- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Medical Insurance Premiums NJ

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medical Insurance Premiums NJ

First, I'm embarrassed to say I've spent a fair amount of time trying to determine whether my Medicare, Medicap, Part D, dental and vision insurance premiums are tax deductible. I am retired and did not receive social security payments in 2023 (but will sometime in the future). I understand there are federal 7.5% and 2% NJ thresholds that would have to be satisfied first.

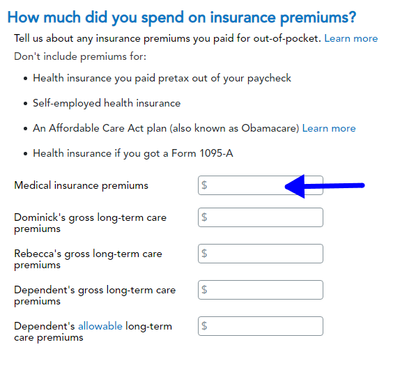

Secondly, the only place I have found to possibly enter an amount is pictured below from the federal return. Looking for confirmation or direction if this is the correct place to capture all or as many premiums that are deductible. Note - If NJ allows premiums that federal does not I would have to assume there is a place on the NJ return to enter this information but I have not found it.

Thank you for your insights

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medical Insurance Premiums NJ

Yes, your Medicare, Medigap, Part D, dental, and vision are all deductible as a medical deduction. As you noted, the total combined with your other medical expenses are only deductible for the amount that is above the 7.5% threshold for federal and 2% for NJ.

You can combine all of your premiums together and include them in the Medical Insurance Premiums box that you have highlighted.

Yes, you are correct. If there is something additional that NJ would allow that the federal does not allow, it will be covered in the NJ interview questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medical Insurance Premiums NJ

Yes, your Medicare, Medigap, Part D, dental, and vision are all deductible as a medical deduction. As you noted, the total combined with your other medical expenses are only deductible for the amount that is above the 7.5% threshold for federal and 2% for NJ.

You can combine all of your premiums together and include them in the Medical Insurance Premiums box that you have highlighted.

Yes, you are correct. If there is something additional that NJ would allow that the federal does not allow, it will be covered in the NJ interview questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medical Insurance Premiums NJ

Thanks so much!!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

amy

New Member

dixonmarr

New Member

jenneyd

New Member

swick

Returning Member

jackkgan

Level 5