040 Schedule D, line 1 a, column h shows $576.

($576 is the total gain from the 1099B, however, some of the gains are from US Treasury sources which would be subtracted from the Michigan gains ... the $52 expected value)

The MI-8949 line 1 section is also blank, no entries at all.

The US form 8949 has no short term entries and only (2) long term entries. I would expect that these would be loaded from the brokerage download. Is this controlled by an interview question?

Next, in forms mode, check for values entered by double clicking Open Forms or by scrolling to:

- U.S. Form 6252 Installment Sale (Form Not Present)

- U.S. Form 4684 Casualties and Thefts (Form Not Present)

- U.S. Form 6781 Gains and Losses From Section 1256 Contracts and Straddles (Form Not Present)

- U.S. Form 8824 Like-Kind Exchanges (Form Not Present)

If possible, you could delete these forms or return to the Federal interview to adjust an answer in the Stocks, Mutual Funds, Bonds, Other section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan e-file MI-1040D line 1E and line 2E appear to be transposed

Hello Again KathrynG3.

I have another couple of questions. I have already paid to efile this state return. The error surfaced afterward so I have not filed at this point.

Question 1) Can I delete the state tax return and start again?

Question 2) If I delete the state tax return, will Turbo Tax still acknowledge that the efile payment has already been made?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan e-file MI-1040D line 1E and line 2E appear to be transposed

1) Yes. To delete and re-add the state:

- From the left menu select State>

- Continue>next to your state, click the Trash Can icon and follow through the rest of the questions ending with Done

- Click Add Another State>Your state>and go through the interview again.

2) Yes. The payment should only be charged once per state.

It would be helpful to have a TurboTax ".tax2019" file that is experiencing this issue. You can send us a “diagnostic” file that has your “numbers” but not your personal information. If you would like to do this, here are the instructions:

- On your menu bar at the very top, click "Online">

- Send Tax File to Agent click send

- The pop-up will have a token number

I'll be able to open TurboTax with your numbers but not your personal information. That may help diagnose the issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan e-file MI-1040D line 1E and line 2E appear to be transposed

Hello KathrynG3. Thank you so much for the feedback. I did send the "diagnostic" return for you to examine and perhaps discover the issue. I will wait to hear from you before deleting the state return and going through the interview again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan e-file MI-1040D line 1E and line 2E appear to be transposed

@huppster01, please post the diagnostic token number in the thread. I do not have any other way of opening it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan e-file MI-1040D line 1E and line 2E appear to be transposed

Sorry about that. The token number is 637466.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan e-file MI-1040D line 1E and line 2E appear to be transposed

Thank you for sending the diagnostic file. The solution is to correct some technicalities of late breaking updates and importing issues.

Regarding the import problem:

I found a series of zeros in some of the interest, dividends and capital gains/losses where the boxes did not apply and should have been blank. This caused a smattering of data to identify as Michigan but without the necessary details for an adjustment. This was erroneous since no adjustment was necessary.

To check if your copy, and not just the diagnostic file has -0-'s where they do not belong, check your 1099-INT, 1099-DIV and 1099-B import. In a few cases for the Forms 1099- INT and -DIV, there were -0-s even though the checkbox was not checked that more details were on the form.

For the Form 1099-B import, click on any of the capital transactions from the Federal Stock transaction Step-By-Step interview. Click continue and see if there are zeros listed with Michigan identified.

Therefore, it is unlikely the state tax balance due should be reduced by $27.

You had asked earlier about what the MI-1040D instructions were regarding differences. With a closer look at your Schedule D transactions, I do not think this is required.

See this Michigan.gov resource: When am I required to file a Michigan Adjustments of Capital Gains and Losses MI-1040D? which is also shown (less a mortgage foreclosure link that is n/a)

To resolve and file:

- Open Form MI-1040D and select Delete this form in the lower corner of the window and run the review again leaving the partially allocated capital transaction data as is, which should no longer affect your state filing.

- If there still was an error, I recommend deleting the line items until the red exclamation point disappears--first with the detail schedule lines from the MI-8949

- Alternatively, delete your import and re-add it: How do I update or delete something I imported into TurboTax?

Regardless, I do recommend making sure your program is recently updated due to all the updates more recently: Manually update TurboTax for Windows Software (Basic, Deluxe, Premier, Home & Business)

Thank you for your patience and perseverance @huppster01

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan e-file MI-1040D line 1E and line 2E appear to be transposed

Hello Kathryn,

Hope you can help me with same issue that i have on MI-1040D.

Line 1a, Line 8a sections showing wrong values. Stock sale entries from my federal are not copied over to State [MI] capital gain section completely & i can't adjust entries which should not be reported as capital gains to MI as we have moved mid year out of MI.

My diagnostic token number is 958195.

Could you please have a look and help me if there is any corrupted data exist, which is not helping to copy over stock sale from federal to state.

Please also advice, how to correct the problem.

Best Regards

Bhanu.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan e-file MI-1040D line 1E and line 2E appear to be transposed

Hello @KathrynG3

All my stock sales {105) from one fidelity account were consolidated and marked with adjustment code "BYPASS8949". This does not happen with other accounts from fidelity where i had 95 stock sales and none of them has any wash sale. all 95 entries were shown in 8949 form.

Please advice how to remove this adjustment code, so that i show all my capital gains from MI - 8949 sheet as z and report them only in federal.

Token number generated from desktop version - 965601.

Kindly have a look and feedback

Best Regards

Bhanu

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ktkwaa7

New Member

jpatter132880

New Member

moesterle

New Member

ae5880

Level 1

230n

New Member