- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Is the New Mexico solar panel tax credit encoded in TurboTax Deluxe? If so, where is it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the New Mexico solar panel tax credit encoded in TurboTax Deluxe? If so, where is it?

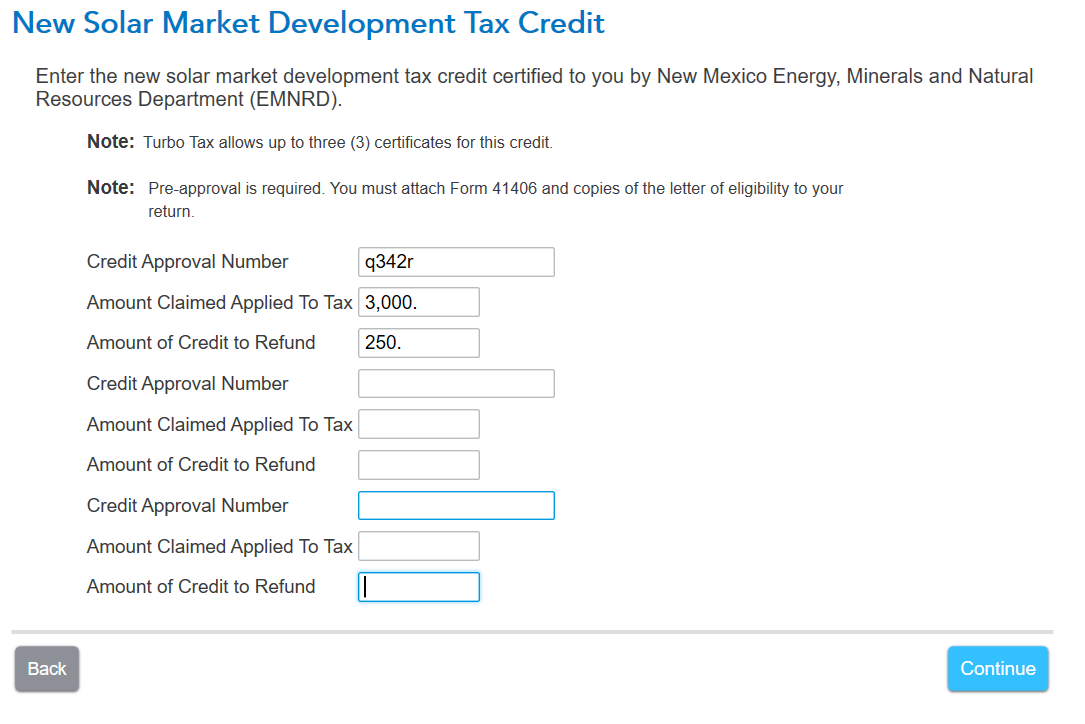

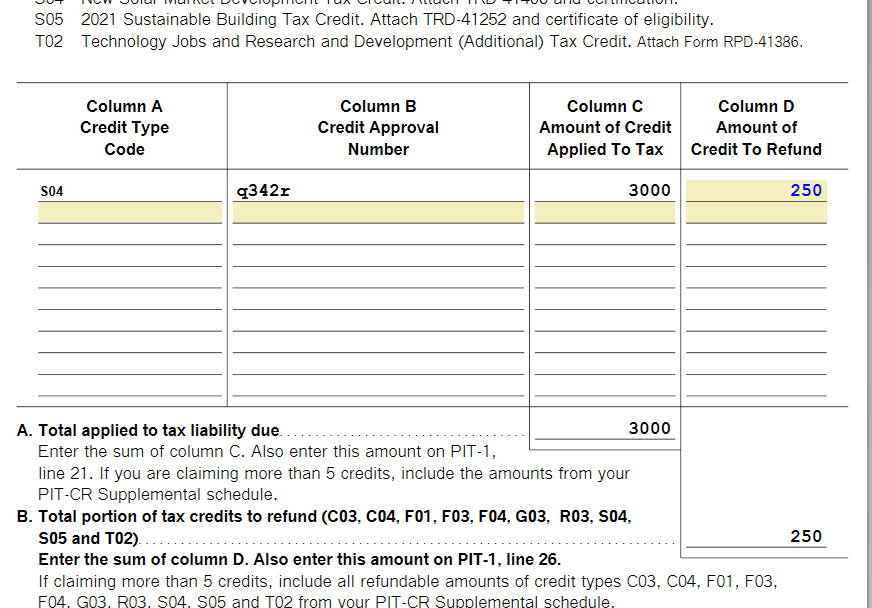

The second line is simply how much do you want to go against your tax liability. It can be anything from zero up to your tax liability or the credit, whichever is lower, listed on PIT-1 page 1 line 18.

The next line is how much do you want refunded. Pick any number up to the allowed amount.

Tax credit amount : The tax credit is equal to 10% of the costs of equipment, materials, and labor for a solar energy system, up to $6,000

Use your allowed amount and determine how to allocate.

I made up a dummy return to enter the solar panel credit. On the entry, I did some towards tax credit and some to refund. Then the actual form shows the amounts entered.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the New Mexico solar panel tax credit encoded in TurboTax Deluxe? If so, where is it?

Line #2 on form TRD 41406 asks for how much I owe in New Mexico taxes before I apply for the solar credit. Turbo Tax won't tell me how much I owe in New Mexico taxes until I pay for the state filing, and I cannot file until I upload the TRD 41406, which needs the amount I owe first. I'm stuck in a loop. Where can I find the amount I owe in New Mexico taxes so I can fill out the form and attach it to the state return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the New Mexico solar panel tax credit encoded in TurboTax Deluxe? If so, where is it?

When using TurboTax Online, you can see the taxes that you owe to your state by looking at the state tax summary page. Use the following steps:

- From the left rail menu in TurboTax Online, select Tax Tools (You may have to scroll down on the left rail menu.)

- Select Tax Tools

- On the drop-down select Tools

- On the pop-up menu titled “Tools Center”, select View Tax Summary to see the Federal summary

- On the left sidebar, select XX Tax Summary to see your state summary

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the New Mexico solar panel tax credit encoded in TurboTax Deluxe? If so, where is it?

Where do I get the Credit approval number from? Is it the same as the Project number that's on the Certificate of Eligibility issued by EMNRD? If my total tax credit amount is showing $5000 on the certificate of eligibility, do I enter the same amount on the 2nd and 3rd lines which are the Amount claimed applied to tax and Amount of Credit to Refund? I'm so confused. I'm stuck on this page.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the New Mexico solar panel tax credit encoded in TurboTax Deluxe? If so, where is it?

Where do I get the Credit approval number from? Is it the same as the Project number that's on the Certificate of Eligibility issued by EMNRD? If my total tax credit amount is showing $5000 on the certificate of eligibility, do I enter the same amount on the 2nd and 3rd lines which are the Amount claimed applied to tax and Amount of Credit to Refund? I'm so confused. I'm stuck on this page.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the New Mexico solar panel tax credit encoded in TurboTax Deluxe? If so, where is it?

This might be a stupid question but if the Eligible Tax Year End is 2023 on the New Solar Market Development Tax Credit Certificate of Eligibility, can I file it on my 2024 tax return or should I amend my 2023 state PIT instead? I applied for this tax credit with EMNRD for the state of New Mexico last December 2024 and the issuance date of the Certificate of Eligibility is January 2025.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the New Mexico solar panel tax credit encoded in TurboTax Deluxe? If so, where is it?

According to NM ECMD, this tax credit is available in the 2024 tax year thus you may file it on your 2024 NM return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the New Mexico solar panel tax credit encoded in TurboTax Deluxe? If so, where is it?

3 Questions:

1. Where do I find the Credit Approval Number?

2. I entered my tax owed to NM before entering the solar amount in line 2, then entered the Total Tax Credit Amount in line 3. When I did this, it change my owed amount to a refund in the amount of the total tax credit amount. This doesn't seem right. It seems like it should be the difference of the tax owed and the credit. What am I doing wrong?

3. After I enter these, it asks me to upload 2 documents, a Form 41406 (New Solar Market Development Tax Credit) and a 41406 letter (letter of eligibility). I have the certificate, but not a letter. The NM tax website does have a form TRD-41406. Is this what is needed?

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the New Mexico solar panel tax credit encoded in TurboTax Deluxe? If so, where is it?

1. In your certificate of eligibility paperwork. See New Mexico Solar Credit

2. Your tax liability should be reduced by the amount of credit claimed. The overage becomes a refund. Check that you entered your tax liability where it asks for amount applied to tax. See screenshot.

3. No. You must have the letter of eligibility. New Solar Market Development Tax Credit Claim Form page 1 shows you line 2 state tax liability, line 3 the amount of credit you are claiming. The amount over your tax liability becomes a refund on the next line.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the New Mexico solar panel tax credit encoded in TurboTax Deluxe? If so, where is it?

what if I am not a business, but an individual - do i still check the business/solar development box?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the New Mexico solar panel tax credit encoded in TurboTax Deluxe? If so, where is it?

Yes, an individual is eligible to claim this credit. See these FAQs from the New Mexico Government.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kkrana

Level 1

marylwale338

New Member

RamGoTax

New Member

jtmcl45777

New Member

paul22mcintosh

New Member