- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

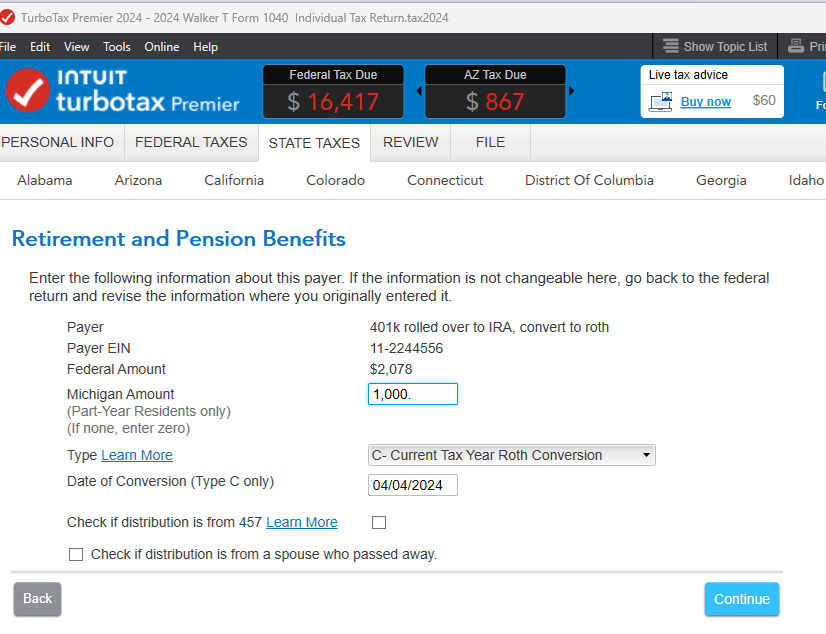

If you entered your Roth conversion in your Federal return, your Federal AGI transfers to Michigan. If you lived in MI when you did the Roth conversion, you could include the income in MI, or you could split the income between your part-year state returns, allocating per amount of time lived in each state.

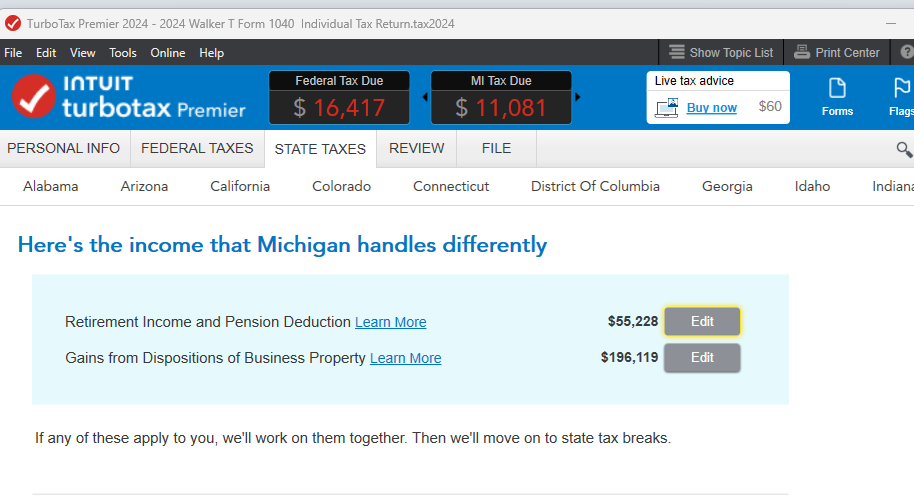

In the MI interview, you can click on Pensions on the page 'Here's Income that MI handles differently' to get to a summary of 1099-R's where you can edit the conversion entry, and allocate amount to MI.

Here's more info on How to Enter a Back-Door Roth Conversion and How to File a Part-Year Resident Return.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 12, 2025

12:48 PM