- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: I live in PA, work in DE. Which state is receiving the payment in Box 17 of my W2? If it's the DE income tax, do I have to file separately for PA?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in PA, work in DE. Which state is receiving the payment in Box 17 of my W2? If it's the DE income tax, do I have to file separately for PA?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in PA, work in DE. Which state is receiving the payment in Box 17 of my W2? If it's the DE income tax, do I have to file separately for PA?

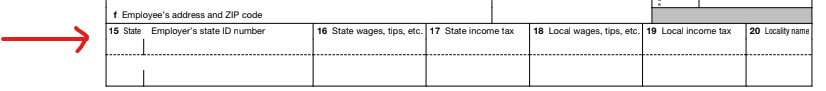

The tax withheld is reported to the state which is listed in box 15. Which state is reported in box 15 of the W-2?

Delaware defines a nonresident as follows:

Nonresident

Nonresidents are individuals who are not Delaware residents at any time during the year.

Pennsylvania defines a resident as follows:

Resident

Defined as a person that is either domiciled in Pennsylvania or has a permanent abode in Pennsylvania and spends a total of 183 or more days in Pennsylvania.

In TurboTax Online, you likely will file a full-year Pennsylvania resident tax return and a nonresident Delaware tax return.

Delaware and Pennsylvania do not have a reciprocal agreement.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in PA, work in DE. Which state is receiving the payment in Box 17 of my W2? If it's the DE income tax, do I have to file separately for PA?

If you live in PA and work in DE, then Yes, you definitely have to file in both states. You must file a non-resident DE tax return and your home state PA return.

You'll be able to claim an "other state credit" on your PA return for the taxes paid to DE, so the net effect is that you won't be double-taxed. But you still must file a return in both states.

In TurboTax, be sure to complete the non-resident state return first, before you do the home state tax return, so that the program can calculate and apply the credit.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rltkbirnbaum

New Member

Matt034

Level 1

dnotestone

Level 2

TashaBenz123

Level 1

sethness

Returning Member