- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Michigan Back Door ROTH Qualifying Private or Non Qualifying?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan Back Door ROTH Qualifying Private or Non Qualifying?

I did a backdoor conversion of my traditional IRA to ROTH, Since I received a 1099-R with a distribution code of 2, I would like to know if this is a Qualifying Private Retirement benefit or Non-Qualified Retirement benefit?

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan Back Door ROTH Qualifying Private or Non Qualifying?

Traditional and Roth IRAs are Non-Qualified Retirement plans.

Please see What is a "qualified retirement plan"? for additional information

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan Back Door ROTH Qualifying Private or Non Qualifying?

Traditional and Roth IRAs are Non-Qualified Retirement plans.

Please see What is a "qualified retirement plan"? for additional information

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan Back Door ROTH Qualifying Private or Non Qualifying?

Will that still hold good even for a backdoor conversion?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan Back Door ROTH Qualifying Private or Non Qualifying?

Yes, that would still apply to backdoor Roth conversions.

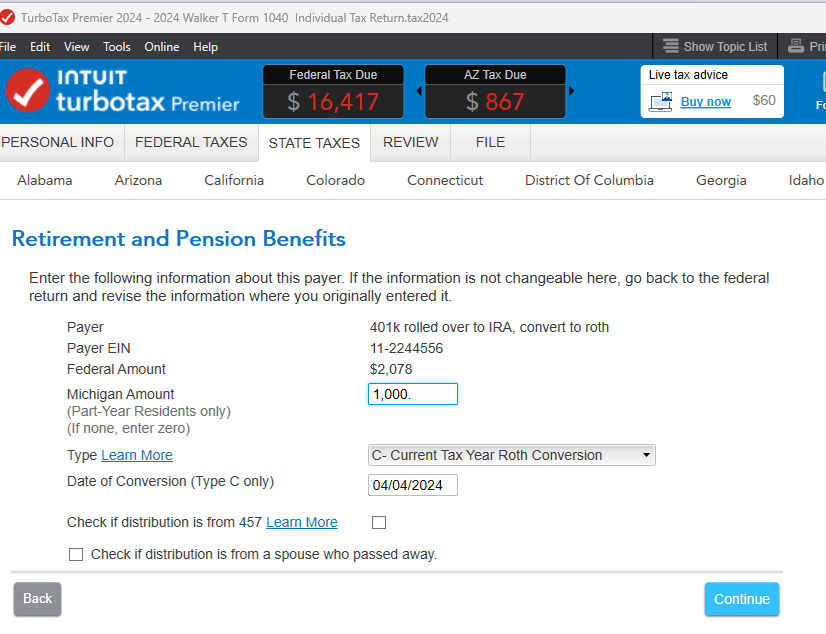

Please make sure you select "Current year conversion from a traditional IRA to a Roth IRA" on the "Where is your distribution from?" screen after you enter your Form 1099-R during the federal interview.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan Back Door ROTH Qualifying Private or Non Qualifying?

Hi,

I converted 120K from IRA to Roth IRA in 2024 and asked fidelity not to withheld tax on that conversion as I will pay estimated tax. I'm a part year resident as I lived in Michigan for 3 months till march end. I will get 1099-R next year.

I am preparing to pay estimated tax. My questions -

1. Should I account for 120K conversion as income and pay tax in Michigan ? I know I have to pay federal tax but not sure about Michigan tax. I did the conversion in February while I was in Michigan.

2. Can I claim personal exemption of $5800 in Michigan 2025 return being a non resident ?

Regards'

RM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan Back Door ROTH Qualifying Private or Non Qualifying?

If you entered your Roth conversion in your Federal return, your Federal AGI transfers to Michigan. If you lived in MI when you did the Roth conversion, you could include the income in MI, or you could split the income between your part-year state returns, allocating per amount of time lived in each state.

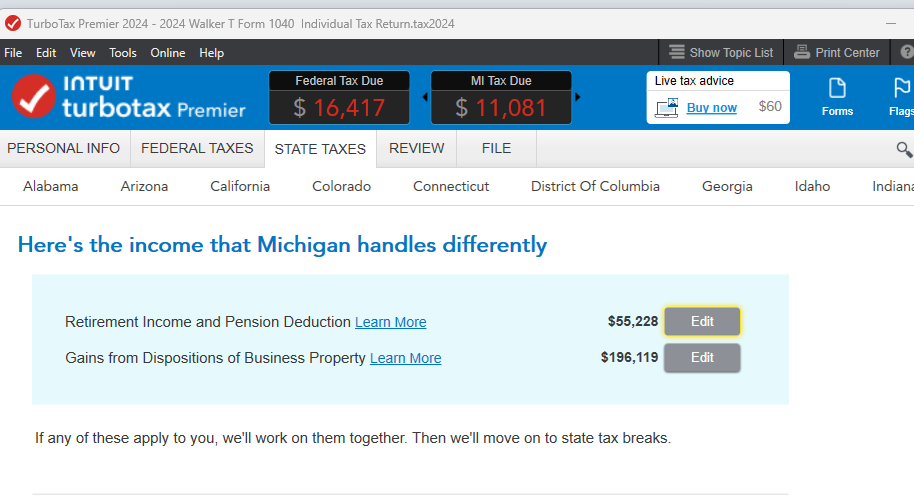

In the MI interview, you can click on Pensions on the page 'Here's Income that MI handles differently' to get to a summary of 1099-R's where you can edit the conversion entry, and allocate amount to MI.

Here's more info on How to Enter a Back-Door Roth Conversion and How to File a Part-Year Resident Return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Rprincessy

New Member

stefaniestiegel

New Member

karliwattles

New Member

2399139722

New Member

Hypatia

Level 1