- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: I have tax exempt interest and I entered each state on the Federal Return but it is not adding it to NC D-400 or D-400 Sch S. How do I fix this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have tax exempt interest and I entered each state on the Federal Return but it is not adding it to NC D-400 or D-400 Sch S. How do I fix this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have tax exempt interest and I entered each state on the Federal Return but it is not adding it to NC D-400 or D-400 Sch S. How do I fix this?

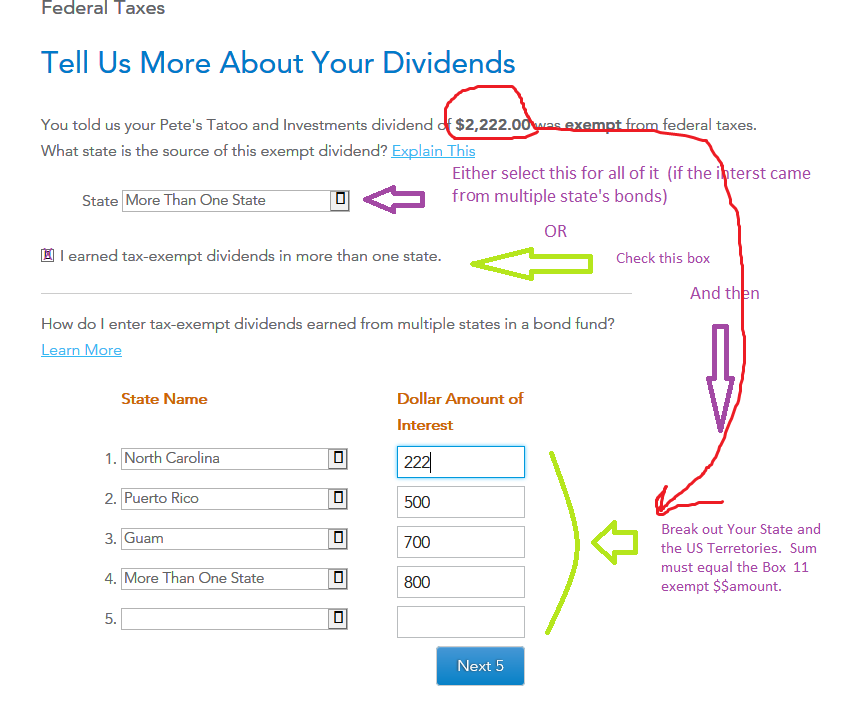

Not sure what you did...but to make sure, you only enter the NC amount and any US Territories (like Puerto Rico) in the federal section for that form, and all the other states are lumped together as one total.

.......so you might need to entirely delete the form type where you entered it in the Federal section (1099-DIV or 1099-INT?)...then re-enter it again....only doing the break-out of states as follows:

NC...……………...100

PR...………………..50

Multiple States.....850

_________________________________

The Multiple States selection is at the very end of the list of states when selecting them.

(for others...the desktop software uses the term "More than one state" )

______________________

That "should" work, and show up on line 1 of the D400 Sch S. That Line 1 will contain $$ from both box 11 of the 1099-DIV, and box 8 of the 1099-INT (& occasionally a form K-1)

______________________________________

Here's another example of what the followup page should look like in the Federal section for a 1099-DIV with box 11 $$ in it:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have tax exempt interest and I entered each state on the Federal Return but it is not adding it to NC D-400 or D-400 Sch S. How do I fix this?

Not sure what you did...but to make sure, you only enter the NC amount and any US Territories (like Puerto Rico) in the federal section for that form, and all the other states are lumped together as one total.

.......so you might need to entirely delete the form type where you entered it in the Federal section (1099-DIV or 1099-INT?)...then re-enter it again....only doing the break-out of states as follows:

NC...……………...100

PR...………………..50

Multiple States.....850

_________________________________

The Multiple States selection is at the very end of the list of states when selecting them.

(for others...the desktop software uses the term "More than one state" )

______________________

That "should" work, and show up on line 1 of the D400 Sch S. That Line 1 will contain $$ from both box 11 of the 1099-DIV, and box 8 of the 1099-INT (& occasionally a form K-1)

______________________________________

Here's another example of what the followup page should look like in the Federal section for a 1099-DIV with box 11 $$ in it:

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

techie353

Level 3

rmbibber

New Member

LBonge221

New Member

user17638037803

Level 1

jvmorrow

New Member