- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Indiana tax payment 2020

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Indiana tax payment 2020

You can pay your Indiana income tax directly on the Indiana Department of Revenue’s website at Pay Taxes Electronically.

That’s a much better option than mailing in a voucher or scheduling a payment in TurboTax since it goes straight to IDR without any third-party involvement.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Indiana tax payment 2020

Does the TurboTax direct debit NOT work for Indiana? If direct debit was specified with account details and payment date in TurboTax, does the Indiana tax still need to be paid separately?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Indiana tax payment 2020

After I filled out all the bank ACH info, I got a message saying something like “you’re not finished until you print out and send this form”, which was a voucher to send with a payment. But before I sent the payment, I came here to see if I could get clarification. Then a day later I noticed that my payment had been deducted from my bank account. So I think the online payment worked. I hope.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Indiana tax payment 2020

I had the same issue. I just saw that Indiana tax payment has been debited from checking account. Is the system now working?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Indiana tax payment 2020

Does anyone know if this is resolved for the 2022 tax season? I know it bit me in the butt last year because there was the illusion the payment was being made, but this year it seemed different. I looked on my Indiana TT cover sheet and it details out the payment method for the 2022 tax payment. However, for 2021 the cover sheet was clear that you had to mail a check (but i didn't read that initially last year.).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Indiana tax payment 2020

Did you enter a specific date for your payment to be withdrawn and has that date passed?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Indiana tax payment 2020

I entered the same day i was filing thinking that it would process immediately. To be fair today is day 1 after filing. My federal and state have not processed for payment yet. I think the bigger question is if this year are we finally able to pay through TT or will i be mailing a check at the last moment. I have a few days so i am hoping to see it come through soon.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Indiana tax payment 2020

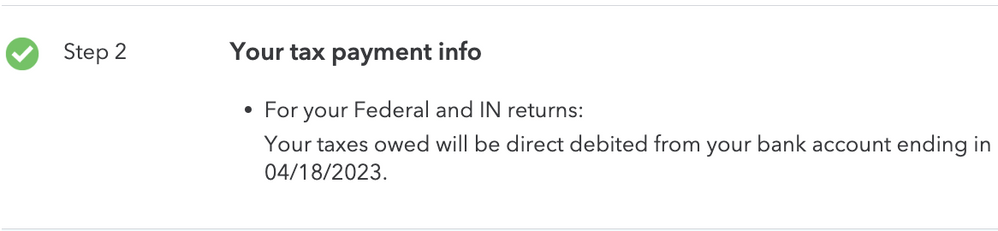

This happened again this year. This time, my Indiana return states that it is going to be paid from my bank account on 4/18. It has the account and routing numbers on the worksheets...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Indiana tax payment 2020

Your tax payments do not go through immediately because the return has to be accepted first.

It can take up to 48 hours for your federal return to be accepted and your state is held until after the federal is accepted.

Your payment is credited to the date and time you submit your e-file as long as the return is accepted, but the actual movement of your money can't take additional hours, or days.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Indiana tax payment 2020

Here is the result of 2 conversations I had this morning:

1. Talked to TT directly and was informed that according to their internal documentation, Indiana does not allow direct debit, but they recommended I speak directly with Indiana DOR

2. Talked to Indiana DOR, who informed me that they do now accept direct debit and they have had several tax payers from TT make double payments this year because of the confusion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Indiana tax payment 2020

My taxes followed exactly as outlined above.

1. Federal tax return was accepted

2. Indiana state tax return was accepted

3. Tax payment pulled from bank account as set up within TT! The payment got pulled about 2 days after I designated - apparently as it took time for each return return to be accepted before the payment could actually be made.

Hope this helps!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Indiana tax payment 2020

Mine processed overnight. So good news for me hope yours this year goes through.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Indiana tax payment 2020

Hoping to bump this post up for Tax Year 2022 filers, but Turbo Tax IS misleading. You enter bank information, then are prompted to download a PDF of the amount(s) you thought you already paid😢

You must make electronic payments directly to IN - DOR. Choose 'Non-bill payments' if you don't have an INTIME account.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Indiana tax payment 2020

I called the Indiana DOR and spoke directly to them. They confirmed the change this year and stated that the amount with be debited and some TT users are making double payments via both debit and INTime!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Indiana tax payment 2020

Just to follow up...my State of Indiana Payment was NOT Paid through direct debit, my Federal Payment was.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Embraj381

New Member

WindyCityDave

New Member

cetasha

New Member

sethness

Returning Member

Deysi15

Level 1