- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Do you realize that New Jersey has raised the Veteran deduction to $6000.00?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do you realize that New Jersey has raised the Veteran deduction to $6000.00?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do you realize that New Jersey has raised the Veteran deduction to $6000.00?

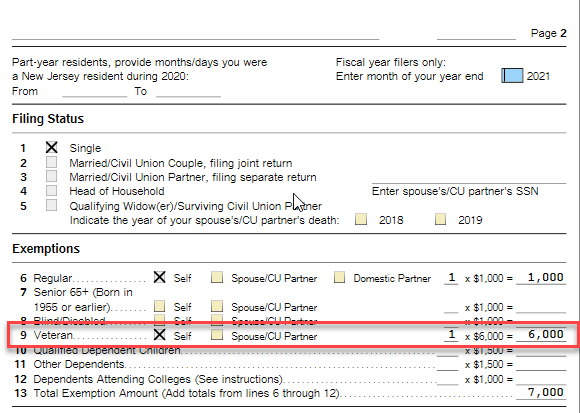

Yes. According to the NJ Division of Taxation, military veterans who were honorably discharged or released under honorable circumstances from active duty in the Armed Forces of the U.S. by the last day of the tax year are eligible for an additional $6,000 exemption. Each spouse/CU partner who is a veteran is eligible for the additional exemption. This exemption cannot be claimed for a domestic partner or dependents. The taxpayer must certify that he or she was honorably discharged or released under honorable circumstances from active duty the first time claiming the exemption(s).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do you realize that New Jersey has raised the Veteran deduction to $6000.00?

I am a veteran living in NJ. I don't see where Turbo Tax accounts for my veteran's status. I could sure use that $6000 deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do you realize that New Jersey has raised the Veteran deduction to $6000.00?

New Jersey will give you the $6,000 additional exemption if you are honorable discharged veteran.

- On Other situations that may apply to you check Military Veteran. Continue.

- On Exemption for Military Veterans put a check next to your name to show you were honorable discharged.

The exemption will be added on NJ-1040 line 9.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do you realize that New Jersey has raised the Veteran deduction to $6000.00?

the first time, you must attach proof of discharge or upload proof on NJ website.

After that you can amend previous years to get the rebate.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do you realize that New Jersey has raised the Veteran deduction to $6000.00?

Is this for recently discharged vets only? My husband was discharged back in the 1970’s...we never used this and turbo tax just ask’s the question...so I said yes, but not sure he would qualify though and because I said yes, I am getting a 6000 deduction for NJ. Do I need to uncheck this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do you realize that New Jersey has raised the Veteran deduction to $6000.00?

For 2017 and 2018, the exemption was $3,000. It's been $6,000 since then.

Although this next thing is not authoritative (it's in a newsletter for postal employees who are vets - see https://nalc.org/member-benefits/body/Veterans-in-New-Jersey.pdf), it appears that the first year that this exemption was active was 2017, not before.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do you realize that New Jersey has raised the Veteran deduction to $6000.00?

I just reread your question. There does not seem to be any limit on when the veteran served, just that he/she was honorably discharged.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do you realize that New Jersey has raised the Veteran deduction to $6000.00?

Yes thank you! As quoted below from the link you provided it does look like he does qualify..

“If you are a military veteran, you are eligible for this exemption if you were honorably discharged. Recently discharged veterans become eligible in the tax year they were released under honorable circumstances.”

Just have to send discharge papers the first time you apply.

Thanks so much!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

veryacaruvial

New Member

ecasey1982

Level 1

Luckydog3432

New Member

tomandjerry1

Level 4

thefoxs

Level 1