- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

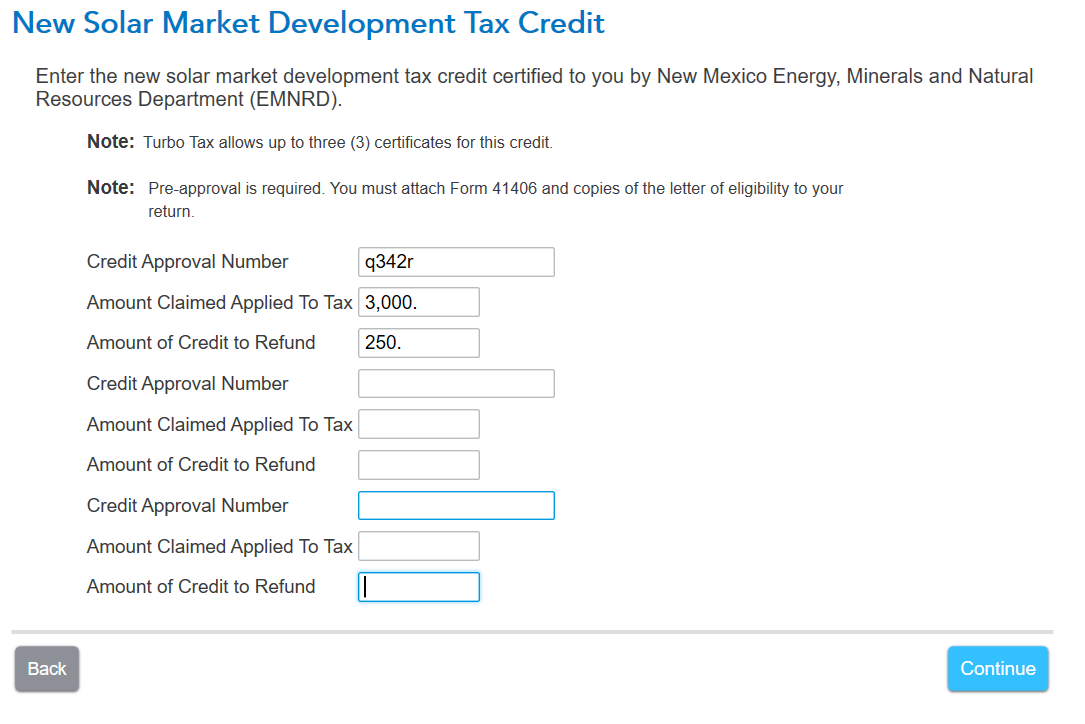

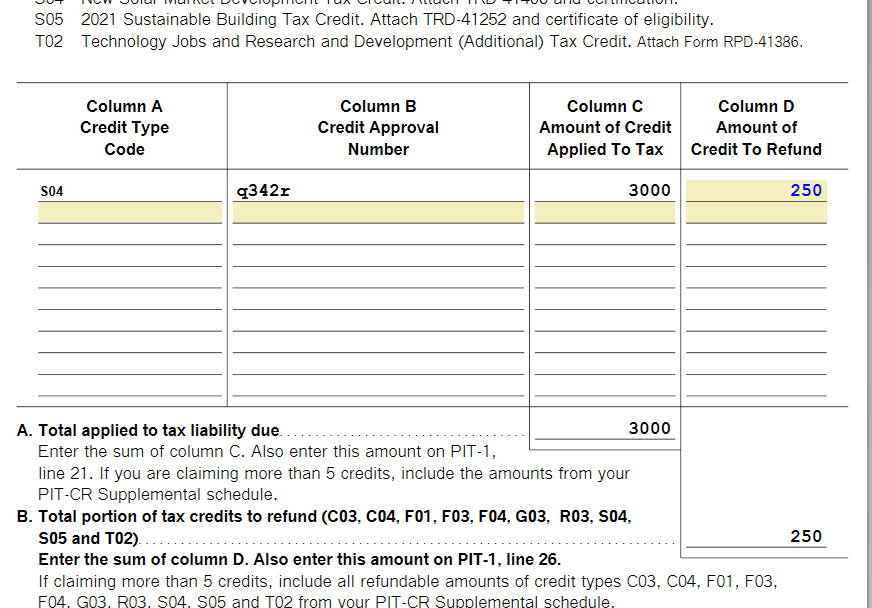

The second line is simply how much do you want to go against your tax liability. It can be anything from zero up to your tax liability or the credit, whichever is lower, listed on PIT-1 page 1 line 18.

The next line is how much do you want refunded. Pick any number up to the allowed amount.

Tax credit amount : The tax credit is equal to 10% of the costs of equipment, materials, and labor for a solar energy system, up to $6,000

Use your allowed amount and determine how to allocate.

I made up a dummy return to enter the solar panel credit. On the entry, I did some towards tax credit and some to refund. Then the actual form shows the amounts entered.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

January 27, 2025

3:53 PM