- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

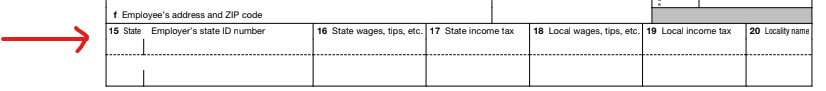

The tax withheld is reported to the state which is listed in box 15. Which state is reported in box 15 of the W-2?

Delaware defines a nonresident as follows:

Nonresident

Nonresidents are individuals who are not Delaware residents at any time during the year.

Pennsylvania defines a resident as follows:

Resident

Defined as a person that is either domiciled in Pennsylvania or has a permanent abode in Pennsylvania and spends a total of 183 or more days in Pennsylvania.

In TurboTax Online, you likely will file a full-year Pennsylvania resident tax return and a nonresident Delaware tax return.

Delaware and Pennsylvania do not have a reciprocal agreement.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

January 28, 2024

1:02 PM