- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: I live outside of NYC in NYS but I work in NYC. I am able to exclude income earned outside of...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live outside of NYC in NYS but I work in NYC. I am able to exclude income earned outside of NYC from my NYC tax return, right? can I get any credit from NYS?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live outside of NYC in NYS but I work in NYC. I am able to exclude income earned outside of NYC from my NYC tax return, right? can I get any credit from NYS?

Your New York City tax is applied to your New York City income only, but they use the total income to determine your tax rate. (They calculate based on the full year then apply the % of NYC income).

Unfortunately, New York state does not offer a tax credit if you have to pay NYC taxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live outside of NYC in NYS but I work in NYC. I am able to exclude income earned outside of NYC from my NYC tax return, right? can I get any credit from NYS?

Thank you for your answer. My NYC-1127 is based on the whole NYS taxable income. Turbo tax did it! What can I do for applying only for NYC income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live outside of NYC in NYS but I work in NYC. I am able to exclude income earned outside of NYC from my NYC tax return, right? can I get any credit from NYS?

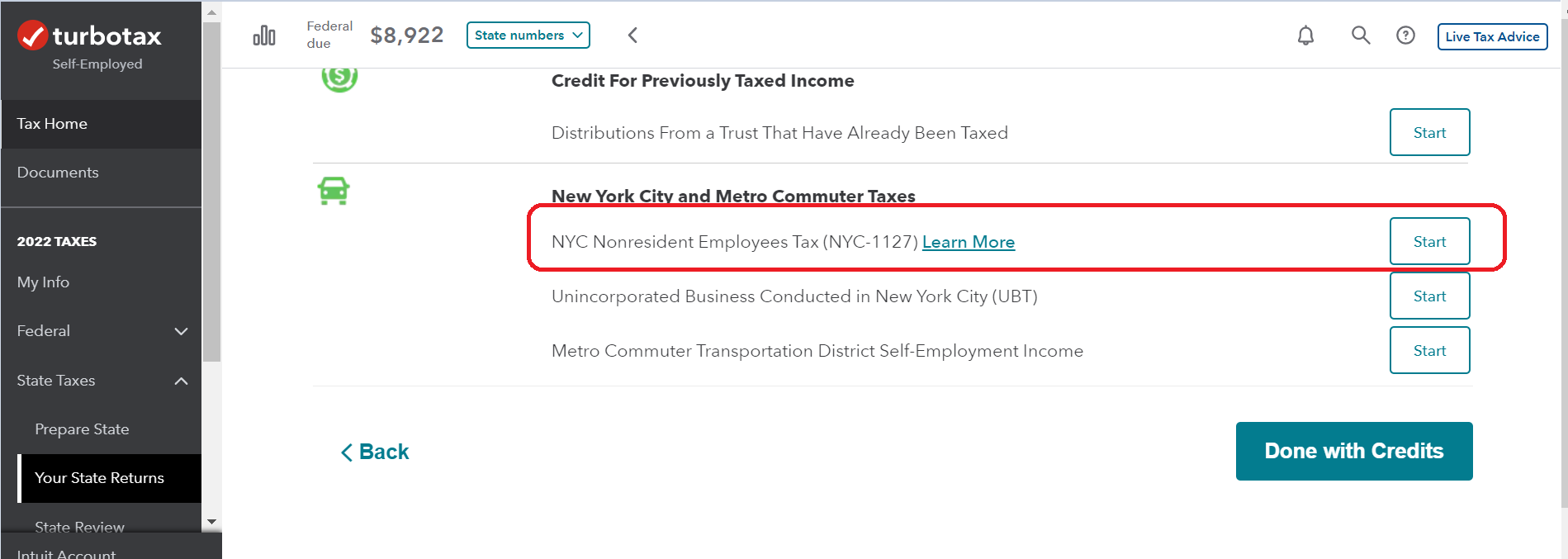

Just to clarify- did you go to this section in TurboTax New York? Also, do you have a spouse? @lsw7266506

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live outside of NYC in NYS but I work in NYC. I am able to exclude income earned outside of NYC from my NYC tax return, right? can I get any credit from NYS?

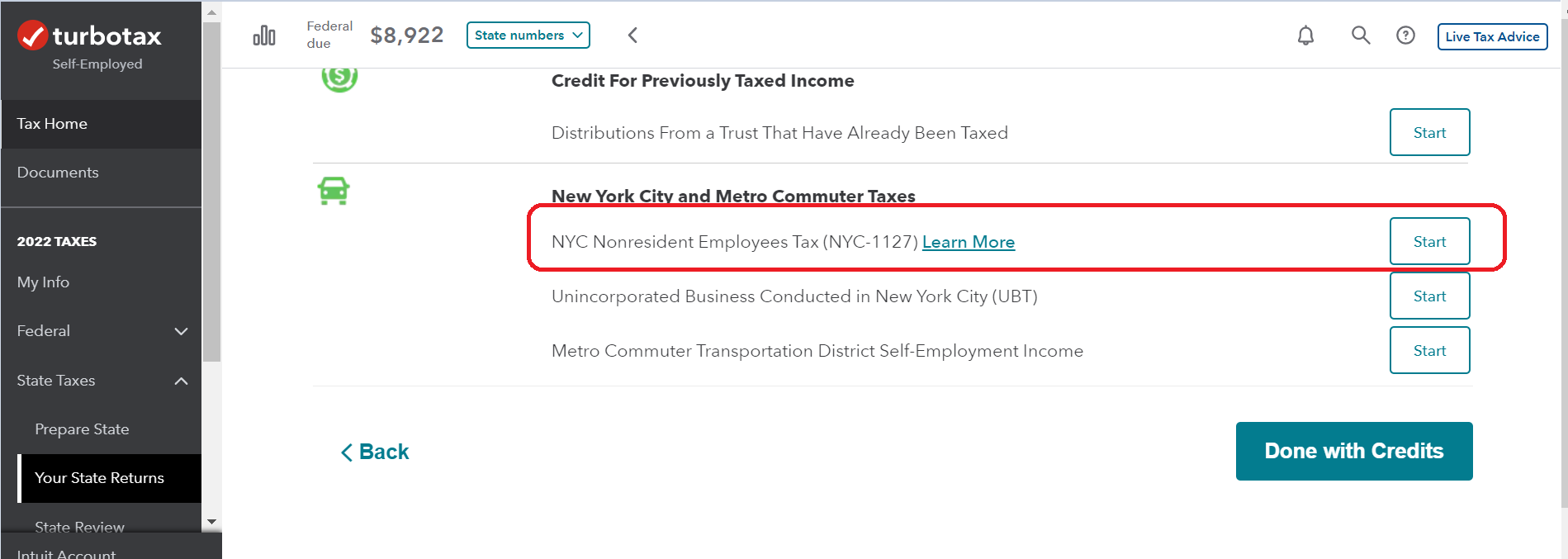

It looks different but I did the below one.

| New York City Employment Taxes | ||

| NYC Nonresident Employees Tax (NYC-1127) Learn More |

The above one doesn't care about my income from out of the city. They charged based on whole my income.

This NYC-1127 system did it.

But the spouse's income was excluded.

This rule is based on Section 1127 of the New York City Charter so I'm not sure I need to pay tax for out-of-city income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live outside of NYC in NYS but I work in NYC. I am able to exclude income earned outside of NYC from my NYC tax return, right? can I get any credit from NYS?

Yes. This is the form required for Non-Resident Employees of the City of New York - Form 1127

Your out of city income is captured on your regular NY State income tax return. The Form 1127 on taxes NYC income and the NYC taxes withheld. If your spouse's income was outside of NYC then it is appropriate that her income is excluded.

Most New York City employees living outside of the five boroughs (hired on or after January 4, 1973) must file form NYC-1127. This form calculates the City waiver liability, which is the amount due as if the filer were a resident of NYC.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live outside of NYC in NYS but I work in NYC. I am able to exclude income earned outside of NYC from my NYC tax return, right? can I get any credit from NYS?

Your New York City tax is applied to your New York City income only, but they use the total income to determine your tax rate. (They calculate based on the full year then apply the % of NYC income).

Unfortunately, New York state does not offer a tax credit if you have to pay NYC taxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live outside of NYC in NYS but I work in NYC. I am able to exclude income earned outside of NYC from my NYC tax return, right? can I get any credit from NYS?

Thank you for your answer. My NYC-1127 is based on the whole NYS taxable income. Turbo tax did it! What can I do for applying only for NYC income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live outside of NYC in NYS but I work in NYC. I am able to exclude income earned outside of NYC from my NYC tax return, right? can I get any credit from NYS?

Just to clarify- did you go to this section in TurboTax New York? Also, do you have a spouse? @lsw7266506

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live outside of NYC in NYS but I work in NYC. I am able to exclude income earned outside of NYC from my NYC tax return, right? can I get any credit from NYS?

It looks different but I did the below one.

| New York City Employment Taxes | ||

| NYC Nonresident Employees Tax (NYC-1127) Learn More |

The above one doesn't care about my income from out of the city. They charged based on whole my income.

This NYC-1127 system did it.

But the spouse's income was excluded.

This rule is based on Section 1127 of the New York City Charter so I'm not sure I need to pay tax for out-of-city income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live outside of NYC in NYS but I work in NYC. I am able to exclude income earned outside of NYC from my NYC tax return, right? can I get any credit from NYS?

Yes. This is the form required for Non-Resident Employees of the City of New York - Form 1127

Your out of city income is captured on your regular NY State income tax return. The Form 1127 on taxes NYC income and the NYC taxes withheld. If your spouse's income was outside of NYC then it is appropriate that her income is excluded.

Most New York City employees living outside of the five boroughs (hired on or after January 4, 1973) must file form NYC-1127. This form calculates the City waiver liability, which is the amount due as if the filer were a resident of NYC.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live outside of NYC in NYS but I work in NYC. I am able to exclude income earned outside of NYC from my NYC tax return, right? can I get any credit from NYS?

Thank you for your answer.

First, Look at the first page of NYC-1127. You can see "2-1127 LIABILITY CALCULATION".

Line 1 is NYS Taxable income. This is the whole of my income including income from out of the city.

Line 2 is Tax. this tax is based on Line 1 which is the whole my income.

I think the problem is Line 1 and 2.

Can you clarify Line 1 and Line 2? I want to remove my income from out of the city.

Then Line 2 will be the tax from only income from the city.

Second, Look at Schedule A of next page. This one is also based on NYS Adjust Gross Income.

Please check this one.

I really appreciate all your answers!

Please help me this one more.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live outside of NYC in NYS but I work in NYC. I am able to exclude income earned outside of NYC from my NYC tax return, right? can I get any credit from NYS?

I would like to take a deeper look at this. However, I need a diagnostic file which is a copy of your tax return that has all of your personal information removed. You can send one to us by following the directions below:

- Sign into your online account.

- Locate the Tax Tools on the left-hand side of the screen.

- A drop-down will appear. Select Tools

- On the pop-up screen, click on “Share my file with agent.”

- This will generate a message that a diagnostic file gets sanitized and transmitted to us.

- Please respond back with the Token Number that was generated.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live outside of NYC in NYS but I work in NYC. I am able to exclude income earned outside of NYC from my NYC tax return, right? can I get any credit from NYS?

Token no is 1071307.

Thank you so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live outside of NYC in NYS but I work in NYC. I am able to exclude income earned outside of NYC from my NYC tax return, right? can I get any credit from NYS?

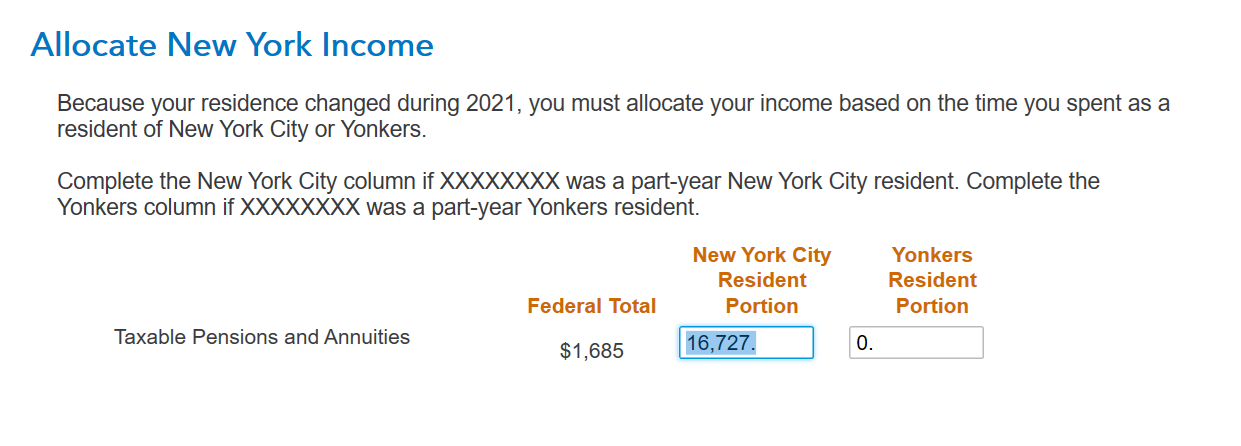

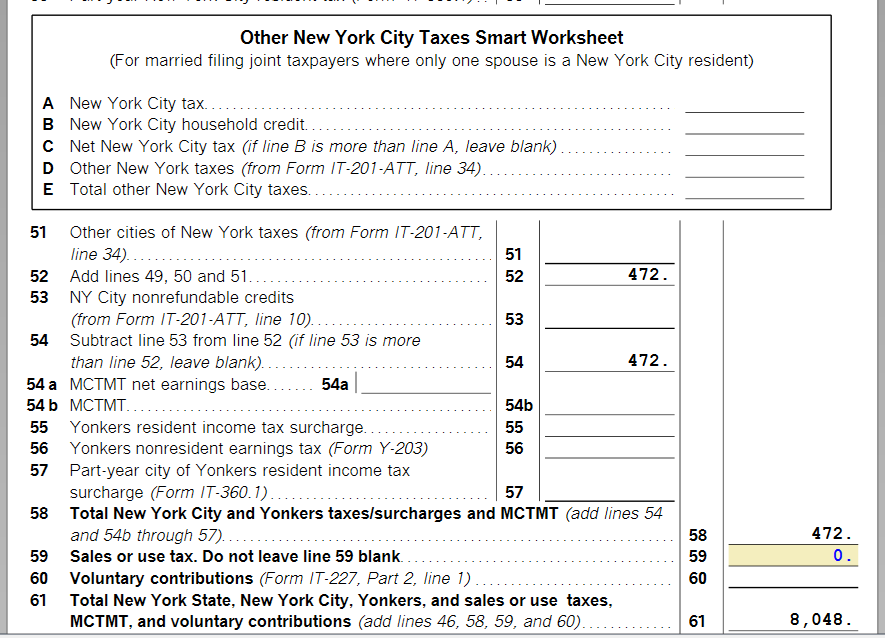

- Because you were a Part Year New York City resident and you did not earn income in New York City while you were a nonresident, your 1127 does not get filed. Instead, a IT360.1 shows the income earned in New York City while you were a New York resident. NOTE: You must mail the IT360.1.

- You may also want to check the allocation shown below- your allocation here should not be more than the federal amount- this is doubling your New York City income. If you change the allocation, you will see the taxable income on the IT360.1 equal your NYC wages. (refer to the tax due on the second screen shot below).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live outside of NYC in NYS but I work in NYC. I am able to exclude income earned outside of NYC from my NYC tax return, right? can I get any credit from NYS?

"Thank you for your response!

I have allocated my income between New York City and the rest of the state on my IT-201 form. I filed my city taxes on the "gov/eservices" website and entered my City income on the City employee line, and my out-of-city income on the non-city employee line. The allocation worked I received the credit.

However, I have concerns about the amount of my refund so I sent them a message to ask about the difference between my expected refund and the amount that I received.

Thank you so much!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

LokiMiri

New Member

JohnASmith

Level 4

edmarqu

Level 2

Falcon5

New Member

Smithy4

Level 2