- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

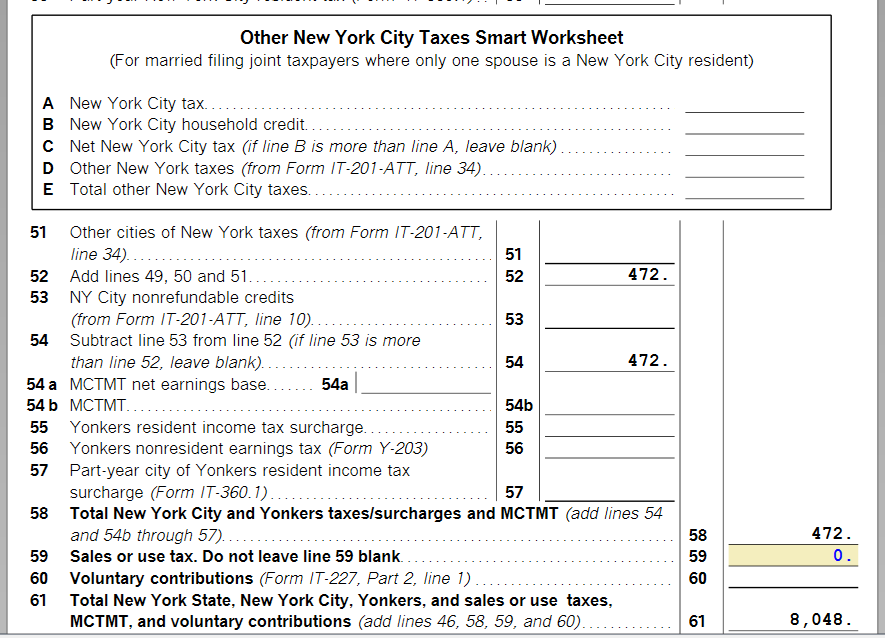

- Because you were a Part Year New York City resident and you did not earn income in New York City while you were a nonresident, your 1127 does not get filed. Instead, a IT360.1 shows the income earned in New York City while you were a New York resident. NOTE: You must mail the IT360.1.

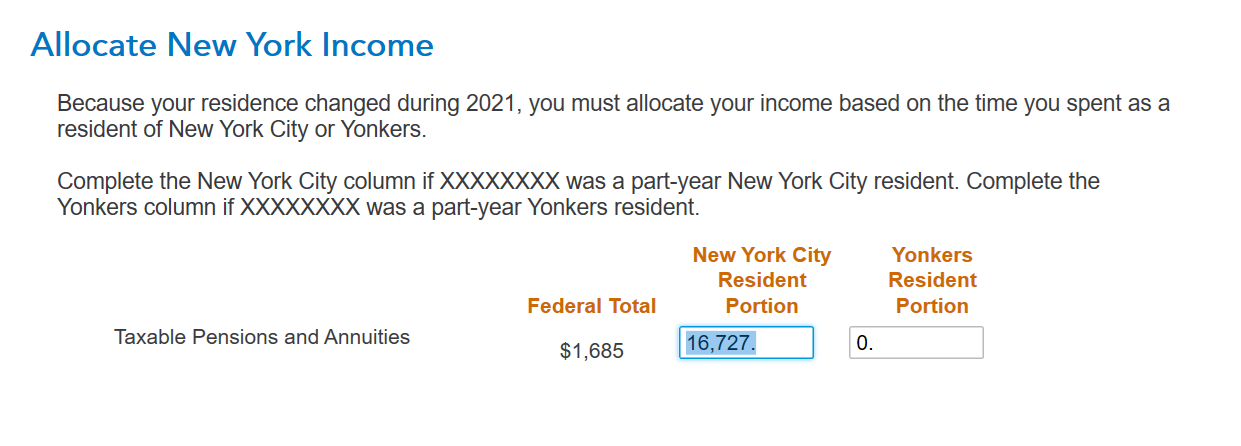

- You may also want to check the allocation shown below- your allocation here should not be more than the federal amount- this is doubling your New York City income. If you change the allocation, you will see the taxable income on the IT360.1 equal your NYC wages. (refer to the tax due on the second screen shot below).

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 23, 2023

5:51 PM