- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medical Insurance Premiums NJ

First, I'm embarrassed to say I've spent a fair amount of time trying to determine whether my Medicare, Medicap, Part D, dental and vision insurance premiums are tax deductible. I am retired and did not receive social security payments in 2023 (but will sometime in the future). I understand there are federal 7.5% and 2% NJ thresholds that would have to be satisfied first.

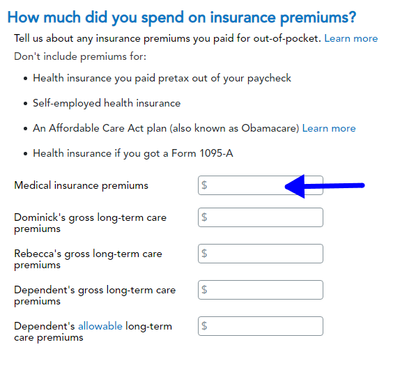

Secondly, the only place I have found to possibly enter an amount is pictured below from the federal return. Looking for confirmation or direction if this is the correct place to capture all or as many premiums that are deductible. Note - If NJ allows premiums that federal does not I would have to assume there is a place on the NJ return to enter this information but I have not found it.

Thank you for your insights